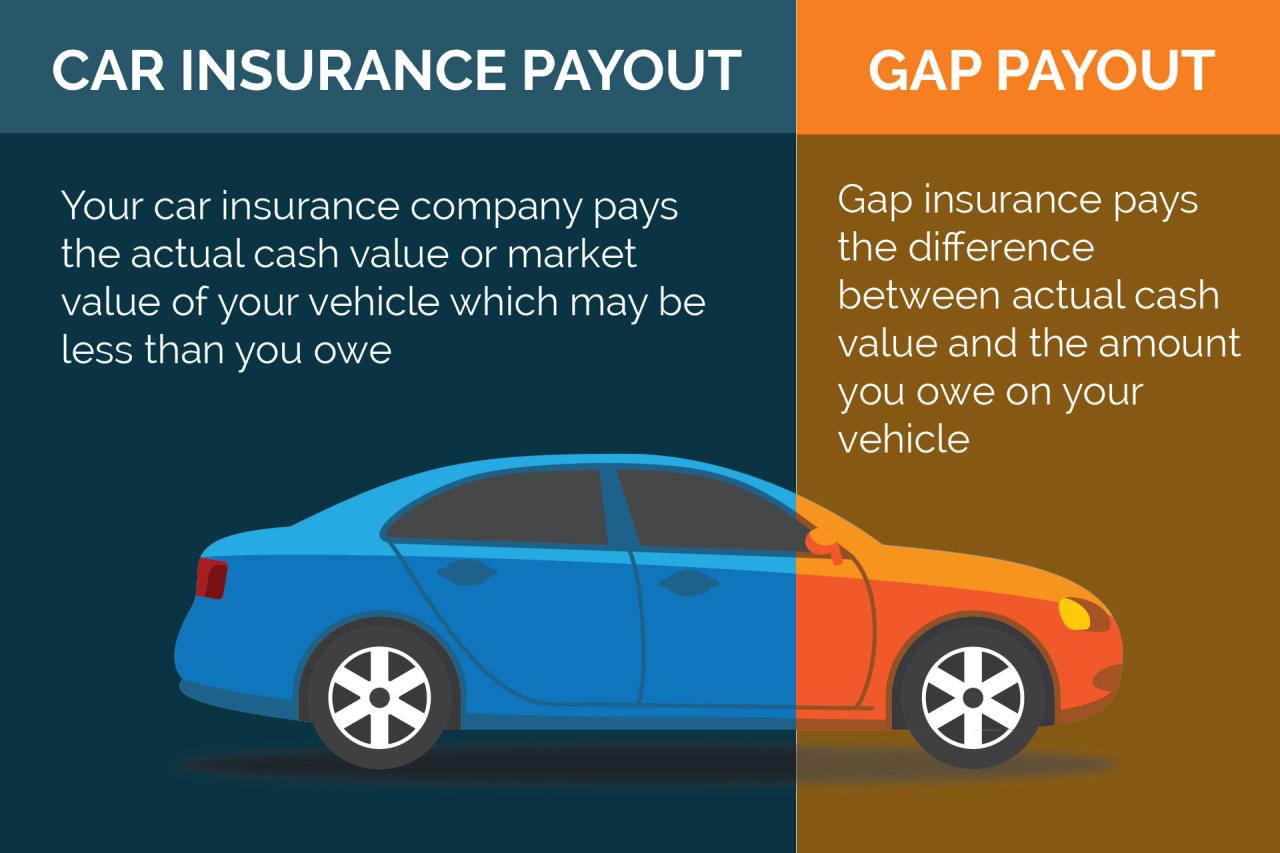

Gap insurance is a type of coverage that can help protect you from financial loss if your vehicle is totaled in an accident. This insurance policy covers the difference between the actual cash value (ACV) of your vehicle and the outstanding loan balance. In simpler terms, it bridges the gap between what your car is worth and what you owe on it.

Imagine this scenario: you’re driving your car, and unfortunately, you get into an accident that results in a total loss. Your insurance company will pay you the ACV of your vehicle, but what happens if that amount is less than what you still owe on your loan? This is where gap insurance comes in handy. It steps in to cover the remaining balance, preventing you from being stuck with a significant debt even after your car is gone.

Gap Insurance

Gap insurance helps cover the difference between what your car is worth and what you owe on your loan if your car is totaled or stolen. This can be a significant amount of money, especially if you have a new car or if you have financed your car for a longer term.

What is Gap Insurance?

Gap insurance is a type of insurance that covers the difference between the actual cash value (ACV) of your car and the outstanding balance on your auto loan or lease. The ACV is what your car is worth at the time of the loss, which is typically determined by an insurance adjuster.

Who Needs Gap Insurance?

Gap insurance is most beneficial for people who:

- Have financed their car for a longer term.

- Have a new car or a car with a high loan balance.

- Have a car that depreciates quickly.

How Does Gap Insurance Work?

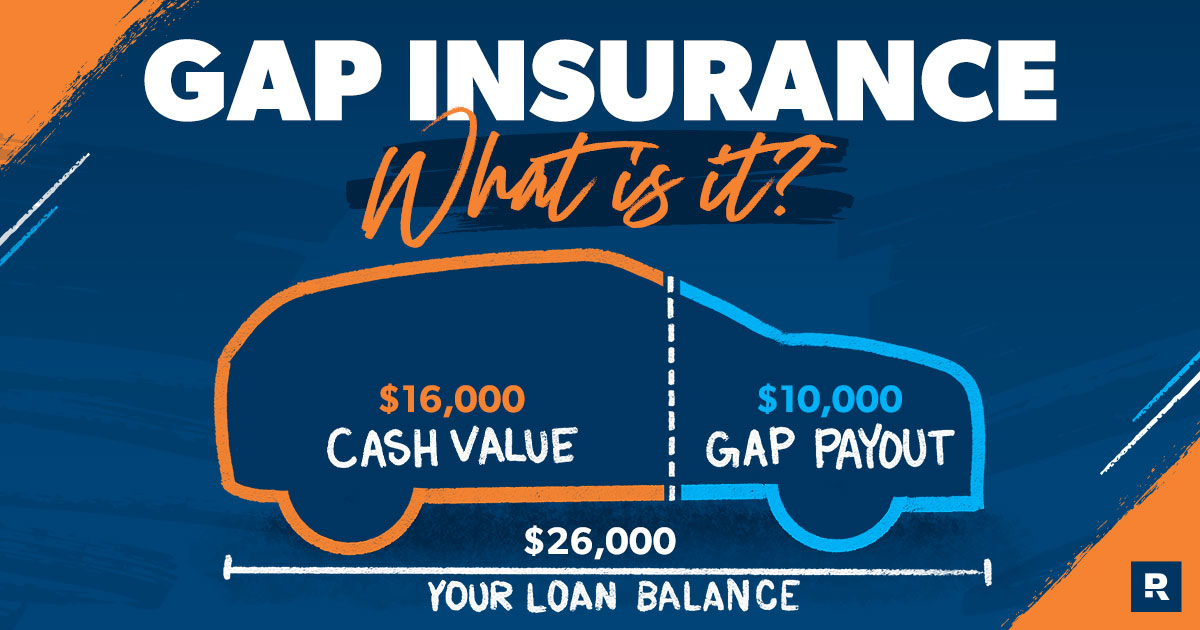

If your car is totaled or stolen, your insurance company will pay you the ACV of your car. If the ACV is less than the amount you owe on your loan, you will be responsible for paying the difference. Gap insurance will cover this difference, up to the amount of your loan balance.

Example

Let’s say you bought a new car for $30,000 and financed it for 60 months. After three years, your car is totaled in an accident. The ACV of your car at the time of the accident is $15,000. You still owe $18,000 on your loan. Without gap insurance, you would be responsible for paying the $3,000 difference. However, if you had gap insurance, it would cover the $3,000 difference.

Types of Gap Insurance

There are two main types of gap insurance:

- Dealer-sold gap insurance: This is sold by the dealership when you purchase your car. It is typically more expensive than lender-sold gap insurance.

- Lender-sold gap insurance: This is sold by the lender that financed your car. It is typically less expensive than dealer-sold gap insurance.

Cost of Gap Insurance

The cost of gap insurance varies depending on the lender, the type of car you have, and the amount of your loan balance. The average cost of gap insurance is between $300 and $600.

Conclusion

Gap insurance can be a valuable investment for people who want to protect themselves from financial loss if their car is totaled or stolen. It is important to weigh the cost of gap insurance against the potential benefits. If you are financing your car for a longer term or if you have a new car with a high loan balance, gap insurance may be a good option for you.

Ultimate Conclusion: Gap Insurance

Gap insurance is a valuable tool for protecting your financial well-being in the event of a total vehicle loss. By understanding its mechanics, considering your specific needs, and carefully evaluating your options, you can make an informed decision about whether gap insurance is right for you. Remember, it’s always wise to consult with a qualified insurance professional to discuss your individual circumstances and determine the best course of action for your financial security.

Gap insurance can be a valuable addition to your car insurance policy, especially if you have a loan or lease on your vehicle. This type of coverage helps bridge the gap between what your insurance pays out in the event of a total loss and the amount you still owe on the car.

If you’re considering adding gap insurance, it’s worth exploring options like geico car insurance , which offers various coverage options tailored to your needs. By understanding the benefits of gap insurance and comparing different providers, you can make an informed decision about whether it’s the right choice for your situation.