Cash value life insurance offers a unique blend of life insurance protection and investment potential. This type of insurance not only provides a death benefit to your beneficiaries upon your passing but also allows you to accumulate cash value within the policy that can be accessed for various financial needs.

Unlike term life insurance, which provides coverage for a specific period, cash value life insurance is a permanent policy that offers lifelong coverage. It functions by accumulating cash value over time, which you can borrow against or withdraw from during your lifetime. The policy’s death benefit remains in place regardless of how much cash value you withdraw.

Understanding Cash Value Life Insurance

Cash value life insurance is a type of permanent life insurance that combines death benefit coverage with a savings component. It allows policyholders to accumulate cash value over time, which can be borrowed against or withdrawn.

Definition of Cash Value Life Insurance

Cash value life insurance is a permanent life insurance policy that builds cash value over time. This cash value is invested and grows tax-deferred, providing policyholders with a savings component in addition to death benefit coverage.

Types of Cash Value Life Insurance

There are several types of cash value life insurance, each with its own unique features and benefits. Here are some common examples:

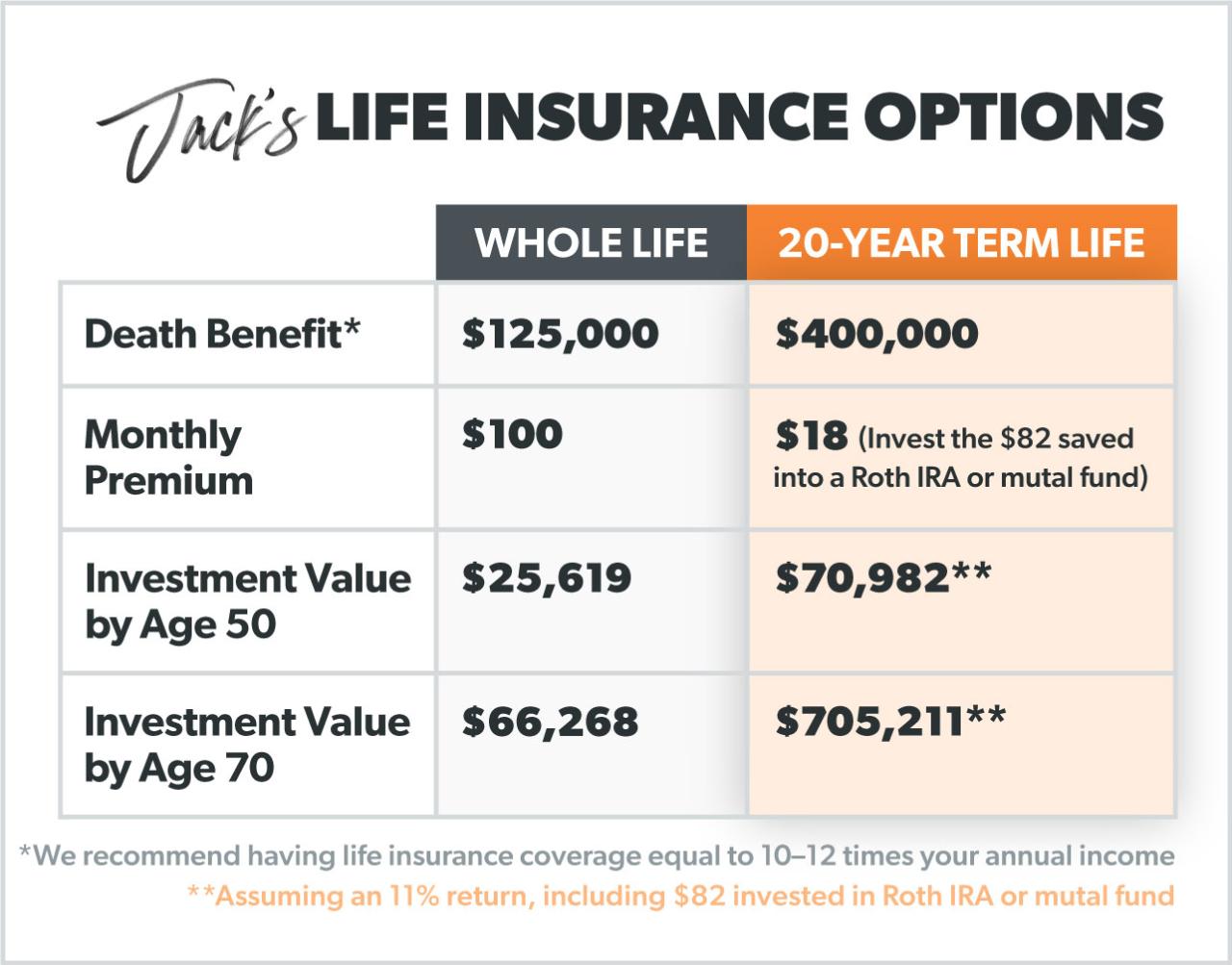

- Whole Life Insurance: This type of insurance provides a fixed death benefit and a guaranteed cash value growth rate. It typically has higher premiums than other types of cash value insurance, but it offers a predictable and stable investment option.

- Universal Life Insurance: This type of insurance offers more flexibility than whole life insurance. Policyholders can adjust their premiums and death benefit, and they have more control over how their cash value is invested.

- Indexed Universal Life Insurance: This type of insurance links its cash value growth to the performance of a specific market index, such as the S&P 500. It offers the potential for higher returns, but it also carries more risk than whole life or universal life insurance.

- Variable Life Insurance: This type of insurance allows policyholders to invest their cash value in a variety of sub-accounts, such as mutual funds. It offers the potential for higher returns, but it also carries more investment risk.

Key Features and Benefits of Cash Value Life Insurance

Cash value life insurance offers several key features and benefits that make it attractive to many policyholders.

- Death Benefit Coverage: This provides financial protection for your beneficiaries in the event of your death.

- Cash Value Accumulation: This allows you to build savings over time, which can be used for various purposes, such as retirement planning, college funding, or unexpected expenses.

- Tax-Deferred Growth: The cash value in your policy grows tax-deferred, meaning you won’t have to pay taxes on the earnings until you withdraw them.

- Loan Access: You can borrow against your cash value at a low interest rate, giving you access to funds when you need them.

- Flexibility: Many cash value life insurance policies offer flexibility in terms of premiums, death benefit, and investment options.

How Cash Value Life Insurance Works

Cash value life insurance is a type of permanent life insurance that combines a death benefit with a savings component. This savings component, known as cash value, accumulates over time and can be accessed by the policyholder.

Accumulation of Cash Value

Cash value accumulates within the policy through a process called “premium allocation.” When you pay your premium, a portion of it is allocated to the death benefit, and the remaining portion is allocated to the cash value account.

Premium Allocation

The allocation of premiums between the death benefit and cash value is determined by the specific policy terms. Generally, a higher percentage of your initial premiums will go towards the death benefit, and as the cash value grows, a greater portion of your premiums will be allocated to the cash value account.

Interest Rates and Investment Options

Cash value growth is influenced by interest rates and investment options. The insurance company typically invests the cash value in a variety of assets, such as bonds, stocks, and real estate. The returns on these investments, along with interest rates, determine the rate of growth of your cash value.

Accessing or Withdrawing Cash Value

You can access or withdraw your cash value in a few ways:

- Policy Loans: You can borrow against your cash value at a fixed interest rate. This can be a useful option for short-term financing needs.

- Partial Withdrawals: You can withdraw a portion of your cash value, but this will reduce the death benefit and may be subject to surrender charges.

- Cash Surrender: You can surrender the policy and receive the accumulated cash value, but this will terminate the policy and you will lose the death benefit.

Advantages of Cash Value Life Insurance

Cash value life insurance offers a unique combination of death benefit protection and a savings component, providing several advantages for policyholders. It allows you to build wealth over time while ensuring your loved ones are financially secure in case of your passing.

Death Benefit and Cash Value Component

Cash value life insurance combines the traditional death benefit of term life insurance with a savings component known as cash value. The death benefit ensures your beneficiaries receive a lump sum payment upon your death, providing financial security and covering expenses like funeral costs, debt repayment, and living expenses.

The cash value component, accumulated through premium payments and investment earnings, grows tax-deferred and can be accessed through withdrawals or loans. This provides a flexible financial tool for various needs, including emergencies, retirement planning, and even college funding.

Long-Term Wealth Accumulation

Cash value life insurance offers a unique way to accumulate wealth over the long term. A portion of your premium payments goes towards building cash value, which grows tax-deferred through investment earnings.

The cash value component acts as a savings vehicle, allowing your money to grow over time. Unlike traditional savings accounts, cash value life insurance provides the benefit of tax-deferred growth, meaning you don’t have to pay taxes on your earnings until you withdraw the money.

Using Cash Value for Financial Planning and Emergencies

Cash value life insurance offers a flexible financial tool that can be used for various needs. You can access your cash value through withdrawals or loans, providing financial flexibility for unexpected expenses or planned financial goals.

- Emergencies: In times of unexpected financial hardship, you can access your cash value through withdrawals or loans to cover expenses like medical bills, home repairs, or job loss.

- Financial Planning: Cash value can be used for long-term financial planning, such as saving for retirement, college education, or a down payment on a house.

Retirement Planning

Cash value life insurance can play a crucial role in your retirement planning strategy. As your cash value grows over time, it can provide a supplemental income stream during retirement.

- Tax-Deferred Growth: Cash value grows tax-deferred, allowing your money to accumulate more rapidly than in a traditional savings account.

- Guaranteed Minimum Return: Cash value life insurance policies often guarantee a minimum rate of return on your cash value, providing some protection against market fluctuations.

- Tax-Free Withdrawals: You can often withdraw your cash value tax-free during retirement, providing a valuable source of income.

Factors to Consider When Choosing Cash Value Life Insurance

Choosing the right cash value life insurance policy requires careful consideration of your financial needs and goals. You’ll need to weigh several factors to ensure the policy aligns with your individual circumstances and long-term financial objectives.

Assessing Your Financial Needs and Goals

It’s crucial to understand your current financial situation and future aspirations to make an informed decision about cash value life insurance.

- Determine your coverage needs: Calculate the amount of life insurance you need to protect your loved ones financially in case of your untimely demise. Consider factors like outstanding debts, dependents’ living expenses, and future educational costs.

- Evaluate your investment goals: Cash value life insurance can serve as a savings vehicle, but it’s essential to align your investment goals with the policy’s potential returns. Assess your risk tolerance, investment horizon, and desired rate of return.

- Assess your budget: Cash value life insurance premiums are typically higher than term life insurance premiums. Determine how much you can afford to pay each month and ensure the policy fits within your overall financial plan.

Key Factors to Consider When Choosing a Policy, Cash value life insurance

Once you’ve assessed your financial needs and goals, you can start evaluating specific cash value life insurance policies.

- Death benefit: This is the amount your beneficiaries will receive upon your death. Choose a policy with a death benefit that meets your family’s needs.

- Cash value accumulation: This refers to the amount of money that accumulates in your policy’s cash value account. The rate of growth depends on the policy’s interest rate and investment options.

- Premiums: These are the regular payments you make to maintain your policy. Consider the premium structure, payment frequency, and potential for future premium increases.

- Policy features: Different cash value life insurance policies offer various features, such as loan options, dividend payments, and riders. Compare these features to find a policy that aligns with your needs.

Role of Interest Rates and Investment Options

The interest rate and investment options offered by a cash value life insurance policy play a significant role in its performance.

- Interest rates: The interest rate determines the rate of growth of your cash value account. Higher interest rates generally lead to faster cash value accumulation.

- Investment options: Some cash value life insurance policies offer investment options, allowing you to allocate your cash value to different investment vehicles. Choose options that align with your risk tolerance and investment goals.

Comparing Different Cash Value Life Insurance Policies

When comparing different cash value life insurance policies, consider the following factors:

- Premium costs: Compare premiums from different insurers and policy types. Look for policies with competitive premiums that fit your budget.

- Death benefit: Ensure the death benefit is sufficient to meet your family’s needs.

- Cash value accumulation: Compare the interest rates and investment options offered by different policies. Choose a policy with a favorable rate of return and investment options that align with your goals.

- Policy features: Compare the features offered by different policies, such as loan options, dividend payments, and riders. Select a policy with features that are valuable to you.

- Financial strength of the insurer: Choose a policy from a financially sound insurer with a strong track record of paying claims.

Common Misconceptions About Cash Value Life Insurance

Cash value life insurance is often misunderstood, leading to inaccurate perceptions and decisions. It’s crucial to separate fact from fiction to make informed choices about your financial future.

Distinguishing Cash Value Life Insurance from Investment Products

While cash value life insurance policies accumulate cash value, it’s essential to understand that they are not the same as traditional investments. Cash value life insurance policies primarily provide death benefits, with the cash value component serving as a secondary feature. Conversely, investment products, such as stocks, bonds, or mutual funds, are designed solely for investment purposes.

Potential Risks and Limitations of Cash Value Life Insurance

Cash value life insurance policies are subject to various risks and limitations. It’s crucial to be aware of these factors before making a decision.

High Costs and Fees

Cash value life insurance policies typically come with higher premiums and fees compared to term life insurance. These costs can significantly impact the overall return on investment.

Lower Returns Compared to Other Investments

The cash value component of these policies may not grow as rapidly as other investment options, such as stocks or mutual funds. The returns are generally lower due to the insurance component and the guaranteed nature of the policy.

Limited Liquidity

Accessing the cash value in a cash value life insurance policy can be restricted. You may face penalties or fees for withdrawing funds before a certain age or for exceeding specific limits.

Complexity and Lack of Transparency

Cash value life insurance policies can be complex and difficult to understand. The terms and conditions can be intricate, making it challenging to assess the true cost and potential returns.

Potential for Lapse

If you fail to pay premiums on time, your policy may lapse, leading to the loss of both the death benefit and the accumulated cash value.

Balanced Perspective on the Advantages and Disadvantages

Cash value life insurance offers potential benefits, but it’s essential to weigh these against the associated risks.

Advantages

- Death Benefit: Cash value life insurance provides a guaranteed death benefit to your beneficiaries, ensuring their financial security in the event of your passing.

- Cash Value Accumulation: The policy accumulates cash value that you can borrow against or withdraw for various financial needs.

- Tax Advantages: The cash value component may grow tax-deferred, offering potential tax benefits compared to other investments.

- Long-Term Coverage: Cash value life insurance provides lifelong coverage, ensuring you’re protected throughout your life.

Disadvantages

- Higher Premiums and Fees: The premiums and fees associated with cash value life insurance can be significantly higher than term life insurance.

- Lower Returns: The cash value component may not grow as rapidly as other investment options, resulting in lower returns over time.

- Limited Liquidity: Accessing the cash value may be restricted, with potential penalties or fees.

- Complexity: The policies can be complex and difficult to understand, making it challenging to assess the true cost and potential returns.

- Potential for Lapse: Failure to pay premiums on time can lead to policy lapse, resulting in the loss of both the death benefit and the accumulated cash value.

Conclusion (Avoid)

Cash value life insurance is a complex financial product with both potential benefits and drawbacks. It’s essential to carefully weigh these factors before making a decision.

Key Takeaways

This article has explored the key features, advantages, and disadvantages of cash value life insurance. You’ve learned about how it works, its potential for wealth accumulation, and the importance of considering factors like premiums, fees, and investment performance.

Advantages and Disadvantages of Cash Value Life Insurance

- Advantages

- Provides death benefit to beneficiaries.

- Offers potential for cash accumulation and investment growth.

- Can provide tax-deferred growth on cash value.

- Can be used as a source of loans with favorable interest rates.

- Disadvantages

- Higher premiums compared to term life insurance.

- Complex product with potential for high fees and charges.

- Investment returns are not guaranteed.

- May not be suitable for everyone, especially those with limited financial resources or short-term needs.

Recommendation for Readers Considering Cash Value Life Insurance

Cash value life insurance can be a valuable tool for individuals seeking a combination of life insurance protection and investment growth. However, it’s crucial to understand the complexities involved and to carefully consider your individual needs and financial situation.

It’s recommended to consult with a qualified financial advisor who can help you assess your specific circumstances and determine if cash value life insurance is the right choice for you. They can also help you understand the various options available and provide guidance on selecting a policy that meets your requirements.

Concluding Remarks

Cash value life insurance presents a complex financial instrument with potential advantages and disadvantages. It’s crucial to carefully consider your individual financial goals, risk tolerance, and long-term needs before deciding if this type of insurance is right for you. If you’re seeking both life insurance coverage and a potential investment vehicle, understanding the intricacies of cash value life insurance is essential for making informed financial decisions.

Cash value life insurance offers a unique combination of financial protection and investment potential. If you’re interested in exploring career paths related to financial planning and counseling, consider checking out the Adler University graduate programs. These programs can provide the knowledge and skills necessary to help individuals navigate the complexities of cash value life insurance and other financial products.