Dog insurance sets the stage for this enthralling narrative, offering readers a glimpse into a world where peace of mind meets responsible pet ownership. Imagine a world where unexpected veterinary bills don’t become a financial burden, where you can focus on your beloved dog’s recovery without the added stress of mounting costs.

Dog insurance is a safety net for pet owners, providing financial protection against the unforeseen health challenges that can arise during a dog’s lifetime. It’s a way to ensure that your furry friend receives the best possible care, regardless of the cost. This comprehensive guide explores the ins and outs of dog insurance, helping you make informed decisions for your canine companion’s well-being.

What is Dog Insurance?

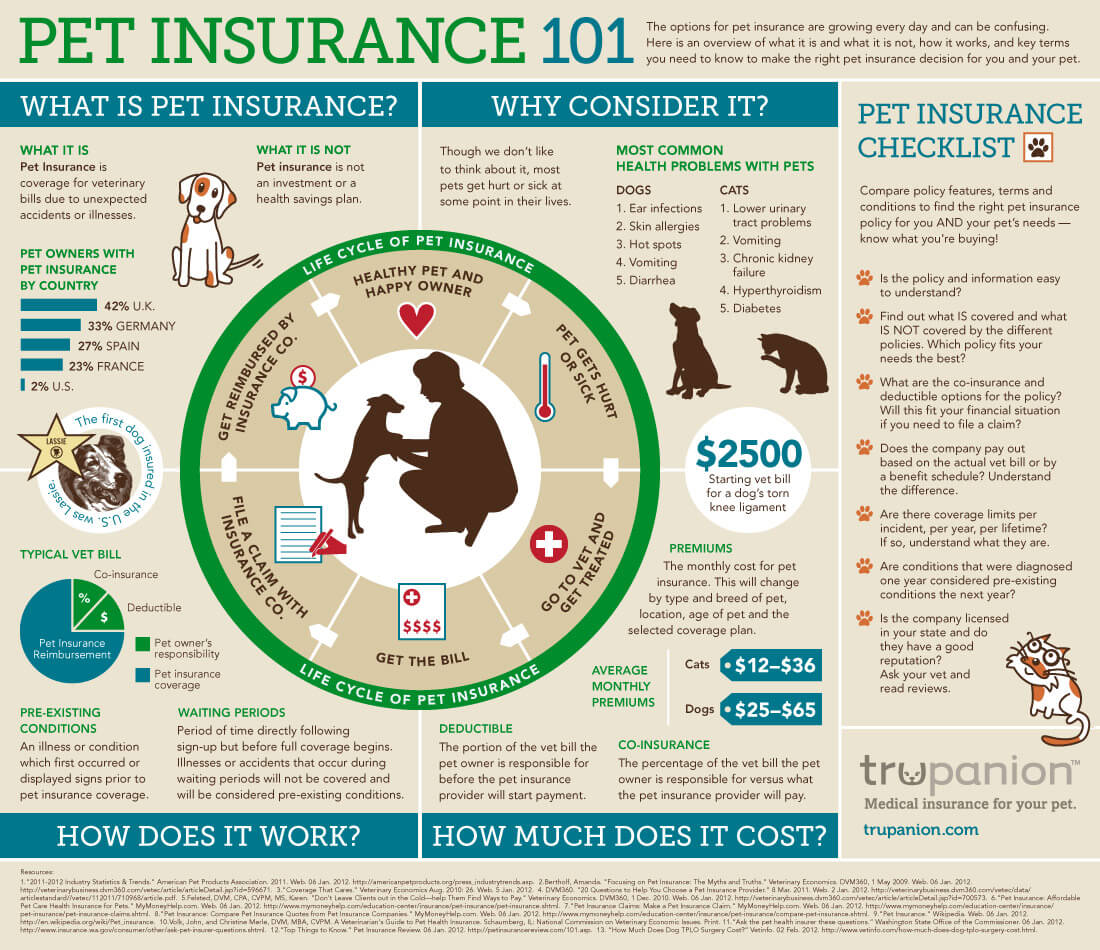

Dog insurance is a type of coverage that helps pet owners pay for unexpected veterinary expenses. It’s similar to health insurance for humans, but it’s designed specifically for our furry friends.

Just like human health insurance, dog insurance policies can cover a wide range of medical costs, including accidents, illnesses, and even preventative care.

Types of Dog Insurance Coverage

Dog insurance policies offer various types of coverage, depending on your needs and budget. Here are some common types:

- Accident Only: This coverage pays for vet bills related to accidents, such as broken bones, car accidents, or bites.

- Illness: This coverage helps with vet bills related to illnesses, such as infections, diseases, and chronic conditions.

- Preventative Care: This coverage covers routine vet visits, vaccinations, and other preventative measures, such as dental cleanings and parasite treatments.

- Comprehensive: This coverage offers a combination of accident, illness, and preventative care coverage, providing the most comprehensive protection for your dog.

Benefits of Dog Insurance

Dog insurance can offer several benefits for pet owners, including:

- Peace of mind: Knowing that you have financial protection for unexpected vet bills can provide peace of mind and allow you to focus on your dog’s recovery.

- Financial security: Vet bills can be expensive, and dog insurance can help you avoid financial strain in the event of an accident or illness.

- Access to the best care: With dog insurance, you can afford to provide your dog with the best possible medical care, without worrying about the cost.

- Potential cost savings: While you pay monthly premiums, dog insurance can help you save money in the long run by covering vet bills that could otherwise be very expensive.

Factors to Consider When Choosing Dog Insurance

Choosing the right dog insurance policy can be a daunting task, as there are many factors to consider. It’s crucial to compare different policies, understand the coverage they offer, and select the one that best suits your dog’s needs and your budget.

Coverage Options and Costs

Understanding the different types of coverage and their associated costs is essential.

- Accident and Illness Coverage: This is the most common type of coverage, protecting your dog against unexpected medical expenses due to accidents or illnesses. These policies typically cover a wide range of conditions, including injuries, illnesses, and surgeries. The cost of this coverage can vary depending on the policy’s deductible, co-insurance, and annual limit.

- Third-Party Liability: This coverage protects you from financial liability if your dog causes damage to someone else’s property or injures another person. This type of coverage is particularly important for large or aggressive breeds. The cost of third-party liability coverage can vary depending on the policy’s limit of indemnity.

- Additional Coverages: Some insurance providers offer additional coverages, such as dental care, behavioral therapy, and even preventative care, like vaccinations and parasite treatments. These additional coverages come at an extra cost and can significantly increase the overall premium.

Understanding Policy Terms and Conditions

It’s crucial to thoroughly read and understand the policy terms and conditions before purchasing dog insurance.

- Deductible: This is the amount you pay out-of-pocket before the insurance company starts covering costs. A higher deductible typically means a lower premium, but you’ll pay more upfront in case of a claim.

- Co-insurance: This is the percentage of the vet bill you’re responsible for paying after the deductible has been met. A higher co-insurance percentage means a lower premium, but you’ll pay more for each claim.

- Annual Limit: This is the maximum amount the insurance company will pay out for claims in a given year. A higher annual limit typically means a higher premium, but you’ll have more coverage in case of multiple claims.

- Exclusions: All insurance policies have exclusions, which are conditions or events that are not covered. It’s important to carefully review the exclusions to ensure that your dog’s specific needs are covered. For example, some policies may exclude coverage for pre-existing conditions or certain breeds.

- Waiting Periods: Some policies have waiting periods before certain conditions are covered. This means that if your dog develops a condition within the waiting period, the insurance company may not cover the costs.

Key Features of Dog Insurance Policies

A comprehensive dog insurance policy should cover a range of essential aspects to protect your furry friend from unexpected medical expenses. Different providers offer varying levels of coverage, so it’s crucial to compare and contrast their offerings to find the best fit for your dog’s needs and your budget.

Coverage Options, Dog insurance

The coverage offered by different dog insurance providers can vary significantly. Here’s a breakdown of common coverage options:

- Accident and Illness Coverage: This is the most common type of coverage, protecting against unexpected accidents and illnesses. It typically covers vet fees for diagnosis, treatment, surgery, hospitalization, and medication.

- Routine Care Coverage: Some policies may include coverage for routine care, such as vaccinations, dental cleanings, and parasite prevention. However, this is less common and usually has limitations or co-pays.

- Third-Party Liability Coverage: This coverage protects you from financial liability if your dog injures someone or damages property. It’s particularly important for larger or more energetic breeds.

- Behavioral Coverage: Some policies may cover behavioral issues, such as aggression or anxiety, if they require professional intervention.

- Cruciate Ligament Coverage: This specific coverage addresses the common issue of cruciate ligament tears, which can be costly to repair. It’s often available as an add-on or separate policy.

Premium and Deductible

The premium you pay for dog insurance is determined by various factors, including your dog’s breed, age, location, and chosen coverage level. The deductible is the amount you pay out of pocket before the insurance kicks in. Here’s a table comparing the key features of popular dog insurance policies:

| Provider | Coverage | Premium (Monthly) | Deductible |

|---|---|---|---|

| Provider A | Accident and Illness | $30 – $50 | $100 – $500 |

| Provider B | Accident, Illness, and Routine Care | $40 – $70 | $200 – $750 |

| Provider C | Accident and Illness, Third-Party Liability | $50 – $90 | $300 – $1000 |

Note: Premiums and deductibles can vary widely depending on your specific circumstances. It’s essential to get personalized quotes from multiple providers to compare prices and coverage options.

Other Important Features

In addition to coverage options and pricing, consider these key features when evaluating dog insurance policies:

- Annual Limit: This is the maximum amount the insurance company will pay out per year. Make sure the limit is high enough to cover potential major medical expenses.

- Waiting Periods: Some conditions may have waiting periods before they are covered. For example, a pre-existing condition might not be covered for a certain period after the policy starts.

- Claims Process: Understand how to file a claim and how quickly you can expect reimbursement. Look for providers with a straightforward and efficient claims process.

- Customer Service: Choose a provider with a reputation for excellent customer service and responsiveness. You’ll need to rely on them when dealing with unexpected medical emergencies.

Tips for Saving Money on Dog Insurance

Dog insurance can be a valuable investment, but it can also be a significant expense. Fortunately, there are several strategies you can employ to lower your premiums and make coverage more affordable.

Choosing a Deductible and Coverage Level

A higher deductible generally translates to lower monthly premiums. Consider your budget and risk tolerance when selecting a deductible. If you’re comfortable shouldering a larger upfront cost in the event of a claim, opting for a higher deductible can save you money in the long run.

Similarly, the level of coverage you choose will impact your premium. Comprehensive plans that cover a wide range of conditions will typically be more expensive than plans with limited coverage.

Exploring Discounts and Bundling Options

Many insurance companies offer discounts for various factors, such as:

- Multiple pet coverage: Insuring multiple pets with the same provider can often result in a discount.

- Breed discounts: Certain dog breeds may be considered lower risk and qualify for discounted premiums.

- Age discounts: Younger dogs may receive lower premiums compared to older dogs.

- Payment in full: Paying your annual premium upfront may lead to a discount.

Benefits of Preventative Care

Investing in preventative care can significantly reduce your overall insurance costs. Routine checkups, vaccinations, and parasite prevention can help detect and address health issues early, potentially preventing more serious and expensive conditions later on.

For example, annual dental cleanings can help prevent tooth decay and gum disease, which can lead to costly procedures down the line.

Resources for Affordable Dog Insurance

- Comparison websites: Websites like Policygenius and Compare.com allow you to compare quotes from multiple insurance providers, helping you find the most affordable option.

- Consumer advocacy groups: Organizations like the American Kennel Club (AKC) and the American Veterinary Medical Association (AVMA) offer resources and information on dog insurance, including recommendations for reputable providers.

- Financial advisors: Consulting with a financial advisor can provide valuable insights into your insurance needs and help you make informed decisions about coverage and affordability.

Dog Insurance and Pet Ownership

Dog insurance plays a crucial role in responsible pet ownership, ensuring that you can provide the best possible care for your furry companion, regardless of unexpected health challenges. It acts as a safety net, protecting you from the potentially crippling financial burden of unforeseen veterinary expenses.

Financial Preparation for Unexpected Veterinary Expenses

Dog insurance is designed to help pet owners financially prepare for unexpected veterinary expenses. It provides financial assistance for a wide range of covered medical costs, including accidents, illnesses, and even routine care.

“Dog insurance can be a lifesaver, particularly when faced with a serious illness or injury that requires expensive treatments.”

By having dog insurance, you can focus on your dog’s recovery without the added stress of worrying about how to afford the necessary care. This peace of mind allows you to make the best decisions for your dog’s health without financial constraints.

The Future of Dog Insurance

The dog insurance industry is undergoing a period of rapid evolution, driven by technological advancements, changing pet owner expectations, and a growing awareness of the rising costs of veterinary care. These trends are shaping the future of dog insurance, leading to new innovations, expanded coverage options, and a more personalized approach to pet healthcare.

Technological Advancements and Their Impact

Technological advancements are transforming the dog insurance landscape in several ways.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are being used to analyze vast amounts of data related to pet health, claims history, and veterinary practices. This data analysis helps insurers develop more accurate risk assessments, personalize premiums, and predict future claims. AI-powered chatbots are also being used to provide 24/7 customer support and streamline the claims process.

- Telemedicine and Remote Monitoring: Telemedicine is becoming increasingly popular for pet healthcare, allowing owners to consult with veterinarians remotely via video conferencing. This trend is likely to continue, leading to more frequent use of telemedicine for routine checkups, medication refills, and even remote monitoring of chronic conditions. Dog insurance providers are adapting to this shift by offering coverage for telemedicine consultations and remote monitoring devices.

- Wearable Technology: Wearable devices like fitness trackers and smart collars are collecting real-time data on pet activity levels, sleep patterns, and even heart rate. This data can provide valuable insights into pet health and potentially help predict health issues. Dog insurance providers are exploring ways to integrate this data into their risk assessments and potentially offer discounts for owners who actively monitor their pets’ health.

- Blockchain Technology: Blockchain technology is being explored for its potential to improve transparency and security in the insurance industry. It could be used to create a secure and immutable record of pet health information, claims history, and policy details. This could help streamline the claims process and potentially reduce fraud.

The Future of Pet Healthcare and its Implications

The future of pet healthcare is characterized by a growing emphasis on preventative care, personalized medicine, and the use of advanced technologies.

- Preventive Care: Pet owners are becoming increasingly proactive in their approach to pet healthcare, focusing on preventative measures to avoid costly illnesses later. Dog insurance providers are recognizing this trend by offering coverage for preventative care services like vaccinations, dental cleanings, and parasite prevention.

- Personalized Medicine: Advances in genomics and personalized medicine are allowing veterinarians to tailor treatment plans to individual pets based on their genetic makeup and specific health needs. This trend is likely to lead to more effective treatments and potentially lower healthcare costs in the long run. Dog insurance providers are adapting to this shift by offering coverage for genetic testing and personalized treatment plans.

- Advanced Technologies: The use of advanced technologies like robotic surgery, stem cell therapy, and gene editing is becoming more common in veterinary medicine. These technologies can offer more effective treatment options for complex conditions, but they also come with a higher price tag. Dog insurance providers are evaluating how to incorporate coverage for these technologies into their policies.

Closure

In conclusion, dog insurance is a valuable tool for responsible pet owners, offering financial peace of mind and ensuring your furry friend receives the best possible care. By carefully considering the various factors involved, you can select a policy that meets your needs and budget, providing a safety net for unexpected veterinary expenses. With the right dog insurance, you can focus on what matters most: your dog’s health and happiness.

Dog insurance can be a valuable investment, especially for breeds prone to health issues. If you’re considering this option, it’s helpful to speak with an insurance agent who specializes in pet coverage. They can guide you through the different plans available and help you find the best fit for your furry friend’s needs and your budget.