Full coverage car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Full coverage car insurance provides the most comprehensive protection for your vehicle, safeguarding you against a wide range of potential risks. This type of insurance goes beyond the bare minimum requirements, offering peace of mind and financial security in the event of accidents, theft, or natural disasters.

Understanding the intricacies of full coverage car insurance is crucial for any responsible driver. This guide will delve into the core components of full coverage, explore its benefits and limitations, and provide valuable insights into the claims process and cost considerations. We’ll also examine alternative options and offer practical tips for saving on premiums, empowering you to make informed decisions about your car insurance needs.

Benefits of Full Coverage Car Insurance

Full coverage car insurance offers comprehensive protection for your vehicle and financial security in various unforeseen circumstances. It provides peace of mind knowing that you are financially protected in case of accidents, theft, or natural disasters.

Financial Protection in Case of Accidents, Full coverage car insurance

Full coverage insurance provides financial protection in case of an accident, regardless of who is at fault. This includes coverage for:

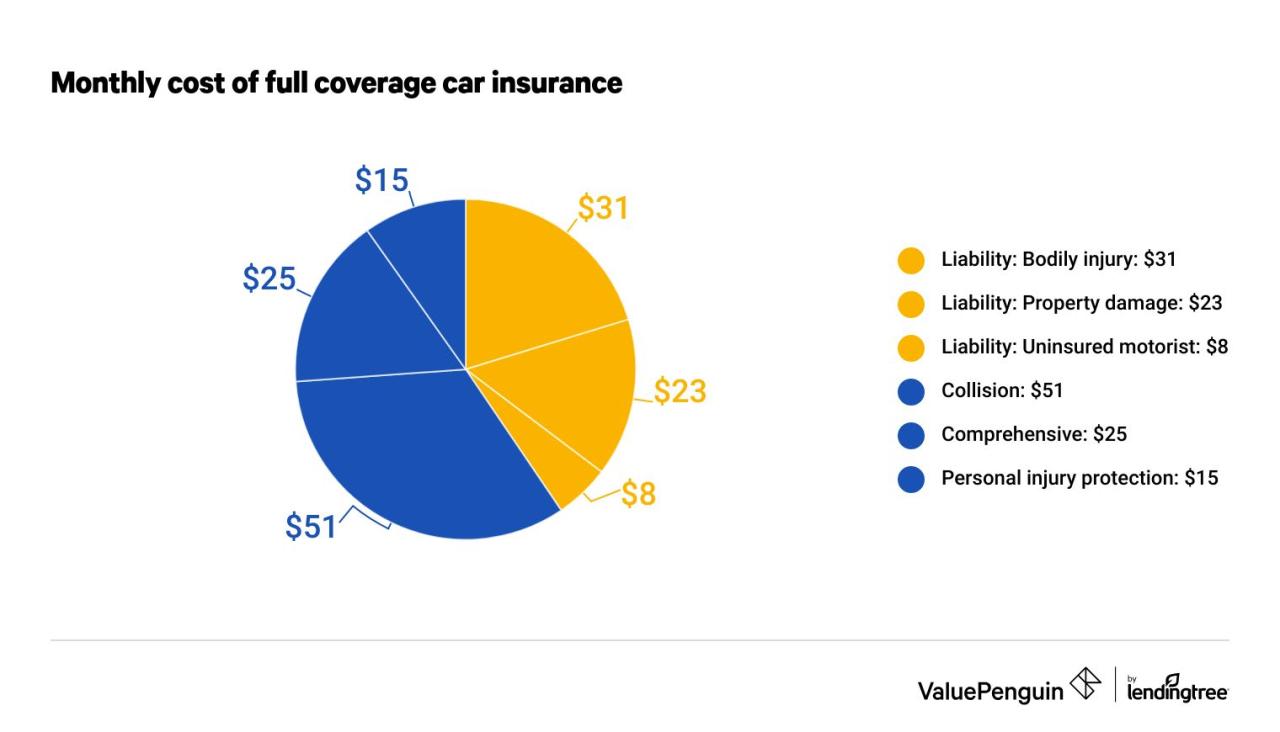

- Collision Coverage: Covers repairs or replacement of your vehicle if it is damaged in an accident, even if you are at fault.

- Comprehensive Coverage: Covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects.

Peace of Mind and Financial Security

Full coverage insurance offers peace of mind and financial security by providing:

- Protection against significant financial losses: Accidents can be costly, and full coverage helps protect you from substantial financial burdens. It covers repairs, replacement, or medical expenses related to the accident.

- Financial stability: Having full coverage ensures you have financial stability in the event of a covered incident, preventing you from dipping into savings or facing significant debt.

- Reduced stress: Knowing you have comprehensive protection can reduce stress and anxiety in the event of an accident, allowing you to focus on recovery and other priorities.

Real-Life Scenarios Where Full Coverage Proves Beneficial

Full coverage insurance provides valuable protection in various real-life situations, such as:

- A car accident: If you are involved in an accident, full coverage can help cover repairs or replacement of your vehicle, regardless of fault. It can also cover medical expenses for yourself and passengers.

- Vehicle theft: Full coverage can provide financial protection if your car is stolen. It covers the cost of replacing or repairing your vehicle, depending on the policy terms.

- Natural disaster: If your car is damaged due to a natural disaster, such as a flood, earthquake, or hurricane, full coverage can help cover the cost of repairs or replacement.

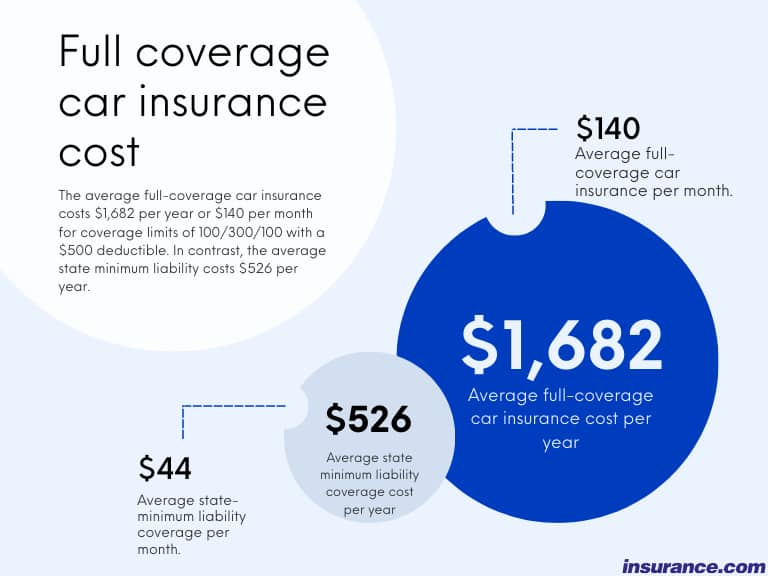

Factors Affecting Full Coverage Costs

Full coverage car insurance provides comprehensive protection, but the cost can vary significantly. Several factors influence the premium you pay, and understanding these factors can help you make informed decisions about your insurance coverage.

Driving History

Your driving history is a significant factor in determining your full coverage car insurance cost. A clean driving record with no accidents or violations usually results in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly increase your insurance costs.

- Accidents: Each accident, regardless of fault, can increase your premium. The severity of the accident, such as property damage or injuries, can further impact the cost.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can lead to higher premiums. The number and severity of violations can influence the increase.

- DUI Convictions: A DUI conviction significantly increases your insurance costs. This is because it demonstrates a higher risk of future accidents and legal issues.

Vehicle Type

The type of vehicle you drive also affects your full coverage insurance costs. Certain vehicle characteristics, such as make, model, year, and safety features, influence the premium.

- Make and Model: Some car models are known for their higher repair costs or a higher risk of theft. These vehicles tend to have higher insurance premiums.

- Year: Newer vehicles typically have more advanced safety features, which can lead to lower insurance costs. Older vehicles, on the other hand, may have higher premiums due to potential mechanical issues and higher repair costs.

- Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and electronic stability control often have lower premiums. These features reduce the risk of accidents and injuries, making the vehicle less risky to insure.

Location

Your location plays a crucial role in determining your full coverage insurance costs. The risk of accidents and theft varies depending on the area you live in.

Full coverage car insurance provides comprehensive protection against a range of risks, including accidents, theft, and natural disasters. If you’re looking for a reputable insurer known for its customer service and competitive rates, consider checking out liberty mutual insurance.

They offer a variety of full coverage options to suit different needs and budgets, helping you find the right level of protection for your vehicle.

- Urban Areas: Cities with high population density and traffic congestion generally have higher insurance rates due to increased accident risks.

- Rural Areas: Rural areas with lower population density and less traffic often have lower insurance rates.

- Crime Rates: Areas with higher crime rates, particularly for vehicle theft, tend to have higher insurance premiums.

Age

Your age can influence your full coverage car insurance costs. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher insurance premiums. As you age, your risk profile generally decreases, leading to lower premiums.

- Young Drivers: Young drivers often lack experience and may be more likely to take risks. Insurance companies consider this increased risk and charge higher premiums.

- Mature Drivers: Older drivers, particularly those over 65, may have slower reaction times and reduced vision, which can increase their risk of accidents. However, they also have more driving experience and may be more cautious, leading to varying premium adjustments.

Credit Score

In many states, insurance companies use your credit score as a factor in determining your insurance premiums. This is based on the assumption that individuals with good credit are more financially responsible and less likely to file claims.

- Good Credit Score: A good credit score can lead to lower insurance premiums. This is because you are perceived as a lower risk to the insurance company.

- Poor Credit Score: A poor credit score can result in higher insurance premiums. Insurance companies may see you as a higher risk, as you are more likely to default on payments or file fraudulent claims.

Choosing the Right Full Coverage Policy

Finding the perfect full coverage car insurance policy involves more than just choosing the cheapest option. It’s about finding a policy that provides the right level of protection at a price that fits your budget. To achieve this, you need to be a smart shopper and understand how to compare quotes and customize your policy to meet your unique needs.

Comparing Quotes

To get the best value for your money, it’s crucial to compare quotes from multiple insurance providers. This allows you to see a range of prices and coverage options, helping you make an informed decision.

- Use online comparison websites: These websites allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each insurer individually.

- Contact insurance agents directly: While online comparison websites are convenient, contacting insurance agents directly can be beneficial. They can provide personalized advice and answer your questions about specific policies.

- Consider your insurance history: Your driving record and claims history significantly influence your insurance premiums. Good driving habits and a clean record can lead to lower rates.

Finding the Best Value

Beyond comparing quotes, you can find the best value by considering the following:

- Deductibles: A deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically lead to lower premiums. Choose a deductible you can comfortably afford in case of an accident.

- Coverage limits: Coverage limits determine the maximum amount your insurance will pay for specific claims. Ensure the limits are sufficient to cover your potential losses in case of an accident.

- Discounts: Most insurers offer discounts for various factors, such as safe driving, good grades, and bundling multiple insurance policies. Ask about available discounts to potentially reduce your premiums.

Customizing Your Policy

Once you’ve compared quotes and considered your needs, you can customize your policy to fit your budget and specific requirements.

- Optional coverages: Many insurance policies offer optional coverages, such as roadside assistance, rental car reimbursement, and gap insurance. Consider whether these additional coverages are necessary and affordable for your situation.

- Adjust coverage limits: Depending on your car’s value and your financial situation, you can adjust coverage limits to reflect your needs. For example, if you have an older car with lower value, you might opt for lower coverage limits.

- Negotiate your premium: Don’t be afraid to negotiate your premium with the insurer. You might be able to get a better rate by explaining your good driving record or by bundling multiple policies.

Understanding Exclusions and Limitations

Full coverage car insurance provides comprehensive protection, but it’s crucial to understand that it doesn’t cover everything. Like most insurance policies, full coverage policies have exclusions and limitations that Artikel situations where coverage might not apply.

Exclusions and Limitations

It’s essential to carefully review your policy documents to understand the specific exclusions and limitations that apply to your coverage. Here are some common exclusions and limitations:

- Wear and Tear: Full coverage insurance generally doesn’t cover damage caused by normal wear and tear. This includes things like tire punctures, worn-out brake pads, or faded paint.

- Cosmetic Damage: Minor scratches, dents, or blemishes that don’t affect the car’s functionality are usually not covered.

- Mechanical Failures: Damage resulting from mechanical breakdowns or malfunctions is typically not covered by full coverage insurance. For example, if your engine seizes up due to a mechanical failure, you won’t be covered.

- Acts of God: While full coverage insurance often covers damage caused by natural disasters like floods, earthquakes, or tornadoes, it may have limitations or exclusions for certain events.

- Driving Under the Influence: If you’re driving under the influence of alcohol or drugs and cause an accident, your insurance coverage may be limited or denied.

- Uninsured or Underinsured Motorists: While full coverage includes uninsured/underinsured motorist coverage, there may be limits on the amount of compensation available.

- Rental Car Coverage: Full coverage insurance may include rental car coverage, but there might be limitations on the duration or daily allowance for rental car expenses.

Examples of Scenarios Where Coverage Might Not Apply

- Driving Without a License: If you’re driving without a valid driver’s license and get into an accident, your insurance coverage may be denied.

- Using Your Car for Commercial Purposes: Full coverage insurance typically doesn’t cover damage that occurs while using your car for business purposes.

- Racing or Off-Road Driving: If you’re involved in a race or are driving off-road and damage your car, your insurance coverage might be limited or denied.

- Leaving Your Car Unattended: If you leave your car unattended with the keys in the ignition and it gets stolen, your insurance coverage may be limited.

Claims Process and Procedures

Filing a claim under full coverage car insurance is a straightforward process, but it’s crucial to understand the steps involved to ensure a smooth and efficient resolution. This section will guide you through the process, explaining the required documentation, the claims handling process, and expected timelines.

Documentation and Information Required

When filing a claim, having the necessary documentation readily available is essential for a prompt processing. The following information is typically required:

- Policy Information: Your policy number, coverage details, and contact information.

- Accident Details: Date, time, location, and description of the accident. Include details about the other vehicles involved, any injuries sustained, and witness information.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), and license plate number.

- Driver’s License: A copy of your driver’s license and any other relevant licenses involved.

- Police Report: If the accident involved a police report, a copy of the report is essential.

- Photos and Videos: Pictures or videos of the damage to your vehicle and the accident scene can be helpful.

- Repair Estimates: If you have already obtained repair estimates from a mechanic, provide copies of these estimates.

Claims Handling Process

Once you have filed your claim, the insurance company will initiate the claims handling process. This typically involves the following steps:

- Claim Review: The insurance company will review your claim and the supporting documentation to verify the details and coverage.

- Investigation: Depending on the complexity of the claim, the insurance company may conduct an investigation to gather further information. This could involve contacting witnesses, reviewing police reports, or conducting an inspection of the damaged vehicle.

- Damage Assessment: Once the investigation is complete, the insurance company will assess the damage to your vehicle and determine the cost of repairs or replacement.

- Payment Processing: If your claim is approved, the insurance company will process the payment for the repairs or replacement. Payment can be made directly to the repair shop or to you, depending on your policy terms.

Expected Timelines

The time it takes to process a claim can vary depending on the complexity of the claim and the efficiency of the insurance company. However, you can expect the following general timelines:

- Initial Claim Filing: Within 24-48 hours after filing your claim, you should receive an acknowledgement from the insurance company.

- Investigation: The investigation process can take anywhere from a few days to a few weeks, depending on the complexity of the claim.

- Damage Assessment: Once the investigation is complete, the damage assessment can typically be completed within a few days.

- Payment Processing: Once the damage assessment is finalized, payment processing can take anywhere from a few days to a few weeks.

Important Note: It’s crucial to cooperate with the insurance company throughout the claims process. Respond to any requests for information promptly and provide all necessary documentation. This will help expedite the process and ensure a smooth resolution.

Alternatives to Full Coverage

While full coverage car insurance offers comprehensive protection, it might not always be the most cost-effective option for everyone. Depending on your individual circumstances and financial situation, exploring alternative car insurance options can be beneficial.

Let’s delve into some alternative car insurance options and their pros and cons, helping you make an informed decision.

Liability-Only Coverage

Liability-only coverage, also known as state minimum coverage, provides financial protection for third parties in case you cause an accident. It covers damages to other vehicles or property and medical expenses for injured parties. However, it does not cover damage to your own vehicle.

- Pros:

- Lower premiums compared to full coverage.

- Meets the minimum insurance requirements in most states.

- Suitable for older vehicles with lower market value.

- Cons:

- No coverage for damage to your own vehicle in an accident.

- You will have to pay out of pocket for repairs or replacement of your car.

- Limited protection in case of a major accident or natural disaster.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against non-collision damages, such as theft, vandalism, fire, natural disasters, and other incidents. It doesn’t cover accidents caused by your own driving but provides protection for situations beyond your control.

- Pros:

- Protects your vehicle from non-collision risks.

- Provides financial assistance for repairs or replacement in case of covered events.

- Can be combined with liability coverage for comprehensive protection.

- Cons:

- Higher premiums compared to liability-only coverage.

- May not cover all types of damages, such as wear and tear.

- May have deductibles that you need to pay before coverage kicks in.

Tips for Saving on Full Coverage Costs: Full Coverage Car Insurance

Full coverage car insurance offers comprehensive protection, but it can come with a hefty price tag. Fortunately, there are several strategies you can implement to reduce your premiums and make this type of insurance more affordable. By understanding these strategies and making informed choices, you can save money on your car insurance while maintaining the peace of mind that comes with full coverage.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors in determining your car insurance premiums. Insurance companies view drivers with a history of accidents or traffic violations as higher risks, leading to higher premiums.

- Avoid Traffic Violations: Even minor traffic offenses, like speeding tickets or parking violations, can negatively impact your insurance rates.

- Practice Safe Driving Habits: Defensive driving techniques, such as maintaining a safe following distance, avoiding distractions, and adhering to speed limits, can help prevent accidents and keep your driving record clean.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate to insurance companies that you are committed to safe driving practices. Some insurers may even offer discounts for completing these courses.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower premiums, as you are essentially taking on more financial responsibility in the event of an accident.

- Evaluate Your Risk Tolerance: Consider your financial situation and how much you are comfortable paying out-of-pocket in the event of a claim.

- Consider a Higher Deductible: A higher deductible will typically result in lower premiums. However, ensure you have the financial resources to cover the deductible if you need to file a claim.

Bundling Insurance Policies

Many insurance companies offer discounts when you bundle multiple insurance policies, such as car insurance, homeowners insurance, or renters insurance, with the same provider.

- Explore Bundling Options: Contact your current insurer or shop around for quotes from other companies to see if bundling your policies can save you money.

- Compare Discounts: Make sure to compare the discounts offered by different insurers to ensure you are getting the best deal.

Discounts Offered by Insurance Companies

Insurance companies offer a variety of discounts to help policyholders save money.

- Good Student Discount: This discount is available to students who maintain a certain GPA.

- Safe Driver Discount: This discount is awarded to drivers who have a clean driving record.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may be eligible for a multi-car discount.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS trackers, can reduce your insurance premiums.

- Loyalty Discount: Some insurance companies offer discounts to long-term customers.

- Payment Discount: Paying your premium in full or setting up automatic payments may qualify you for a discount.

Taking Defensive Driving Courses

Defensive driving courses can teach you valuable skills to help you become a safer driver.

- Improved Driving Skills: These courses cover topics such as hazard recognition, defensive driving techniques, and accident avoidance.

- Potential Premium Discounts: Some insurance companies offer discounts to drivers who complete defensive driving courses.

- Increased Awareness: By learning about common driving hazards and developing safer driving habits, you can reduce your risk of accidents and potentially lower your insurance premiums.

Additional Considerations for Full Coverage

Full coverage car insurance, while offering comprehensive protection, involves several important considerations that go beyond the basic benefits. Understanding these nuances can significantly impact your insurance costs, claims experience, and overall financial well-being.

Deductibles and Coverage Limits

Deductibles and coverage limits are fundamental components of full coverage car insurance. They determine the financial responsibility you bear in the event of an accident.

- Deductible: The amount you pay out-of-pocket before your insurance kicks in to cover the remaining costs of repairs or replacement. Higher deductibles typically result in lower premiums. For example, a $500 deductible means you pay the first $500 of repair costs, and your insurance covers the rest.

- Coverage Limits: The maximum amount your insurance company will pay for a covered loss. For example, a $50,000 liability limit means your insurance will cover up to $50,000 in damages caused to another person’s property or injuries.

It is crucial to choose deductibles and coverage limits that align with your financial situation and risk tolerance. A higher deductible may save you on premiums, but it also means you’ll need to have more cash on hand to cover initial expenses. Conversely, higher coverage limits provide greater financial protection but can lead to higher premiums.

Determining Fault in Accidents

Insurance companies use various methods to determine fault in accidents, which significantly impacts the claims process and the financial responsibilities of those involved.

- Police Reports: Police reports provide an objective account of the accident, including witness statements and evidence.

- Witness Statements: Eyewitness accounts can provide valuable insights into the events leading up to the accident.

- Physical Evidence: Skid marks, debris, and damage to vehicles can help determine the cause of the accident.

- Traffic Camera Footage: Surveillance cameras or dashcams can capture valuable footage of the accident.

In some cases, accidents might involve multiple parties, making fault determination more complex. Insurance companies use their own investigation processes and may consult with independent experts to assess the situation. The determination of fault can influence who is responsible for paying for damages, the amount of coverage provided, and the potential for premium increases.

Consequences of Driving Without Adequate Car Insurance

Driving without adequate car insurance can lead to severe consequences, including financial hardship, legal repercussions, and potential license suspension.

- Financial Hardship: In the event of an accident, you could be responsible for covering all repair costs, medical expenses, and legal fees, leading to significant financial burdens.

- Legal Repercussions: Driving without insurance is illegal in most jurisdictions and can result in fines, license suspension, and even jail time.

- License Suspension: If you are found driving without insurance, your license may be suspended, making it impossible to legally operate a vehicle.

It is crucial to ensure that you have the appropriate level of car insurance coverage to protect yourself and others on the road.

Closing Notes

By understanding the nuances of full coverage car insurance, you can make informed decisions that align with your individual circumstances and financial goals. Whether you’re a seasoned driver or a new car owner, having a comprehensive understanding of full coverage car insurance is essential. It empowers you to navigate the complexities of the insurance landscape and secure the protection you need, providing peace of mind and financial security on the road.