UMR Insurance stands as a prominent player in the health insurance landscape, offering a diverse range of plans tailored to meet the unique needs of individuals and employers alike. From comprehensive coverage to innovative digital tools, UMR has established itself as a trusted partner in navigating the complexities of healthcare.

UMR’s history spans decades, marked by a commitment to providing reliable and accessible insurance solutions. The company’s dedication to customer satisfaction is evident in its robust services, which include claims processing, customer support, and a vast network of healthcare providers. Whether you’re seeking individual coverage or employer-sponsored plans, UMR offers a range of options designed to empower you with peace of mind and financial protection.

UMR Insurance Overview

UMR Insurance is a leading provider of health and benefits solutions, offering a comprehensive range of insurance products and services to individuals, families, and businesses. The company has a rich history and a strong commitment to innovation, ensuring its clients receive the best possible coverage and support.

History and Background of UMR Insurance

UMR Insurance has a long and storied history, dating back to 1977 when it was founded as a subsidiary of United HealthCare. Over the years, UMR has grown significantly, expanding its product offerings and service capabilities to meet the evolving needs of its clients. Today, UMR is a recognized leader in the health insurance industry, known for its expertise in claims processing, customer service, and innovative technology solutions.

Types of Insurance Products Offered by UMR, Umr insurance

UMR Insurance offers a wide variety of insurance products, catering to diverse needs and preferences. These products can be broadly categorized as follows:

- Health Insurance: UMR provides comprehensive health insurance plans that cover a wide range of medical expenses, including hospitalization, surgery, and outpatient care. These plans are designed to offer financial protection and peace of mind to individuals and families.

- Dental Insurance: UMR offers dental insurance plans that cover preventive, diagnostic, and restorative dental services. These plans help individuals maintain good oral health and avoid costly dental procedures.

- Vision Insurance: UMR provides vision insurance plans that cover eye exams, eyeglasses, and contact lenses. These plans help individuals maintain good vision and access affordable eye care.

- Life Insurance: UMR offers life insurance policies that provide financial protection to beneficiaries in the event of the policyholder’s death. These policies can help ensure the financial security of loved ones and cover expenses such as funeral costs and outstanding debts.

- Disability Insurance: UMR provides disability insurance policies that offer financial support to individuals who are unable to work due to illness or injury. These policies can help individuals maintain their standard of living during periods of disability.

Key Features and Benefits of UMR Insurance Plans

UMR Insurance plans are designed to provide comprehensive coverage and exceptional customer service. Some of the key features and benefits of UMR insurance plans include:

- Wide Network of Providers: UMR insurance plans offer access to a vast network of healthcare providers, including hospitals, clinics, and specialists. This ensures that policyholders have a wide range of choices when seeking medical care.

- Competitive Premiums: UMR strives to offer competitive premiums on its insurance plans, making quality coverage affordable for individuals and families.

- Excellent Customer Service: UMR is committed to providing exceptional customer service. The company offers multiple channels of support, including phone, email, and online resources, to assist policyholders with their needs.

- Innovative Technology Solutions: UMR utilizes innovative technology solutions to streamline its processes and enhance the customer experience. These solutions include online portals, mobile apps, and automated claims processing systems.

UMR Insurance Coverage

UMR insurance plans provide coverage for a wide range of health conditions and medical services. The specific coverage details and benefits offered vary depending on the chosen plan. Understanding the different coverage levels and benefits is crucial for making an informed decision about the right plan for your individual needs.

Types of Health Conditions and Medical Services Covered

UMR insurance plans typically cover a broad range of health conditions and medical services, including:

- Preventive Care: Routine checkups, vaccinations, screenings, and other preventive services are often covered in full or with minimal out-of-pocket costs.

- Inpatient Hospital Care: Coverage for hospitalization, including room and board, nursing care, and medical services provided during a hospital stay.

- Outpatient Care: Coverage for medical services received outside of a hospital setting, such as doctor’s visits, specialist consultations, and diagnostic tests.

- Prescription Drugs: Coverage for prescription medications, with varying levels of formulary coverage and co-pays depending on the plan.

- Mental Health and Substance Abuse Treatment: Coverage for mental health services, including therapy, counseling, and medication, as well as substance abuse treatment programs.

- Emergency Care: Coverage for emergency medical services, including ambulance transportation and treatment at an emergency room.

- Rehabilitation Services: Coverage for physical therapy, occupational therapy, and speech therapy following an illness or injury.

- Dental and Vision Care: Some UMR plans may offer optional coverage for dental and vision care, but these are often separate from the core health insurance plan.

Comparison of Coverage Levels and Benefits

UMR insurance plans are available in various tiers, each offering different levels of coverage and benefits. The specific plans available and their coverage details may vary depending on your location and employer. However, here’s a general overview of the common plan types:

- High Deductible Health Plan (HDHP): These plans typically have lower monthly premiums but higher deductibles. You’ll pay a significant amount out-of-pocket before your insurance coverage kicks in. HDHPs are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money for healthcare expenses.

- Preferred Provider Organization (PPO): PPO plans provide more flexibility in choosing healthcare providers, but you’ll generally pay a higher premium than with an HMO. You can see out-of-network providers, but you’ll typically have higher out-of-pocket costs.

- Health Maintenance Organization (HMO): HMO plans typically have lower premiums than PPOs, but you’re limited to a network of providers. You’ll need a referral from your primary care physician to see a specialist. HMOs often emphasize preventive care and wellness services.

Key Coverage Details of UMR Insurance Plans

The following table showcases key coverage details for common UMR insurance plans, including deductibles, co-pays, and out-of-pocket maximums. Note that these are just general examples, and actual plan details may vary.

| Plan Type | Deductible | Co-pay | Out-of-Pocket Maximum |

|---|---|---|---|

| HDHP | $1,500 – $3,000 | $20 – $50 | $5,000 – $7,000 |

| PPO | $500 – $1,000 | $30 – $40 | $4,000 – $6,000 |

| HMO | $0 – $500 | $10 – $30 | $3,000 – $5,000 |

UMR Insurance Claims Process

Filing a claim with UMR Insurance is a straightforward process. To get started, you’ll need to gather some basic information and follow the steps Artikeld below.

UMR Insurance Claim Filing Methods

You can file a claim with UMR Insurance in several ways:

- Online: UMR’s website offers a convenient online claim filing portal. This method allows you to submit your claim 24/7, track its progress, and receive updates electronically.

- Phone: You can reach UMR’s customer service representatives by phone to file a claim. They will guide you through the process and answer any questions you may have.

- Mail: UMR provides a downloadable claim form that you can complete and mail to their address. This method is suitable for those who prefer traditional paper-based transactions.

Sample Claim Form

The following is a sample claim form with clear instructions for completion:

UMR Insurance Claim Form

Patient Information:

* Name: _____________________________________________________

* Date of Birth: _______________________________________________

* Policy Number: ______________________________________________

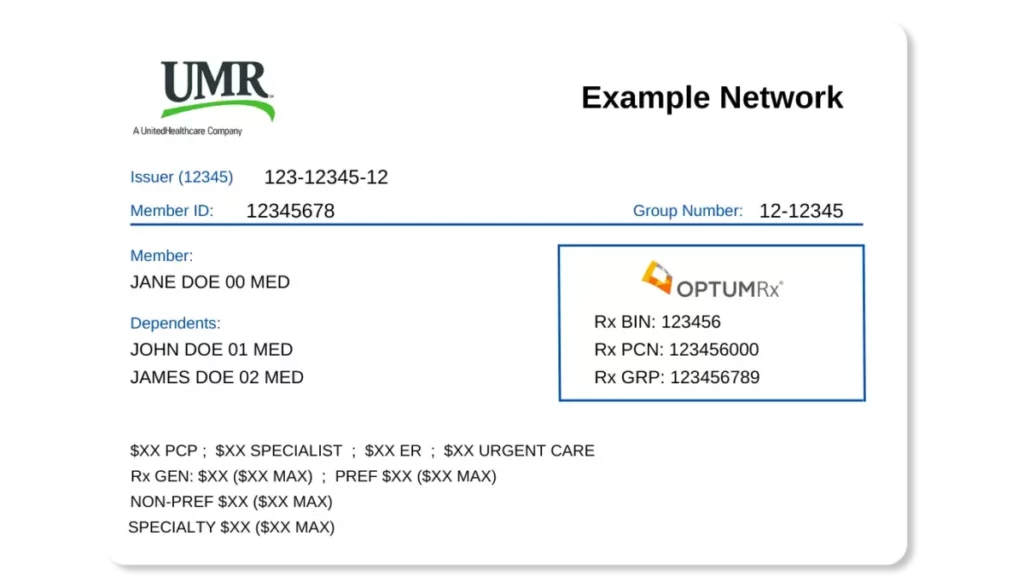

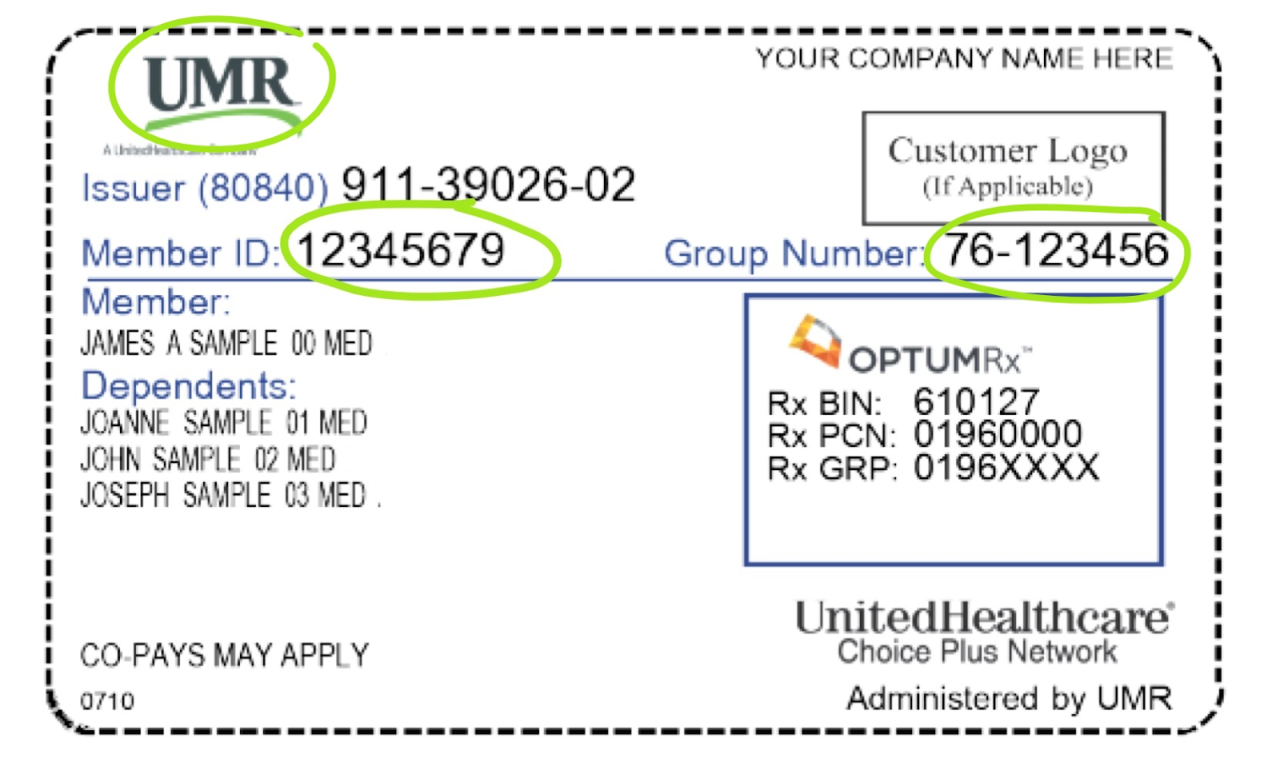

* Member ID: _______________________________________________Claim Information:

* Date of Service: _____________________________________________

* Provider Name: _____________________________________________

* Provider Address: _________________________________________

* Provider Phone Number: ______________________________________

* Description of Services: ____________________________________

* Total Amount Billed: _______________________________________Additional Information:

* Are you filing this claim for yourself or a dependent? __________

* Did you receive any other insurance coverage for this service? __________

* If yes, please provide the details: ____________________________

* Do you have any questions or need assistance with this form? __________Signature: ___________________________________________________

Date: ______________________________________________________

UMR Insurance Customer Support

UMR Insurance prioritizes providing excellent customer support to its policyholders. The company offers a range of options for reaching out to its customer service representatives, ensuring a smooth and responsive experience for all.

Contacting UMR Customer Support

UMR offers various ways to connect with its customer support team, allowing policyholders to choose the most convenient method for their needs.

- Phone: UMR provides a dedicated phone number for customer service inquiries. Policyholders can call the number during business hours to speak with a representative.

- Email: UMR maintains an email address for customer support, allowing policyholders to submit inquiries and receive detailed responses.

- Online Chat: For immediate assistance, UMR offers an online chat feature on its website. This allows policyholders to connect with a representative in real-time.

- Mail: For formal correspondence, policyholders can send letters to UMR’s customer service address.

Customer Service Availability and Response Times

UMR strives to provide prompt and efficient customer service. The availability of customer service representatives varies depending on the chosen contact method.

- Phone: UMR’s phone lines are typically open during standard business hours. However, the company may offer extended hours or weekend availability during peak seasons.

- Email: UMR aims to respond to emails within 24-48 hours. However, response times may vary depending on the complexity of the inquiry.

- Online Chat: UMR’s online chat feature is available during business hours, providing immediate assistance to policyholders.

Resolving Customer Inquiries and Complaints

UMR is committed to addressing customer inquiries and complaints effectively. The company provides a range of resources and tools to facilitate a smooth resolution process.

- Frequently Asked Questions (FAQs): UMR maintains a comprehensive FAQ section on its website, covering common inquiries and providing readily accessible answers.

- Online Account Access: Policyholders can access their account information online, allowing them to manage their policies, view claims, and submit inquiries.

- Complaint Resolution Process: UMR has a formal complaint resolution process, outlining the steps involved in addressing customer grievances.

UMR Insurance for Employers

Offering UMR insurance to your employees can be a valuable investment, providing them with comprehensive healthcare coverage and supporting your business in attracting and retaining top talent.

Benefits of Offering UMR Insurance

UMR insurance offers a range of benefits for both employers and employees, fostering a positive work environment and contributing to a healthier and more productive workforce.

- Attracting and Retaining Top Talent: Providing competitive health insurance benefits is a key factor in attracting and retaining skilled employees. Offering UMR insurance demonstrates your commitment to employee well-being and can make your company more attractive to potential candidates.

- Improved Employee Health and Well-being: UMR insurance provides access to quality healthcare services, promoting preventive care and early detection of health issues. This can lead to a healthier workforce with reduced absenteeism and increased productivity.

- Cost Savings: UMR insurance offers various cost-saving options for employers, such as negotiated rates with healthcare providers and wellness programs that can reduce healthcare expenses in the long run.

- Streamlined Administration: UMR provides dedicated employer resources and support services, simplifying the administration of your health insurance plan and reducing administrative burden.

Enrolling in UMR Insurance Plans

The process of enrolling in UMR insurance plans is straightforward and involves a few key steps:

- Contact UMR: Reach out to UMR’s employer services team to discuss your specific needs and explore available plan options.

- Review Plan Options: UMR will present you with a range of plans tailored to your company size, industry, and employee demographics.

- Choose a Plan: After reviewing the plan options, select the plan that best meets your company’s requirements and budget.

- Implement the Plan: UMR will assist you in implementing the chosen plan, including employee enrollment and communication.

Employer Resources and Support Services

UMR provides a comprehensive suite of employer resources and support services to help you manage your health insurance plan effectively.

- Dedicated Account Management: You will have access to a dedicated account manager who can answer your questions, provide guidance, and assist with plan administration.

- Online Tools and Resources: UMR offers online tools and resources for employers, including plan information, enrollment materials, and claims processing information.

- Wellness Programs: UMR provides various wellness programs that can help improve employee health and reduce healthcare costs. These programs may include health screenings, fitness challenges, and health education materials.

- Employee Communication Support: UMR can assist you in communicating with your employees about the health insurance plan, providing clear and concise information about benefits, coverage, and claims procedures.

UMR Insurance for Individuals

UMR insurance offers a range of individual health insurance plans designed to meet the diverse needs of individuals and families. These plans provide comprehensive coverage for medical expenses, including preventive care, hospitalization, and prescription drugs.

Individual Plan Options

UMR offers various individual health insurance plans with different coverage levels and premium costs. These plans cater to different needs and budgets.

- Bronze plans offer the lowest monthly premiums but have the highest out-of-pocket costs.

- Silver plans offer a balance between premiums and out-of-pocket costs.

- Gold plans have higher monthly premiums but lower out-of-pocket costs.

- Platinum plans offer the highest level of coverage with the lowest out-of-pocket costs and the highest monthly premiums.

Individual Enrollment Process

To enroll in an individual UMR health insurance plan, you can follow these steps:

- Determine your eligibility: UMR plans may have eligibility requirements based on factors such as residency, age, and health status. You can check eligibility on the UMR website or contact their customer service team.

- Compare plans: UMR offers various plan options with different coverage levels and premiums. Use the UMR website’s plan comparison tool or consult with an insurance broker to find the best plan for your needs and budget.

- Apply for coverage: Once you’ve chosen a plan, you can apply for coverage through the UMR website or by contacting their customer service team. You’ll need to provide personal information and health details to complete the application.

- Pay your premium: After your application is approved, you’ll need to pay your monthly premium. You can choose to pay online, by mail, or by phone.

Resources for Choosing a UMR Insurance Plan

Choosing the right UMR health insurance plan can be challenging. Here are some resources that can help:

- UMR website: The UMR website offers a plan comparison tool, information on plan benefits, and customer service resources.

- Insurance brokers: Insurance brokers can provide personalized advice and help you find the best plan for your needs and budget.

- Health insurance marketplaces: Health insurance marketplaces, such as Healthcare.gov, offer a wide range of plans from different insurers, including UMR. You can compare plans and enroll in coverage through these marketplaces.

UMR Insurance in the Healthcare Market

UMR Insurance operates within a highly competitive and dynamic healthcare market. Understanding its position relative to other major providers and the broader market trends is crucial for assessing its future prospects.

UMR Insurance Compared to Other Major Health Insurance Providers

UMR Insurance is a significant player in the health insurance market, particularly in the self-funded and administrative services space. It competes with other major health insurance providers, including:

- Aetna: A large, diversified healthcare company offering a wide range of insurance products, including health, dental, and vision.

- Anthem: Another major health insurer offering a comprehensive suite of products, including commercial health plans, Medicare Advantage, and Medicaid.

- Cigna: A global health services company with a strong presence in the U.S. market, providing health, dental, and disability insurance.

- Humana: Focused on Medicare Advantage and commercial health plans, Humana is a significant player in the senior healthcare market.

- UnitedHealthcare: The largest health insurer in the U.S., offering a broad range of health plans and services.

UMR distinguishes itself by specializing in self-funded plans, where employers take on the financial risk of covering employee healthcare costs. It also provides administrative services for these plans, handling claims processing, provider networks, and other administrative functions.

The Competitive Landscape of the Health Insurance Market

The health insurance market is highly competitive, characterized by:

- Consolidation: The industry has seen a trend of mergers and acquisitions, leading to a smaller number of larger players.

- Increasing Costs: Healthcare costs continue to rise, putting pressure on insurers to manage expenses and offer competitive premiums.

- Technological Advancements: The adoption of technology, such as telehealth and data analytics, is transforming how insurance is delivered and managed.

- Government Regulations: The Affordable Care Act (ACA) and other regulations have significantly impacted the market, affecting coverage, pricing, and access to care.

- Consumer Demand: Consumers are increasingly demanding more affordable and accessible healthcare options, with a focus on value-based care and transparency.

Trends and Future Outlook for UMR Insurance

The future of UMR Insurance is likely to be influenced by:

- Continued Growth of Self-Funded Plans: Employers are increasingly choosing self-funded plans to control costs and customize benefits.

- Focus on Value-Based Care: UMR is likely to continue investing in programs and partnerships that promote value-based care, aligning with the industry trend towards quality and cost-effectiveness.

- Technological Innovation: UMR will need to embrace technology to improve efficiency, enhance customer experience, and offer innovative solutions.

- Changing Demographics: The aging population and rising healthcare needs will present both challenges and opportunities for UMR.

Outcome Summary

In today’s evolving healthcare landscape, UMR Insurance emerges as a beacon of stability and innovation. With its commitment to providing comprehensive coverage, exceptional customer service, and a user-friendly digital experience, UMR empowers individuals and employers to navigate the complexities of healthcare with confidence. Whether you’re seeking individual coverage or employer-sponsored plans, UMR offers a range of options designed to meet your unique needs and ensure your financial security.

UMR insurance is a well-known provider in the health insurance market, offering a range of plans to suit different needs. For those looking for a more digital-focused experience, you might want to consider otto insurance , which specializes in online insurance solutions.

While UMR has a strong reputation for traditional insurance services, Otto offers a modern approach with streamlined processes and convenient online tools.