Car insurance Florida is a crucial aspect of responsible driving in the Sunshine State. Navigating the complex world of car insurance can be overwhelming, especially with the various factors that influence premiums. From mandatory coverages and financial responsibility limits to discounts and claim filing procedures, understanding the ins and outs of Florida car insurance is essential for every driver.

This comprehensive guide delves into the intricacies of car insurance in Florida, providing valuable insights into key aspects like coverage options, rate determination, and navigating the claims process. Whether you’re a new driver, a seasoned motorist, or simply seeking to optimize your insurance plan, this resource equips you with the knowledge to make informed decisions and protect yourself on the road.

Types of Car Insurance Coverage in Florida

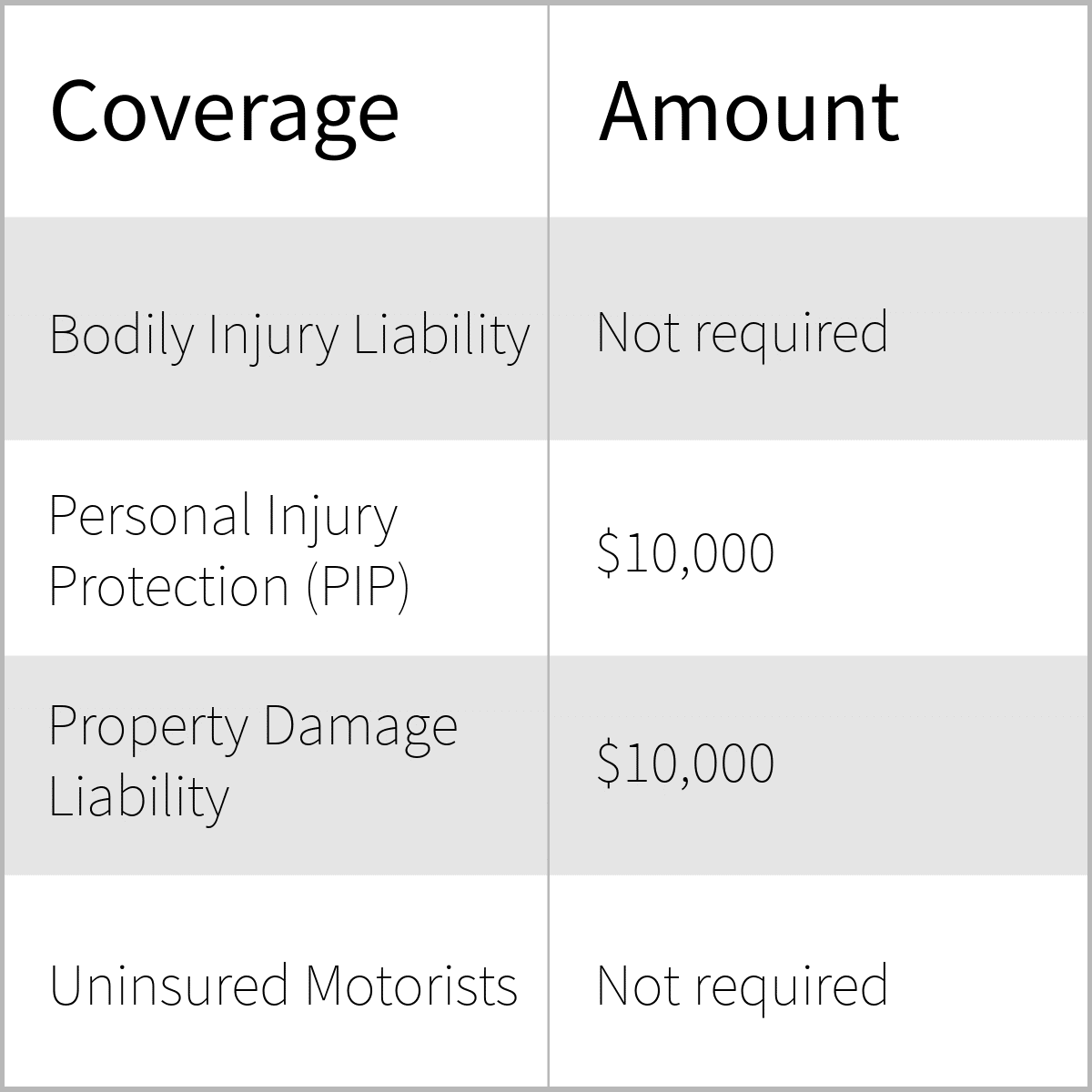

Florida requires drivers to carry certain types of car insurance to be legally allowed to operate a vehicle. This coverage helps protect you financially in case of an accident, and understanding the different types of coverage available is crucial for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident. This coverage can help pay for the other driver’s medical expenses, lost wages, and property damage.

- Bodily Injury Liability: This coverage pays for the other driver’s medical bills, lost wages, and pain and suffering if you are at fault in an accident. Florida law requires a minimum of $10,000 per person and $20,000 per accident for bodily injury liability coverage.

- Property Damage Liability: This coverage pays for damage to the other driver’s vehicle or property if you are at fault in an accident. Florida law requires a minimum of $10,000 for property damage liability coverage.

Liability coverage does not cover your own injuries or vehicle damage.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional in Florida, but they can provide valuable protection for your vehicle.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It can help cover the cost of repairs, including deductibles, and can even pay for the total value of your vehicle if it is totaled.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It can help cover the cost of repairs, including deductibles, and can even pay for the total value of your vehicle if it is totaled.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in case you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Uninsured Motorist Coverage: This coverage pays for your injuries and property damage if you are hit by a driver who does not have insurance.

- Underinsured Motorist Coverage: This coverage pays for your injuries and property damage if you are hit by a driver who has insurance, but the coverage limits are not enough to cover your damages.

Personal Injury Protection (PIP)

PIP is a type of no-fault coverage that pays for your medical expenses and lost wages, regardless of who is at fault in an accident.

- Benefits: PIP can help cover medical expenses, including doctor visits, hospital stays, and rehabilitation. It can also help cover lost wages.

- Limitations: PIP coverage has a limit of $10,000 per person. If your medical expenses exceed this limit, you will be responsible for the remaining costs.

Car Insurance Discounts in Florida: Car Insurance Florida

Lowering your car insurance premium is a common goal for most drivers. Fortunately, Florida car insurance companies offer a variety of discounts that can significantly reduce your monthly payments. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other factors that minimize the risk of accidents.

Good Driving Record Discounts

Drivers with a clean driving history are often eligible for significant discounts. These discounts acknowledge the lower risk associated with drivers who have not been involved in accidents or traffic violations.

- Safe Driver Discount: This is one of the most common discounts offered by insurance companies. To qualify, you must maintain a clean driving record for a specific period, typically 3 to 5 years, without any accidents or traffic violations. The discount amount can vary based on the insurer and the length of your safe driving record.

- Accident-Free Discount: Similar to the safe driver discount, this discount is awarded to drivers who have not been involved in any accidents within a specific time frame, usually 3 to 5 years. The discount amount is often higher for drivers with a longer accident-free period.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can qualify you for a discount. These courses teach safe driving techniques and strategies to avoid accidents. The discount is usually a percentage reduction in your premium.

Safety Feature Discounts

Many car insurance companies offer discounts for vehicles equipped with safety features that can help prevent accidents or mitigate their severity.

- Anti-theft Device Discount: Vehicles with anti-theft devices, such as alarms, immobilizers, or tracking systems, are less likely to be stolen. This lower risk translates to a discount on your insurance premium.

- Airbag Discount: Cars equipped with airbags are safer in the event of a collision, reducing the severity of injuries. Insurance companies recognize this safety feature and offer a discount on your premium.

- Anti-lock Brake System (ABS) Discount: Vehicles with ABS can help prevent skidding and maintain control during braking, reducing the likelihood of accidents. This safety feature often qualifies you for a discount.

- Daytime Running Lights Discount: Vehicles with daytime running lights are more visible during the day, reducing the risk of accidents. This feature can lead to a discount on your premium.

Multiple Policy Discounts

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in a discount.

- Multi-Policy Discount: Insurance companies often offer discounts for bundling multiple policies, such as car insurance, homeowners insurance, and renters insurance. The discount amount can vary depending on the insurer and the specific policies you bundle.

Other Car Insurance Discounts in Florida

- Good Student Discount: Students with good grades may qualify for a discount on their car insurance. This discount recognizes that students with high academic performance tend to be more responsible drivers.

- Senior Citizen Discount: Drivers over a certain age, typically 55 or 65, may qualify for a discount. This discount is based on the observation that older drivers often have more experience and safer driving habits.

- Military Discount: Active military personnel or veterans may be eligible for a discount. This discount is a way for insurance companies to show appreciation for those who serve in the military.

- Paid-in-Full Discount: Paying your car insurance premium in full upfront, rather than making monthly payments, can sometimes qualify you for a discount. This is because insurance companies can earn interest on the full premium amount if it is paid upfront.

Choosing the Right Car Insurance in Florida

Finding the right car insurance in Florida involves a thoughtful process that considers your individual needs and budget. This guide will walk you through the steps of selecting the best coverage for your specific circumstances.

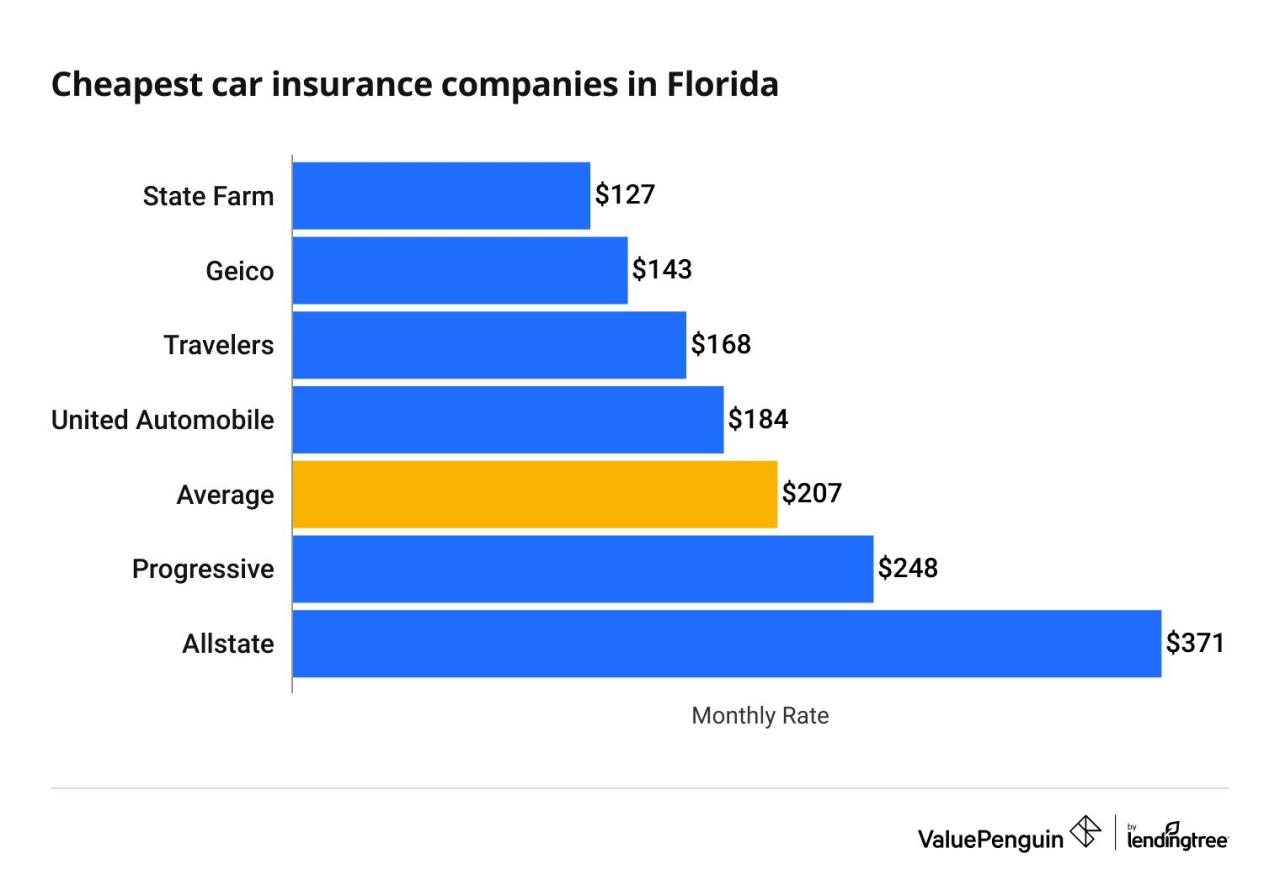

Comparing Car Insurance Providers in Florida

Before making a decision, it is essential to compare different car insurance providers in Florida. This comparison helps you understand the range of coverage options, pricing, and customer service levels available.

- State Farm: Known for its comprehensive coverage and strong customer service, State Farm offers a wide range of policies tailored to various needs.

- Geico: Geico is renowned for its competitive pricing and convenient online tools. It provides a range of coverage options, including liability, collision, and comprehensive.

- Progressive: Progressive is known for its personalized insurance options, including its “Name Your Price” tool, which allows you to set your desired premium and find a policy that matches.

- Allstate: Allstate offers a comprehensive suite of car insurance options, including accident forgiveness and roadside assistance, and is known for its strong customer support.

- USAA: USAA specializes in insurance for military members and their families, offering competitive rates and excellent customer service.

Key Features and Pricing of Car Insurance Companies, Car insurance florida

The following table highlights key features and pricing of various car insurance companies in Florida, based on average annual premiums for a 30-year-old driver with a clean driving record.

| Company | Average Annual Premium | Key Features |

|---|---|---|

| State Farm | $1,200 | Comprehensive coverage, strong customer service, various discounts |

| Geico | $1,150 | Competitive pricing, convenient online tools, multiple coverage options |

| Progressive | $1,100 | Personalized insurance options, “Name Your Price” tool, discounts for safe driving |

| Allstate | $1,250 | Accident forgiveness, roadside assistance, strong customer support |

| USAA | $1,050 | Specialized insurance for military members, competitive rates, excellent customer service |

Car Insurance Regulations in Florida

Florida has a complex regulatory environment for car insurance, with specific rules and requirements designed to protect consumers. The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the insurance industry, ensuring fair practices and protecting consumer rights.

The Role of the Florida Office of Insurance Regulation (OIR)

The OIR is responsible for regulating the insurance industry in Florida, including car insurance. Its primary functions include:

- Licensing and supervising insurance companies

- Monitoring insurance rates and ensuring they are fair and reasonable

- Investigating consumer complaints and resolving disputes

- Developing and enforcing insurance regulations

- Educating consumers about their insurance rights and responsibilities

Consumer Protection Laws Related to Car Insurance

Florida has a number of consumer protection laws designed to safeguard policyholders’ rights and interests. These laws cover various aspects of car insurance, including:

- Unfair Trade Practices Act: This law prohibits insurance companies from engaging in deceptive or unfair practices, such as misrepresenting coverage or denying claims without justification.

- Florida Insurance Code: This code Artikels specific requirements for car insurance policies, including minimum coverage limits and disclosure requirements.

- Florida Consumer Protection Act: This law provides consumers with legal recourse if they believe they have been the victim of unfair or deceptive insurance practices.

Appealing a Car Insurance Rate Increase

If you receive a car insurance rate increase, you have the right to appeal the decision. The process for appealing a rate increase involves the following steps:

- Contact your insurance company: The first step is to contact your insurance company and request an explanation for the rate increase. You should provide any relevant information that may support your appeal, such as a clean driving record or recent safety improvements to your vehicle.

- File a formal appeal: If you are not satisfied with the insurance company’s explanation, you can file a formal appeal with the OIR. The appeal should include a detailed explanation of your reasons for challenging the rate increase and any supporting documentation.

- OIR review: The OIR will review your appeal and may request additional information from your insurance company. If the OIR finds that the rate increase is unjustified, it can order the insurance company to reconsider its decision.

Florida Car Insurance for High-Risk Drivers

In Florida, drivers with poor driving records often face significant challenges when it comes to obtaining affordable car insurance. These challenges stem from insurance companies’ assessments of risk, which are heavily influenced by factors like accidents, traffic violations, and driving history.

Car Insurance for High-Risk Drivers in Florida

High-risk drivers in Florida may find it difficult to secure car insurance at standard rates due to their history of accidents or violations. Insurance companies often view these drivers as a higher risk, leading to increased premiums.

Availability and Cost of Car Insurance for High-Risk Drivers

- Limited Availability: Not all insurance companies are willing to insure high-risk drivers, making it harder to find coverage.

- Higher Premiums: High-risk drivers often face significantly higher premiums compared to drivers with clean driving records. This is because insurance companies charge higher premiums to offset the increased risk they perceive.

- Limited Coverage Options: High-risk drivers may also have fewer coverage options available to them, often being restricted to basic liability coverage.

Alternative Insurance Options for High-Risk Drivers

Drivers with a history of accidents or violations can explore alternative insurance options, such as:

- Specialized Insurance Companies: Some insurance companies specialize in providing coverage to high-risk drivers. These companies typically have higher premiums but may be more willing to insure drivers with less-than-perfect records.

- State-Run Programs: Florida has a state-run program called the Florida Automobile Joint Underwriting Association (FAJUA) that provides insurance to drivers who have been denied coverage by private insurers. While this program can provide coverage, premiums are often higher than standard rates.

- Non-Standard Auto Insurance: Non-standard auto insurance providers cater to high-risk drivers and often offer coverage options not available through traditional insurers. These providers may have stricter underwriting guidelines and higher premiums.

Factors Influencing Insurance Rates for High-Risk Drivers

Insurance companies use a variety of factors to assess risk and determine insurance rates for high-risk drivers. These factors include:

- Driving Record: This includes accidents, traffic violations, and DUI convictions.

- Age and Gender: Younger and male drivers tend to have higher insurance rates.

- Vehicle Type: Sports cars and high-performance vehicles are often associated with higher risk and therefore higher premiums.

- Credit Score: In some states, including Florida, insurance companies use credit score as a factor in determining insurance rates.

- Location: The location where a driver lives can also influence insurance rates, with higher-risk areas typically having higher premiums.

Tips for High-Risk Drivers

High-risk drivers can take steps to improve their chances of obtaining affordable insurance:

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for reducing insurance premiums.

- Improve Your Credit Score: A higher credit score can help lower insurance rates in Florida.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates.

- Consider Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

Car Insurance for Young Drivers in Florida

Getting car insurance as a young driver in Florida can be challenging, as rates are typically higher than for experienced drivers. This is because young drivers have less experience on the road and are statistically more likely to be involved in accidents. However, there are strategies and resources available to help young drivers find affordable car insurance.

Impact of Driving Experience and Age on Insurance Rates

Insurance companies use a variety of factors to determine car insurance premiums, and driving experience and age are two of the most significant. Young drivers with limited driving experience are considered higher risk, leading to higher premiums. As drivers gain experience and reach older ages, their insurance rates tend to decrease.

Car Insurance for Seniors in Florida

Florida has a large senior population, and many of them continue to drive. It’s important for senior drivers to have the right car insurance to protect themselves and others on the road. This section will discuss the specific needs and considerations for senior drivers in Florida, including available discounts and programs.

Car Insurance Discounts for Seniors in Florida

Insurance companies often offer discounts to senior drivers, recognizing their driving experience and lower risk profiles. Here are some common discounts:

- Safe Driver Discount: This is a common discount offered to drivers with a clean driving record. Seniors who have been driving safely for many years are likely to qualify for this discount.

- Senior Citizen Discount: Some insurance companies offer specific discounts for drivers over a certain age, typically 55 or 65.

- Loyalty Discount: Senior drivers who have been with the same insurance company for a long time may qualify for a loyalty discount.

- Multiple Policy Discount: If a senior driver bundles their car insurance with other insurance policies, such as home or renter’s insurance, they may qualify for a discount.

Impact of Health and Medical Conditions on Insurance Premiums

Senior drivers may have health conditions that could affect their driving abilities and increase their risk of accidents. Insurance companies consider these factors when setting premiums.

- Pre-Existing Conditions: Some pre-existing conditions, such as vision problems or diabetes, can impact a driver’s ability to react quickly or make safe driving decisions. Insurance companies may ask about these conditions and adjust premiums accordingly.

- Medical Records: Insurance companies may request access to a driver’s medical records to assess their driving risk.

- Driving Tests: In some cases, insurance companies may require senior drivers to undergo a driving test to assess their abilities.

Programs for Senior Drivers

Florida offers several programs designed to support senior drivers, including:

- Florida Senior Driver Safety Program: This program offers a discount on car insurance for seniors who complete a driver safety course. The course covers topics such as safe driving techniques, traffic laws, and defensive driving strategies.

- Florida Department of Motor Vehicles (DMV) Driver Improvement Program: This program is designed for drivers who have received traffic citations or have been involved in accidents. It provides education on safe driving practices and helps drivers improve their driving skills.

Last Point

In conclusion, navigating car insurance in Florida requires a thorough understanding of the state’s unique requirements, coverage options, and available discounts. By equipping yourself with the knowledge presented in this guide, you can confidently choose the right insurance plan that meets your individual needs and budget. Remember, responsible driving and proper insurance coverage go hand in hand, ensuring your safety and financial security on Florida’s roads.

Car insurance in Florida can be a bit of a maze, with many different companies offering a variety of coverage options. If you’re looking for a company that prioritizes simplicity and affordability, you might want to check out pronto insurance.

They offer a streamlined approach to car insurance, focusing on providing essential coverage without unnecessary extras. Ultimately, the best car insurance in Florida depends on your individual needs and budget, so it’s important to compare quotes from multiple providers before making a decision.