Dairyland Insurance stands as a prominent player in the insurance landscape, offering a diverse range of products and services to meet the needs of its customers. Established with a commitment to providing reliable and affordable coverage, Dairyland Insurance has carved a niche for itself within the industry. Their focus on customer satisfaction and dedication to community involvement have earned them a loyal following and a strong reputation.

This comprehensive guide delves into the history, mission, and core values of Dairyland Insurance, providing insights into their product offerings, customer service, pricing strategies, and commitment to innovation. We’ll also explore their financial stability, reputation, and the company’s approach to claims processing and customer support. By understanding the strengths and weaknesses of Dairyland Insurance, you can make an informed decision about whether their services align with your insurance needs.

Dairyland Insurance Overview

Dairyland Insurance is a well-established insurance provider with a rich history and a commitment to serving its customers. Founded in 1952, the company has evolved into a major player in the insurance industry, known for its diverse range of products and its dedication to customer satisfaction.

Dairyland Insurance’s founding principles were rooted in the belief that everyone deserves access to affordable and reliable insurance coverage. This commitment to affordability and accessibility continues to be a cornerstone of the company’s operations.

Core Values and Mission Statement

Dairyland Insurance’s core values are reflected in its mission statement, which emphasizes customer-centricity, innovation, and community engagement. The company strives to provide its customers with exceptional service, personalized solutions, and a sense of security.

“To provide our customers with the best possible insurance experience, ensuring their peace of mind and financial security.”

This mission statement guides Dairyland Insurance’s actions and decision-making, ensuring that its operations are aligned with its core values.

Target Market and Customer Base

Dairyland Insurance caters to a diverse customer base, focusing primarily on individuals and families in the United States. The company offers a wide range of insurance products, including auto, home, renters, and life insurance, to meet the needs of different demographics and lifestyles.

Dairyland Insurance’s target market includes:

- Individuals and families seeking affordable and comprehensive insurance coverage.

- Customers who value personalized service and a commitment to customer satisfaction.

- Those who appreciate a company that is actively involved in its communities.

The company’s commitment to affordability and accessibility has attracted a broad customer base, making Dairyland Insurance a trusted choice for many Americans.

Insurance Products and Services

Dairyland Insurance offers a comprehensive range of insurance products designed to meet the diverse needs of its customers. These products are designed to provide financial protection against a variety of risks, ensuring peace of mind and financial stability.

Auto Insurance, Dairyland insurance

Auto insurance is a crucial component of protecting yourself and your vehicle. Dairyland Insurance offers a variety of coverage options to meet your specific needs.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage helps pay for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of who is at fault.

Homeowners Insurance

Homeowners insurance is essential for protecting your home and belongings against unforeseen events. Dairyland Insurance offers various homeowners insurance policies tailored to your specific needs.

- Dwelling Coverage: This coverage provides financial protection for your home’s structure, including the walls, roof, and foundation, in case of damage from covered perils such as fire, windstorms, or hail.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and other personal items, against damage or loss from covered perils.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you are found liable for property damage caused by you or a member of your household.

- Additional Living Expenses Coverage: This coverage helps pay for temporary housing and other expenses if you are unable to live in your home due to a covered event.

Renters Insurance

Renters insurance is designed to protect your belongings and provide liability coverage while you are renting a property. Dairyland Insurance offers various renters insurance policies with flexible coverage options.

- Personal Property Coverage: This coverage protects your belongings inside your rental unit, such as furniture, electronics, clothing, and other personal items, against damage or loss from covered perils.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you are found liable for property damage caused by you or a member of your household.

- Additional Living Expenses Coverage: This coverage helps pay for temporary housing and other expenses if you are unable to live in your rental unit due to a covered event.

Business Insurance

Dairyland Insurance offers a variety of business insurance products to protect your business from various risks.

- General Liability Insurance: This coverage protects your business from financial losses arising from third-party claims of bodily injury or property damage.

- Workers’ Compensation Insurance: This coverage provides benefits to employees who are injured or become ill on the job.

- Commercial Property Insurance: This coverage protects your business property, including buildings, equipment, and inventory, against damage or loss from covered perils.

- Commercial Auto Insurance: This coverage protects your business vehicles and drivers from financial losses arising from accidents, theft, or other covered events.

Other Insurance Products

Dairyland Insurance also offers a variety of other insurance products to meet your specific needs.

- Motorcycle Insurance: This coverage protects your motorcycle and provides liability protection in case of an accident.

- Boat Insurance: This coverage protects your boat and provides liability protection in case of an accident.

- RV Insurance: This coverage protects your recreational vehicle and provides liability protection in case of an accident.

- Life Insurance: This coverage provides financial protection for your loved ones in the event of your death.

- Health Insurance: This coverage helps pay for medical expenses.

Customer Experience and Service

Dairyland Insurance prioritizes providing a positive and seamless customer experience. They strive to ensure that their customers feel valued and supported throughout their insurance journey.

Customer Service Channels and Accessibility

Dairyland Insurance offers a variety of customer service channels to ensure accessibility and convenience for its policyholders. These channels include:

- Phone: Customers can reach a customer service representative by phone during business hours.

- Email: Policyholders can contact Dairyland Insurance via email for inquiries and support.

- Online Chat: A live chat feature is available on the Dairyland Insurance website for quick and convenient communication.

- Mobile App: The Dairyland Insurance mobile app allows customers to manage their policies, submit claims, and access other services on the go.

- Social Media: Dairyland Insurance maintains an active presence on social media platforms, offering another avenue for customer interaction and support.

Dairyland Insurance aims to provide prompt and efficient service through these channels, ensuring that customers receive timely assistance.

Customer Satisfaction and Complaint Resolution

Dairyland Insurance is committed to exceeding customer expectations and resolving any issues promptly and fairly. The company implements various strategies to ensure customer satisfaction, including:

- Customer Feedback Collection: Dairyland Insurance actively solicits customer feedback through surveys, reviews, and other channels to understand their needs and areas for improvement.

- Complaint Resolution Process: A clear and transparent process is in place for handling customer complaints. Customers can expect prompt acknowledgment of their concerns and a dedicated team working towards a resolution.

- Employee Training: Dairyland Insurance invests in training its customer service representatives to handle inquiries and complaints effectively, providing them with the skills and knowledge to resolve issues efficiently and professionally.

Dairyland Insurance believes in building long-term relationships with its customers by addressing their concerns and ensuring their satisfaction.

Customer Testimonials and Reviews

Customer testimonials and reviews provide valuable insights into the experiences of Dairyland Insurance policyholders. These testimonials often highlight the company’s:

- Responsive and Helpful Customer Service: Many customers praise the responsiveness and helpfulness of Dairyland Insurance’s customer service representatives.

- Ease of Claim Filing and Processing: Customers often appreciate the straightforward and efficient process for filing and processing claims.

- Competitive Pricing and Coverage Options: Policyholders appreciate the competitive rates and comprehensive coverage options offered by Dairyland Insurance.

While there may be occasional negative reviews, Dairyland Insurance takes these seriously and uses them as opportunities to improve its services and processes.

Financial Stability and Reputation

Dairyland Insurance’s financial stability and reputation are crucial factors for potential customers considering their insurance services. These aspects demonstrate the company’s ability to fulfill its obligations and provide reliable coverage.

Financial Performance and Stability Ratings

Dairyland Insurance’s financial performance is a key indicator of its stability. This information can be assessed through various financial ratings agencies that evaluate insurance companies’ financial strength and ability to meet their policyholder obligations.

- A.M. Best: A.M. Best is a leading credit rating agency specializing in the insurance industry. They assign financial strength ratings to insurance companies based on their financial performance, risk management practices, and overall business operations. A higher rating indicates a stronger financial position and greater ability to meet policyholder claims.

- Standard & Poor’s: Standard & Poor’s (S&P) is another prominent credit rating agency that provides financial ratings for insurance companies. Similar to A.M. Best, S&P’s ratings reflect the company’s financial health and ability to fulfill its obligations.

- Moody’s: Moody’s is a well-respected credit rating agency that evaluates the financial stability of various entities, including insurance companies. Their ratings assess the company’s financial strength, operating performance, and overall creditworthiness.

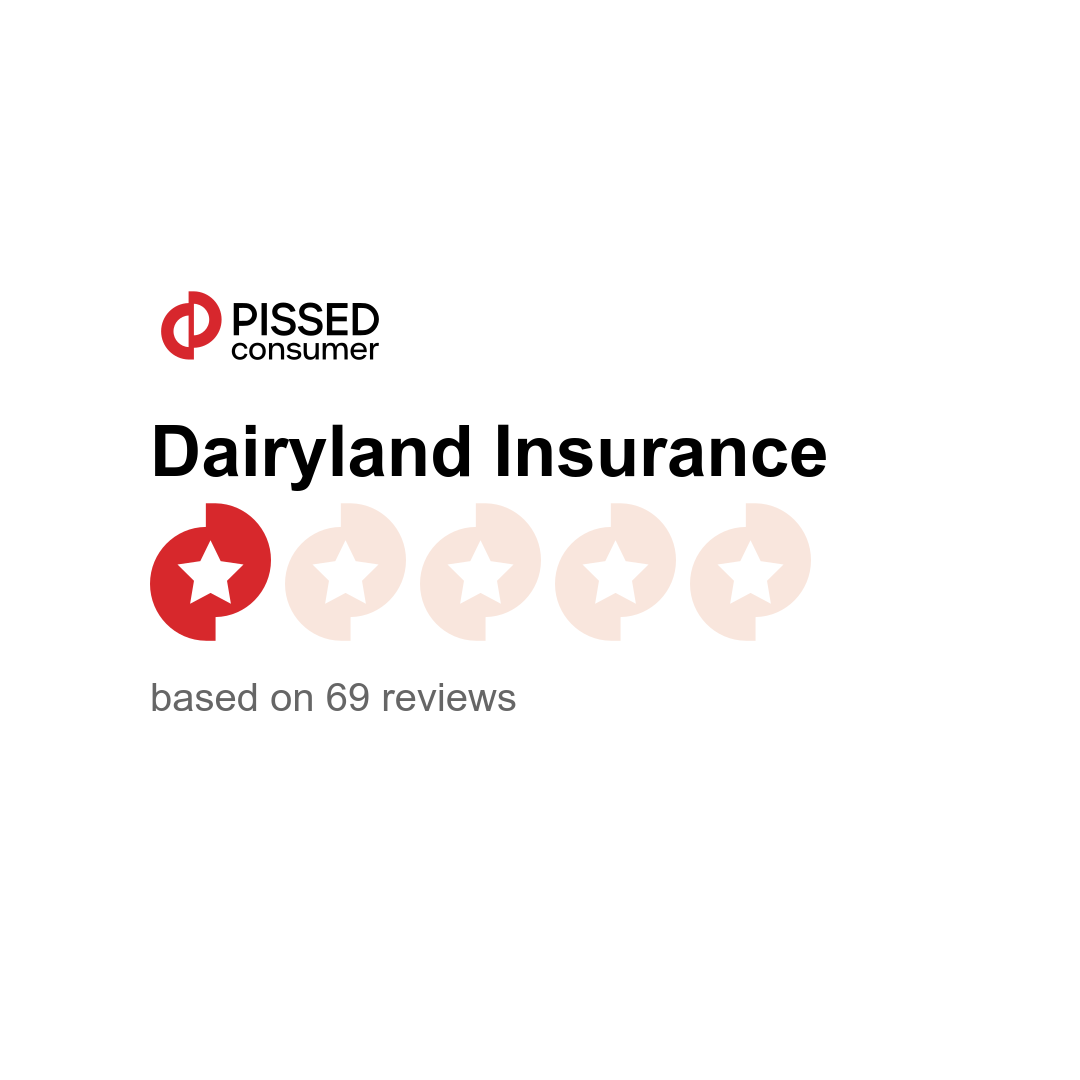

Reputation in the Insurance Industry and Among Consumers

Dairyland Insurance’s reputation is a significant factor influencing customer trust and confidence. A strong reputation is built on a track record of providing excellent customer service, fair claim handling practices, and competitive pricing.

- Industry Recognition: Dairyland Insurance’s reputation in the insurance industry can be assessed through awards, recognitions, and industry rankings. These accolades highlight the company’s performance, innovation, and commitment to customer satisfaction.

- Customer Reviews and Feedback: Online reviews and customer feedback platforms provide valuable insights into Dairyland Insurance’s reputation among consumers. Positive reviews indicate satisfied customers, while negative reviews highlight areas where the company may need to improve.

- Media Coverage: News articles, blog posts, and social media discussions can shed light on Dairyland Insurance’s reputation. Positive media coverage can enhance the company’s image, while negative coverage may raise concerns about its practices or customer service.

Claims Process and Customer Support

Dairyland Insurance strives to make the claims process as straightforward and efficient as possible for its policyholders. The company has implemented a comprehensive claims handling system that prioritizes promptness, transparency, and customer satisfaction.

Filing a Claim

To initiate a claim with Dairyland Insurance, policyholders can choose from several convenient methods:

- Online Portal: Dairyland’s user-friendly online portal allows policyholders to file claims 24/7, providing a convenient and secure option.

- Mobile App: The Dairyland mobile app offers a streamlined claims filing process, allowing policyholders to submit claims and track their progress on the go.

- Phone: Policyholders can reach a dedicated claims team by phone, available during business hours, to file claims and receive immediate assistance.

- Mail: In cases where online or phone filing is not feasible, policyholders can submit claims through traditional mail.

Claims Handling Procedures

Dairyland Insurance follows a standardized claims handling process to ensure fairness and efficiency. The process typically involves the following steps:

- Initial Claim Reporting: Upon receiving a claim, Dairyland Insurance assigns a dedicated claims adjuster to handle the case.

- Investigation: The claims adjuster will investigate the claim, gathering information and evidence to determine the validity and extent of the covered loss.

- Damage Assessment: Depending on the nature of the claim, Dairyland may arrange for an independent inspection or appraisal to assess the damage.

- Claim Evaluation: The claims adjuster reviews the gathered information and evidence to determine the amount of coverage applicable to the claim.

- Payment Processing: Once the claim is approved, Dairyland Insurance processes the payment promptly, typically within a predetermined timeframe.

Claim Timelines

Dairyland Insurance aims to resolve claims within a reasonable timeframe. The specific timeline may vary depending on the complexity of the claim and the availability of required information. For straightforward claims, Dairyland typically strives to process payments within a few business days. However, for more complex claims, the process may take longer.

Customer Support

Dairyland Insurance understands that the claims process can be stressful, and the company is committed to providing dedicated customer support throughout the journey.

- 24/7 Claims Hotline: Policyholders can access a dedicated claims hotline, available around the clock, for immediate assistance and support.

- Dedicated Claims Adjusters: Each claim is assigned to a dedicated claims adjuster who acts as a single point of contact, providing personalized support and updates.

- Online Resources: Dairyland’s website and mobile app offer a wealth of resources, including FAQs, claim forms, and progress tracking tools.

- Email Support: Policyholders can reach out to the claims team via email for inquiries and updates.

Technology and Innovation

Dairyland Insurance recognizes the vital role technology plays in enhancing customer service, streamlining operations, and staying competitive in today’s digital landscape. The company has strategically implemented various technological solutions to modernize its processes, improve efficiency, and provide a seamless experience for its customers.

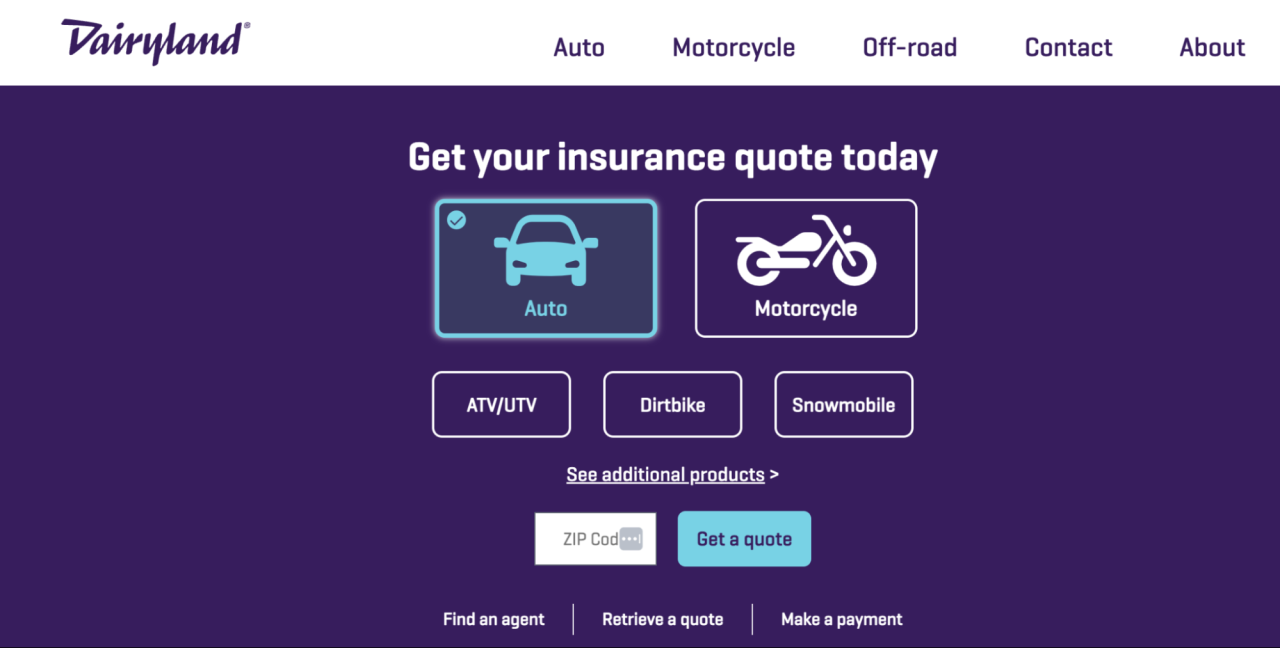

Digital Transformation and Online Platforms

Dairyland Insurance has embraced digital transformation to provide a user-friendly and convenient online experience for its customers. The company’s website serves as a central hub for accessing various services, including:

- Obtaining quotes

- Managing policies

- Filing claims

- Accessing account information

The website is designed with a responsive layout, ensuring optimal viewing and navigation across different devices. This allows customers to easily access the information they need, anytime and anywhere.

Innovative Initiatives and Partnerships

Dairyland Insurance is actively exploring innovative technologies and partnerships to enhance its offerings and stay ahead of the curve. For example, the company has partnered with leading technology providers to implement artificial intelligence (AI) and machine learning (ML) algorithms to automate certain tasks, such as:

- Risk assessment

- Fraud detection

- Claims processing

This not only improves efficiency but also enhances accuracy and reduces human error.

Community Involvement and Social Responsibility

Dairyland Insurance recognizes its responsibility as a corporate citizen and is dedicated to making a positive impact on the communities it serves. This commitment extends beyond providing insurance products and services, encompassing a range of philanthropic programs and initiatives that address critical social issues.

Philanthropic Programs and Initiatives

Dairyland Insurance’s commitment to social responsibility is reflected in its support of various philanthropic programs and initiatives. These programs aim to address diverse community needs, including education, healthcare, disaster relief, and environmental sustainability.

- Educational Support: Dairyland Insurance actively supports educational programs and initiatives that promote academic achievement and provide opportunities for underprivileged students. The company partners with local schools and organizations to offer scholarships, grants, and educational resources.

- Healthcare Initiatives: Recognizing the importance of accessible healthcare, Dairyland Insurance contributes to organizations that provide medical services to underserved communities. These initiatives may include funding for medical equipment, supporting healthcare professionals, or sponsoring health awareness campaigns.

- Disaster Relief Efforts: Dairyland Insurance is committed to providing assistance during natural disasters and emergencies. The company donates to disaster relief organizations and mobilizes resources to help affected communities recover and rebuild.

- Environmental Sustainability: Dairyland Insurance recognizes the importance of environmental protection and supports initiatives that promote sustainability. This may involve investing in renewable energy sources, reducing its carbon footprint, or partnering with environmental organizations to protect natural resources.

Impact of Social Responsibility Efforts

Dairyland Insurance’s social responsibility efforts have a significant impact on its stakeholders, including customers, employees, and the communities it serves.

- Enhanced Customer Loyalty: By demonstrating its commitment to social responsibility, Dairyland Insurance builds trust and loyalty among its customers. Customers are more likely to support companies that share their values and contribute to making a difference.

- Employee Engagement: Engaging in social responsibility initiatives fosters a positive work environment and increases employee morale. Employees feel proud to be part of a company that makes a positive impact on the world.

- Community Development: Dairyland Insurance’s philanthropic programs and initiatives directly contribute to the development and well-being of communities. These programs provide essential resources, support vital services, and create opportunities for individuals and families.

- Positive Brand Image: By actively engaging in social responsibility, Dairyland Insurance enhances its brand image and reputation. The company is perceived as a responsible and ethical organization, which attracts customers, investors, and talent.

Future Outlook and Trends

The insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and the emergence of new risks. Dairyland Insurance must adapt to these trends to remain competitive and thrive in the future.

Impact of Emerging Trends on Dairyland Insurance’s Business Strategy

The changing landscape of the insurance industry presents both opportunities and challenges for Dairyland Insurance. The company needs to strategically adapt its business model to navigate these trends effectively.

- Digital Transformation: The increasing adoption of digital technologies is transforming the insurance industry. Customers expect personalized experiences, seamless online interactions, and instant access to information. Dairyland Insurance must invest in digital platforms, mobile apps, and data analytics to meet these expectations. This will allow the company to offer more personalized insurance products, streamline customer interactions, and improve efficiency in its operations.

- Data-Driven Insights: The availability of vast amounts of data is enabling insurers to gain deeper insights into customer behavior, risk factors, and market trends. Dairyland Insurance can leverage data analytics to develop more accurate risk assessments, personalize insurance offerings, and optimize pricing strategies. This data-driven approach will lead to more competitive pricing and improved customer satisfaction.

- Insurtech Disruption: The rise of insurtech companies is disrupting traditional insurance models. These startups are using technology to offer innovative insurance products, streamlined processes, and more personalized customer experiences. Dairyland Insurance needs to stay ahead of the curve by exploring partnerships with insurtech companies, adopting new technologies, and developing its own innovative solutions. This will allow the company to remain competitive and attract new customers.

- Climate Change and Sustainability: Climate change is posing new risks and challenges for insurers. Extreme weather events, rising sea levels, and other climate-related disasters are increasing the frequency and severity of insurance claims. Dairyland Insurance needs to adapt its underwriting practices, risk assessments, and pricing models to account for these emerging risks. The company can also explore opportunities to promote sustainability and climate resilience among its customers.

Growth Areas and Opportunities for Dairyland Insurance

Dairyland Insurance can leverage the evolving insurance landscape to expand its reach, diversify its offerings, and drive growth.

- Expanding into New Markets: Dairyland Insurance can explore opportunities to expand into new geographic markets or target new customer segments. This could involve expanding its product offerings to cater to specific needs or demographics. For example, the company could consider offering insurance products for emerging technologies, such as autonomous vehicles or drones, or expanding into new markets with a high demand for insurance.

- Developing Innovative Products and Services: Dairyland Insurance can create innovative insurance products and services that address emerging customer needs and market trends. This could include offering flexible insurance plans, personalized coverage options, and integrated solutions that combine insurance with other financial services. For example, the company could develop a bundled insurance package that includes home, auto, and health insurance, or offer personalized insurance plans based on individual risk profiles and lifestyle choices.

- Building Strategic Partnerships: Dairyland Insurance can benefit from building strategic partnerships with other companies in the insurance industry or in related sectors. This could involve collaborating with insurtech companies, fintech firms, or technology providers to develop new products, enhance customer experiences, or access new markets. Partnerships can provide access to new technologies, expertise, and customer segments, fostering innovation and growth.

- Investing in Technology and Innovation: Dairyland Insurance should continue to invest in technology and innovation to improve its operational efficiency, enhance customer experiences, and develop new products and services. This includes investing in data analytics, artificial intelligence, blockchain technology, and other emerging technologies that can transform the insurance industry. Investing in innovation will allow the company to stay ahead of the competition and offer cutting-edge solutions to its customers.

Industry Insights and Expert Opinions: Dairyland Insurance

Gathering insights from industry experts and analysts provides valuable perspectives on Dairyland Insurance’s performance and future prospects. These opinions offer a broader understanding of the company’s strengths, weaknesses, and its position within the competitive landscape.

Industry Expert Opinions on Dairyland Insurance

Industry experts have generally positive views on Dairyland Insurance’s performance and future prospects. Several factors contribute to this positive outlook, including:

- Strong Financial Performance: Dairyland Insurance has a solid track record of financial stability, consistently achieving profitability and maintaining healthy capital reserves. This financial strength provides a solid foundation for future growth and expansion.

- Focus on Niche Markets: Dairyland Insurance has successfully carved a niche for itself in the insurance market by specializing in specific customer segments, such as those seeking affordable coverage or those with unique insurance needs. This focus allows the company to cater to specific customer demands effectively.

- Effective Risk Management: Dairyland Insurance has demonstrated strong risk management capabilities, allowing it to effectively assess and mitigate potential risks, contributing to its financial stability and profitability.

- Customer-Centric Approach: Dairyland Insurance prioritizes customer satisfaction and has implemented various initiatives to enhance customer service, including digital tools and personalized communication. This focus on customer experience fosters loyalty and positive word-of-mouth referrals.

Analysts’ Perspectives on Dairyland Insurance’s Future Prospects

Analysts are generally optimistic about Dairyland Insurance’s future prospects, citing several factors that support this view:

- Growing Demand for Affordable Insurance: The increasing demand for affordable insurance solutions presents a significant opportunity for Dairyland Insurance, given its focus on providing competitive pricing and value-driven products.

- Expansion into New Markets: Dairyland Insurance is exploring opportunities to expand its geographic reach and target new customer segments, potentially leveraging its existing strengths and expertise to penetrate new markets.

- Innovation and Technology: Dairyland Insurance is actively investing in technology and innovation to enhance its operations, improve customer experience, and develop new products and services. This commitment to technological advancement positions the company for continued growth and success in the evolving insurance landscape.

Final Conclusion

Dairyland Insurance stands as a testament to the importance of customer-centricity, innovation, and social responsibility in the insurance industry. Their commitment to these values has earned them a strong reputation and a loyal customer base. As the insurance landscape continues to evolve, Dairyland Insurance is well-positioned to adapt and thrive, offering a range of products and services that cater to the diverse needs of their customers. Whether you’re seeking affordable auto insurance, comprehensive home protection, or reliable business coverage, Dairyland Insurance provides a comprehensive suite of solutions backed by a commitment to excellence.

Dairyland Insurance is known for its affordable rates and comprehensive coverage options. If you’re looking to pursue a career in the arts, you might be interested in the University of the Arts Drexel Pathways Program , which offers a unique blend of artistic and academic learning.

Once you’ve secured your education and chosen your path, Dairyland Insurance can help you protect your future with reliable coverage.