Marketplace insurance, also known as the Health Insurance Marketplace, offers a crucial pathway to affordable health coverage for millions of Americans. This government-run platform connects individuals and families with a variety of health insurance plans, providing a competitive market where consumers can compare options and find the best fit for their needs and budget.

Through the Marketplace, you can access a range of plans, each with varying levels of coverage and costs. These plans are categorized into tiers—bronze, silver, gold, and platinum—with bronze plans offering the lowest monthly premiums but higher out-of-pocket costs, while platinum plans have the highest premiums but the lowest out-of-pocket expenses. The Marketplace also offers financial assistance in the form of tax credits and subsidies to help make coverage more affordable, particularly for those with lower incomes.

Enrollment and Open Enrollment Periods

Getting health insurance through the Marketplace can be a great way to find affordable coverage. But, knowing when and how to enroll is key. Here’s a breakdown of the process and important deadlines.

Open Enrollment Period

The Open Enrollment Period is the time each year when you can apply for Marketplace coverage. This period typically runs from November 1st to January 15th. During this time, you can:

- Sign up for a new health insurance plan

- Change your existing plan

- Enroll in a plan for the first time

It’s crucial to remember that the Open Enrollment Period is the only time you can make changes to your plan unless you qualify for a Special Enrollment Period.

Special Enrollment Periods

There are specific situations that allow you to enroll or make changes to your plan outside of the Open Enrollment Period. These are known as Special Enrollment Periods. Some common reasons for a Special Enrollment Period include:

- Losing your current health insurance coverage

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new state

- Experiencing a change in your household income

If you experience any of these life changes, you may be eligible to enroll in a Marketplace plan outside the regular Open Enrollment Period.

Enrollment Process, Marketplace insurance

There are three main ways to enroll in Marketplace coverage:

- Online: You can enroll directly through the Marketplace website, HealthCare.gov.

- By Phone: You can call the Marketplace call center at 1-800-318-2596 to enroll over the phone.

- Through an Insurance Agent or Broker: You can work with a licensed insurance agent or broker who can help you find and enroll in a plan that meets your needs.

The enrollment process typically involves providing some personal information, such as your income, family size, and location. You’ll then be able to compare plans and choose the one that best fits your needs and budget.

Marketplace Insurance and Employer-Sponsored Coverage

You might be offered health insurance through your employer, but you may also be eligible for coverage through the Health Insurance Marketplace. Understanding the differences between these options can help you choose the best plan for your needs.

Determining the Best Option

Deciding whether Marketplace insurance or employer-sponsored coverage is better for you depends on several factors. Here are some key considerations:

- Cost: Compare the monthly premiums, deductibles, and out-of-pocket costs for both options. Marketplace plans may offer subsidies to reduce costs, while employer-sponsored plans often have different contribution levels depending on your salary and benefits package.

- Coverage: Review the benefits and limitations of each plan. Some plans might have lower copayments or deductibles for certain services, or offer better coverage for specific conditions. Consider your individual healthcare needs and usage patterns.

- Network: Compare the networks of providers available under each plan. Make sure your preferred doctors and hospitals are included. You can use the Health Insurance Marketplace website to find plans with specific providers.

- Flexibility: Employer-sponsored plans often have limited flexibility in terms of changing plans or enrolling during the year. Marketplace plans may offer more options for switching plans or enrolling outside of open enrollment periods, depending on your circumstances.

Affordability and Coverage Options

The Marketplace offers financial assistance in the form of subsidies to help make coverage more affordable. The amount of financial assistance you qualify for depends on your income and household size. These subsidies can significantly reduce your monthly premiums.

In addition to affordability, the Marketplace offers a variety of plans with different levels of coverage. You can choose a plan that best fits your budget and healthcare needs. The Marketplace plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier has different levels of coverage and cost-sharing, with Bronze offering the lowest monthly premium and Platinum offering the highest level of coverage with the highest monthly premium.

Marketplace Insurance and Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) can be a valuable tool for individuals enrolled in marketplace insurance plans. HSAs are tax-advantaged savings accounts that can be used to pay for healthcare expenses.

HSA Eligibility with Marketplace Insurance

You can open an HSA if you have a high-deductible health plan (HDHP) through the marketplace. HDHPs are plans with higher deductibles than traditional health plans, but they often have lower monthly premiums. To be eligible for an HSA, your marketplace plan must meet the following requirements:

- The deductible must be at least $1,500 for individual coverage or $3,000 for family coverage.

- The out-of-pocket maximum must be no more than $7,500 for individual coverage or $15,000 for family coverage.

- You cannot be covered by another health insurance plan, such as a traditional health plan or an employer-sponsored plan.

Benefits of Using an HSA with Marketplace Insurance

There are several benefits to using an HSA with marketplace insurance:

- Tax Savings: Contributions to an HSA are tax-deductible, which can help reduce your taxable income.

- Tax-Free Growth: Earnings on HSA funds are tax-free.

- Tax-Free Withdrawals: Withdrawals for qualified medical expenses are tax-free.

- Account Portability: You can take your HSA with you if you change jobs or insurance plans.

Setting Up an HSA

To set up an HSA, you can contact a bank or credit union that offers HSA accounts. You will need to provide your personal information and your marketplace insurance plan details. Once your account is set up, you can begin making contributions.

Contribution Limits and Eligible Expenses

There are annual contribution limits for HSAs. For 2023, the limit is $3,850 for individual coverage and $7,750 for family coverage. If you are 55 or older, you can contribute an additional $1,000.

HSA funds can be used to pay for qualified medical expenses, such as:

- Doctor’s visits

- Prescription drugs

- Hospital stays

- Dental and vision care

- Over-the-counter medications (with a doctor’s prescription)

It is important to note that HSA funds cannot be used for non-medical expenses. If you withdraw funds for non-medical expenses, you will have to pay taxes and a 20% penalty.

Marketplace Insurance and the Affordable Care Act (ACA)

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted the healthcare landscape in the United States, including the creation and regulation of the health insurance marketplaces. The ACA aimed to expand health insurance coverage, improve affordability, and protect consumers from unfair practices.

Key Provisions of the ACA Impacting Marketplace Insurance

The ACA introduced several key provisions that directly affect marketplace insurance and consumer protections. These provisions ensure access to affordable and comprehensive health insurance for millions of Americans.

- Individual Mandate: This provision required most Americans to have health insurance or pay a penalty. While the individual mandate penalty was eliminated in 2019, it played a crucial role in expanding coverage by incentivizing individuals to enroll in health insurance plans.

- Expansion of Medicaid: The ACA allowed states to expand Medicaid eligibility to individuals with incomes up to 138% of the federal poverty level. This expansion has provided health insurance coverage to millions of low-income Americans.

- Premium Tax Credits: The ACA offers premium tax credits to help individuals and families afford health insurance. These credits are based on income and are available through the marketplace.

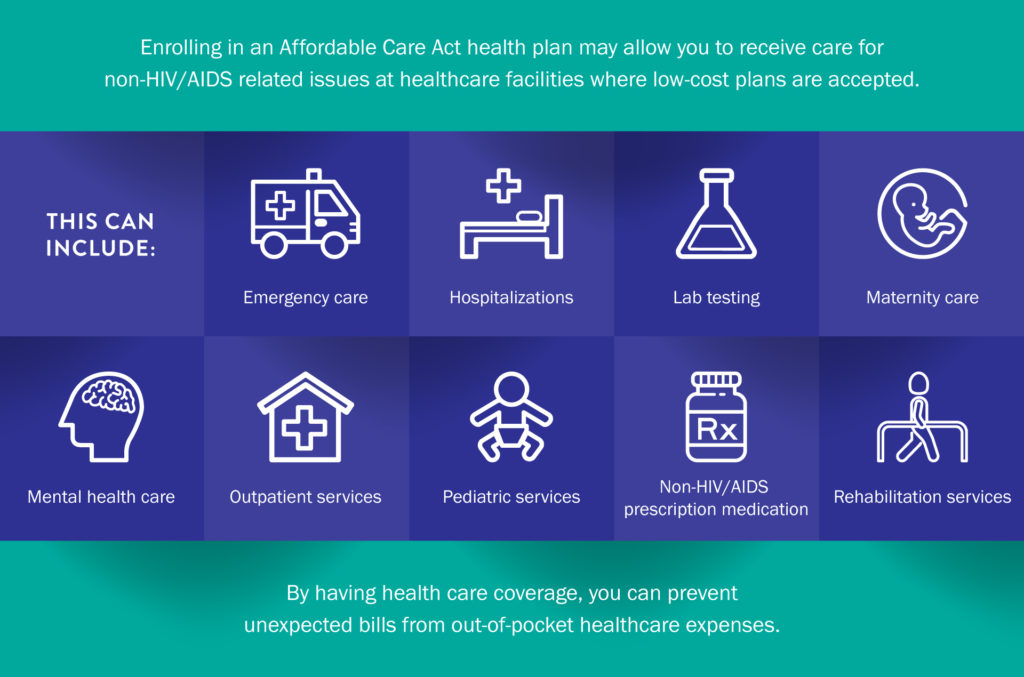

- Essential Health Benefits: The ACA mandates that all marketplace plans must cover essential health benefits, including preventive care, hospitalization, prescription drugs, and mental health services.

- Prohibition of Pre-Existing Condition Exclusions: The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This ensures that individuals with health conditions have access to affordable health insurance.

- Age Rating Restrictions: The ACA limits the extent to which insurance companies can charge higher premiums based on age. This helps to ensure that older adults have access to affordable health insurance.

Ongoing Developments and Potential Changes to the ACA

The ACA has been subject to numerous legal challenges and policy changes since its implementation. These developments have resulted in uncertainties regarding the future of the ACA and its impact on marketplace insurance.

- Repeal and Replace Efforts: The Trump administration attempted to repeal and replace the ACA, but these efforts were ultimately unsuccessful. However, some key provisions, such as the individual mandate penalty, were eliminated.

- Legal Challenges: The ACA has faced numerous legal challenges, some of which have been successful in limiting its scope. For example, the Supreme Court ruled that states could not be forced to expand Medicaid under the ACA.

- Policy Changes: The Trump administration implemented various policy changes that affected the ACA, including reducing the open enrollment period and funding for outreach and enrollment assistance programs.

- Future of the ACA: The future of the ACA remains uncertain. It is possible that future administrations or Congress may attempt to make further changes to the law, potentially affecting marketplace insurance and consumer protections.

Resources and Support for Marketplace Insurance

Navigating the world of health insurance can be complex, but you don’t have to go it alone. The Health Insurance Marketplace offers a wealth of resources and support to help you find the right plan and understand your options.

Helpful Resources

There are numerous resources available to help you understand and navigate the Health Insurance Marketplace. These resources can provide you with information on eligibility, plan options, enrollment deadlines, and more.

- Health Insurance Marketplace Website: The official website of the Health Insurance Marketplace is a great starting point for information. It provides a comprehensive overview of the Marketplace, including eligibility requirements, plan options, and enrollment procedures. You can also use the website to compare plans and apply for coverage.

- State-Based Exchanges: Some states operate their own Health Insurance Marketplaces, which may have different features and resources than the federal Marketplace. You can find information about your state’s exchange on the Marketplace website or by contacting your state’s insurance department.

- Navigators and Assisters: Navigators and assisters are trained professionals who can help you understand your options, compare plans, and enroll in coverage. They are available at no cost to you and can be found through the Marketplace website or by contacting your state’s insurance department.

- Consumer Guides: The Health Insurance Marketplace offers a variety of consumer guides and fact sheets that can help you understand your options and make informed decisions. These resources are available on the Marketplace website and can be downloaded or printed.

- Insurance Companies: If you have questions about a specific plan, you can contact the insurance company directly. Their customer service representatives can provide you with information about coverage, benefits, and costs.

Contact Information

The Health Insurance Marketplace and state-based exchanges offer a variety of ways to get in touch.

- Health Insurance Marketplace Website: You can access the Marketplace website at [Website URL]. The website includes a contact form, phone number, and email address for general inquiries.

- State-Based Exchanges: To find the contact information for your state’s exchange, visit the Marketplace website or contact your state’s insurance department.

- Navigators and Assisters: You can find a list of navigators and assisters in your area on the Marketplace website or by contacting your state’s insurance department.

Assistance and Support Services

The Health Insurance Marketplace offers a variety of assistance and support services to help you navigate the enrollment process.

- Help with Enrollment: The Marketplace website and state-based exchanges offer online tools and resources to help you enroll in coverage. You can also get help from navigators and assisters, who can guide you through the enrollment process.

- Language Assistance: The Marketplace offers language assistance in a variety of languages, including Spanish, Chinese, and Vietnamese. You can access language assistance on the Marketplace website or by calling the Marketplace call center.

- Disability Assistance: The Marketplace offers disability assistance for individuals with disabilities. You can access disability assistance on the Marketplace website or by calling the Marketplace call center.

- Financial Assistance: The Marketplace offers financial assistance to help eligible individuals afford coverage. You can learn more about financial assistance on the Marketplace website or by calling the Marketplace call center.

Last Word

Navigating the world of healthcare insurance can be overwhelming, but the Marketplace provides a valuable resource for finding affordable and comprehensive coverage. By understanding the eligibility criteria, premium calculations, and benefits offered, you can make informed decisions and access the healthcare you need. Remember to explore the available resources and seek assistance if needed to ensure you’re making the best choices for your health and well-being.

Navigating the world of marketplace insurance can be overwhelming, especially with the variety of plans and options available. However, if you’re looking for a way to enhance your understanding of healthcare systems and policies, consider exploring the Columbia University Summer Program.

This program offers insightful courses on healthcare policy and economics, which can provide valuable context for navigating the complexities of marketplace insurance.