Cheap insurance auto – Cheap auto insurance can seem like a dream, especially in today’s economy. But finding affordable coverage without sacrificing essential protection requires a savvy approach. This guide will walk you through the ins and outs of finding the best deals, from understanding your options to negotiating the best rates.

Navigating the world of auto insurance can be overwhelming. With so many companies, coverage options, and factors influencing premiums, it’s easy to feel lost. But don’t worry! We’ll break down the key elements of finding affordable insurance, equipping you with the knowledge and strategies to make informed decisions.

Understanding Cheap Auto Insurance

Finding affordable auto insurance can be a significant challenge, especially in a market with fluctuating prices and diverse coverage options. While the term “cheap” is often associated with low cost, understanding the nuances of this concept is crucial for making informed decisions.

Defining Cheap Auto Insurance

The definition of “cheap auto insurance” can vary depending on individual perspectives and priorities. Some may consider it as insurance with the lowest possible premium, while others may prioritize comprehensive coverage over price. It’s important to remember that cheap insurance doesn’t necessarily equate to poor quality. It’s about finding a balance between cost and the level of coverage that best suits your needs and budget.

Factors Influencing Auto Insurance Costs

Several factors contribute to the cost of auto insurance, and understanding these factors can help you find the best deals.

- Driving Record: A clean driving record with no accidents or violations is a significant factor in determining your insurance premiums. Drivers with a history of accidents or traffic violations typically face higher rates.

- Age and Gender: Younger drivers, especially males, tend to have higher insurance rates due to their statistically higher risk of accidents. As drivers age, their rates generally decrease.

- Vehicle Type and Value: The type and value of your vehicle play a significant role in determining insurance costs. Expensive or high-performance vehicles are often associated with higher premiums due to their higher repair costs.

- Location: Your location, including the city, state, and even neighborhood, can impact your insurance rates. Areas with higher crime rates or traffic congestion often have higher premiums.

- Coverage Options: The level of coverage you choose, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, directly affects your premium. Higher coverage levels generally translate to higher premiums.

- Credit Score: In some states, insurance companies use credit scores as a factor in determining premiums. Drivers with good credit scores may qualify for lower rates.

Trade-offs Associated with Cheap Insurance

While the allure of cheap auto insurance is undeniable, it’s essential to consider the potential trade-offs.

- Limited Coverage: Seeking the cheapest option might lead to limited coverage, potentially leaving you underinsured in case of an accident. For instance, opting for lower liability limits could result in significant financial burden if you are found liable for a severe accident.

- Higher Deductibles: Cheap insurance policies often come with higher deductibles, meaning you’ll have to pay more out-of-pocket before your insurance kicks in. This can be a financial strain if you experience an accident.

- Fewer Benefits: Some cheap insurance policies might offer fewer benefits, such as roadside assistance or rental car coverage, which can be crucial in emergency situations.

Finding Affordable Auto Insurance Options

Finding the right auto insurance can feel overwhelming, but it doesn’t have to be. There are several strategies and resources available to help you find affordable coverage that meets your needs.

Reputable Insurance Companies, Cheap insurance auto

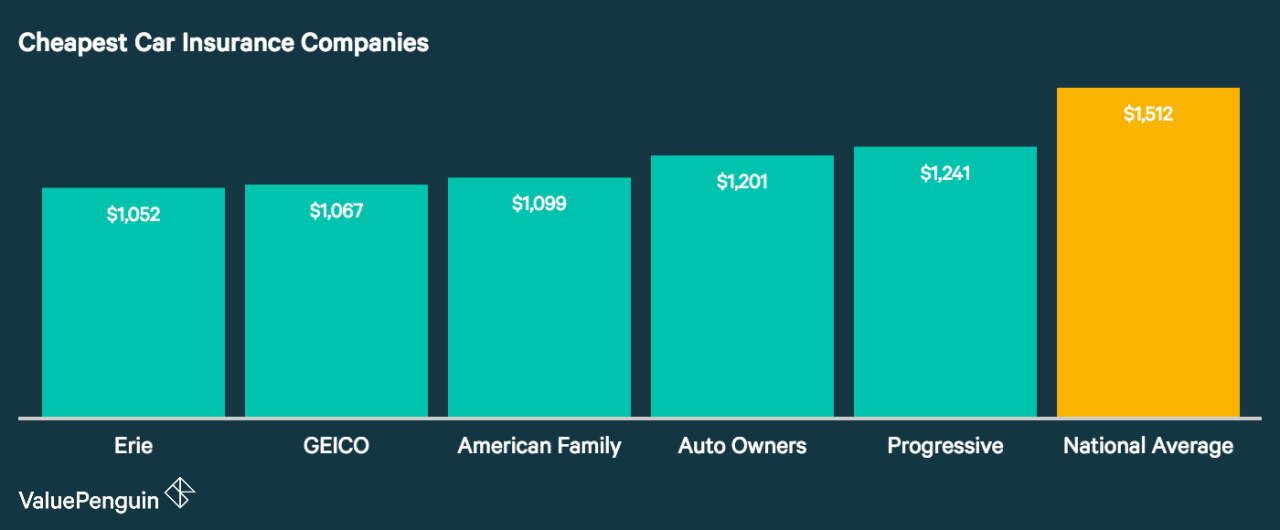

Choosing a reputable insurance company is crucial. Several companies offer competitive rates and excellent customer service. Some of the top-rated insurance companies include:

- Geico

- State Farm

- Progressive

- USAA

- Allstate

Types of Insurance Coverage

Understanding different types of auto insurance coverage is essential to make informed decisions. Each type of coverage comes with a different price tag and provides varying levels of protection.

- Liability Coverage: This is the most basic type of insurance, covering damages to other people and their property if you cause an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

Tips for Getting the Best Rates

Several strategies can help you secure the best possible rates on your auto insurance.

- Shop Around: Compare quotes from multiple insurance companies to find the most competitive rates.

- Bundle Your Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Improve Your Credit Score: A higher credit score can lead to lower insurance premiums.

- Maintain a Good Driving Record: A clean driving record with no accidents or violations will significantly impact your insurance rates.

- Consider a Higher Deductible: Opting for a higher deductible can lower your monthly premiums.

- Take Defensive Driving Courses: Completing a defensive driving course can qualify you for discounts from some insurance companies.

- Ask About Discounts: Many insurance companies offer discounts for various factors, such as being a good student, having safety features in your car, or being a member of certain organizations.

Factors Influencing Insurance Premiums

Insurance companies consider several factors when determining your auto insurance premiums. These factors are used to assess your risk of being involved in an accident and the potential cost of claims. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a major factor in determining your insurance premiums. This includes your driving record, which reflects your past driving behavior.

- Accidents: Having accidents, even if you weren’t at fault, generally increases your premiums. The severity of the accident and the number of accidents you’ve had will influence the impact on your rates.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations significantly increase your premiums. Insurance companies view these violations as indicators of risky driving behavior.

- Years of Driving Experience: Newer drivers, especially those under 25, often pay higher premiums due to their lack of experience and higher risk of accidents. As you gain more experience, your premiums may decrease.

Age

Your age is another significant factor that affects your insurance premiums. Younger drivers typically pay higher premiums because they are statistically more likely to be involved in accidents.

- Young Drivers: Insurance companies view drivers under 25 as statistically more likely to be involved in accidents, often due to inexperience and risk-taking behaviors.

- Mature Drivers: Drivers over 65 may see lower premiums, as they are statistically less likely to be involved in accidents. However, health conditions and vision impairments can sometimes lead to higher premiums in this age group.

Location

The location where you live and drive can significantly impact your insurance premiums. Insurance companies consider factors like:

- Population Density: Areas with higher population density tend to have more traffic, increasing the likelihood of accidents.

- Crime Rates: Areas with high crime rates often have higher rates of car theft and vandalism, leading to higher insurance premiums.

- Weather Conditions: Areas with extreme weather conditions, such as hurricanes or heavy snowfall, may have higher insurance premiums due to increased risk of damage to vehicles.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premiums.

- Vehicle Value: More expensive vehicles generally have higher insurance premiums because they cost more to repair or replace in the event of an accident.

- Performance: High-performance vehicles with powerful engines and sporty features are often associated with higher risk and therefore higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts, leading to lower premiums.

Safety Features

Modern vehicles are increasingly equipped with advanced safety features that can help prevent accidents or mitigate their severity.

- Anti-lock Braking System (ABS): ABS helps prevent wheels from locking during braking, improving vehicle control and reducing the risk of skidding.

- Airbags: Airbags provide a cushion for passengers in the event of a collision, reducing the risk of serious injuries.

- Electronic Stability Control (ESC): ESC helps maintain vehicle stability by applying brakes to individual wheels and reducing engine power when necessary, preventing loss of control.

Usage

The way you use your vehicle can also affect your insurance premiums.

- Mileage: Drivers who drive fewer miles generally pay lower premiums because they have a lower risk of being involved in an accident.

- Commuting Distance: Long commutes often involve more time spent on the road, increasing the risk of accidents.

- Business Use: Using your vehicle for business purposes can increase your premiums, as it exposes you to higher risk of accidents.

Credit Score

Your credit score, a measure of your financial responsibility, is increasingly being used by insurance companies to assess your risk.

- Credit Score and Risk: Insurance companies believe that individuals with good credit scores are more likely to be financially responsible and less likely to file fraudulent claims.

- Impact on Premiums: Drivers with higher credit scores may qualify for lower premiums, while those with lower credit scores may pay higher premiums.

Insurance Discounts

Insurance companies offer various discounts to lower your premiums.

- Safe Driving Discounts: These discounts reward drivers with clean driving records and no accidents or violations.

- Multi-car Discounts: You can save money by insuring multiple vehicles with the same insurance company.

- Good Student Discounts: Students with good grades may qualify for discounts, as they are often seen as responsible individuals.

- Safety Feature Discounts: Vehicles equipped with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

Navigating Insurance Claims

Filing an insurance claim can be a stressful experience, but understanding the process and your policy’s coverage can make it smoother. Knowing what to expect and how to navigate the claims process can help you get the compensation you deserve.

Filing an Insurance Claim

Filing a claim involves reporting the incident to your insurance company and providing the necessary documentation.

- Contact your insurance company: Immediately after an accident, contact your insurer and report the incident. They will guide you through the next steps and provide you with a claim number.

- Gather necessary documentation: This includes details about the incident, such as the date, time, location, and the parties involved. You may also need to provide police reports, medical records, and photos of the damage.

- Complete the claim form: Your insurance company will provide you with a claim form to fill out, which requires information about the incident, your policy details, and your contact information.

- Submit the claim: Once you have completed the claim form and gathered all necessary documentation, submit it to your insurance company.

Understanding Coverage Limits

Your insurance policy’s coverage limits determine the maximum amount your insurance company will pay for a claim. It’s crucial to understand your coverage limits to avoid any surprises later.

- Liability coverage: This covers damages you cause to other people or their property.

- Collision coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

Dealing with Insurance Adjusters

Insurance adjusters investigate claims and determine the amount of compensation you are eligible for. It’s essential to be prepared when dealing with them.

- Know your rights: Be aware of your rights as a policyholder and don’t hesitate to ask questions.

- Be polite but firm: Be respectful but assertive when discussing your claim.

- Document everything: Keep a record of all communication with the insurance adjuster, including dates, times, and the content of conversations.

- Don’t settle for less: If you feel the insurance company is not offering a fair settlement, don’t be afraid to negotiate or seek legal advice.

Final Wrap-Up: Cheap Insurance Auto

By understanding the factors that affect your insurance premiums, exploring different coverage options, and taking advantage of available discounts, you can secure affordable auto insurance without compromising on the protection you need. Remember, shopping around, comparing quotes, and staying informed are key to finding the best deal. With a little effort and a strategic approach, you can confidently navigate the world of auto insurance and secure a policy that fits your budget and provides the peace of mind you deserve.

Finding cheap auto insurance can be a challenge, but it doesn’t have to be a stressful process. Start by looking for providers in your local area, using a search engine like auto insurance near me to get a list of options.

Compare quotes from multiple companies and don’t hesitate to ask about discounts and special offers. By taking the time to shop around, you can find the best deal on affordable and reliable auto insurance.