American General Life Insurance, a renowned name in the financial services industry, has been providing individuals and families with comprehensive life insurance solutions for decades. Established in 1954, the company has grown into a major player in the life insurance market, offering a wide range of products and services designed to meet the diverse needs of its clientele.

From traditional term life insurance to more complex universal life policies, American General provides a spectrum of options to help individuals secure their families’ financial future. The company also offers additional services like retirement planning and annuities, further solidifying its position as a one-stop shop for financial security.

Company Overview

American General Life Insurance Company, often referred to as American General, is a prominent player in the life insurance industry with a rich history spanning over a century. Established in 1901, the company has evolved and expanded its offerings to cater to a diverse clientele.

History and Milestones

American General Life Insurance Company was founded in 1901 as the American National Insurance Company in Galveston, Texas. The company’s initial focus was on providing life insurance policies to individuals in the Southern United States.

Over the years, American General has experienced significant growth and expansion. Some key milestones include:

- 1960s: American General began expanding its product offerings to include annuities and health insurance.

- 1970s: The company entered the retirement planning market with the launch of its first 401(k) plan.

- 1980s: American General acquired several other insurance companies, expanding its reach and market share.

- 1990s: The company adopted the name American General Life Insurance Company and continued to expand its operations through acquisitions and strategic partnerships.

- 2000s: American General was acquired by AIG (American International Group), a multinational insurance and financial services company.

Current Size, Market Share, and Financial Performance

American General Life Insurance Company is currently a subsidiary of AIG. The company is one of the largest life insurance providers in the United States, with a significant market share.

American General’s financial performance has been strong in recent years. The company has consistently reported positive earnings and a healthy balance sheet. This strong financial position has enabled American General to continue investing in its operations and expanding its product offerings.

Products and Services: American General Life Insurance

American General Life Insurance offers a wide range of life insurance products designed to meet the diverse needs of individuals and families. These products provide financial security and peace of mind, ensuring that loved ones are protected in the event of the policyholder’s passing.

Types of Life Insurance

The company provides various life insurance options, each catering to specific needs and financial situations.

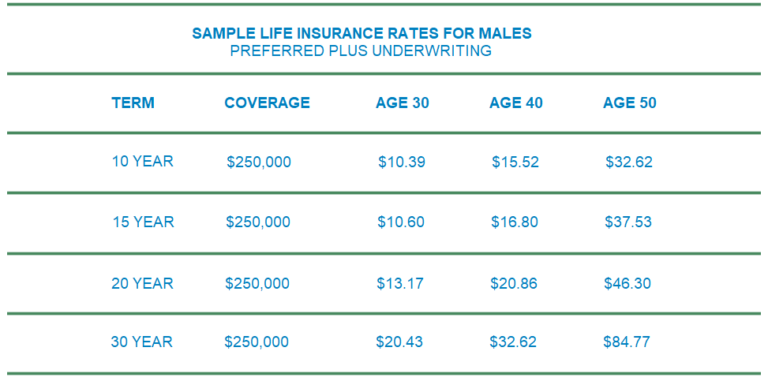

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a lower premium compared to permanent life insurance but does not build cash value. Term life insurance is ideal for individuals with temporary financial obligations, such as a mortgage or young children.

- Whole Life Insurance: This type of insurance provides lifetime coverage, meaning it remains in effect as long as the policyholder pays the premiums. It also builds cash value, which can be borrowed against or withdrawn. Whole life insurance is suitable for individuals seeking long-term financial protection and a savings component.

- Universal Life Insurance: This type of insurance offers flexible premiums and death benefit options. It also builds cash value, which earns interest at a variable rate. Universal life insurance is suitable for individuals seeking flexibility and control over their policy.

Additional Services

American General Life Insurance offers additional services beyond life insurance products, including:

- Retirement Planning: The company provides financial guidance and resources to help individuals plan for their retirement years. This includes advice on saving, investing, and managing retirement assets.

- Annuities: Annuities are financial products that provide a stream of income during retirement. American General offers a range of annuity options, including fixed annuities, variable annuities, and indexed annuities.

Target Audience

American General Life Insurance targets a broad audience, encompassing individuals and families at various life stages and income levels. However, the company’s primary focus is on individuals and families seeking reliable and comprehensive insurance solutions to protect their financial well-being.

This diverse group shares common concerns and needs related to financial security and the potential risks associated with life’s uncertainties.

Needs and Concerns

American General’s target audience is primarily concerned with protecting their loved ones financially in case of unexpected events, such as death, disability, or critical illness. This includes:

* Financial protection for dependents: Individuals with families, especially those with young children or spouses who depend on their income, prioritize life insurance to provide financial support in case of their untimely demise. This helps ensure their loved ones can maintain their lifestyle, cover expenses, and pay off debts.

* Income replacement: Disability insurance is crucial for individuals who rely on their income for their livelihood. It provides financial assistance in case of an illness or injury that prevents them from working.

* Medical expenses: Critical illness insurance helps individuals cover the high costs associated with major health conditions, ensuring they can focus on their recovery without financial stress.

* Long-term care: As individuals age, the need for long-term care becomes more significant. Long-term care insurance helps cover the expenses associated with nursing homes, assisted living facilities, or in-home care, allowing individuals to maintain their quality of life and financial independence.

How American General Addresses These Needs

American General offers a comprehensive suite of insurance products designed to address the specific needs and concerns of its target audience:

* Life insurance: American General offers various life insurance options, including term life, whole life, and universal life, to suit different needs and budgets. These products provide financial security to beneficiaries, ensuring their loved ones are financially protected in case of the policyholder’s death.

* Disability insurance: American General’s disability insurance policies help individuals maintain their income if they become unable to work due to an illness or injury. These policies provide financial support during a difficult time, allowing individuals to focus on their recovery.

* Critical illness insurance: American General’s critical illness insurance provides a lump-sum payment to individuals diagnosed with a covered critical illness. This payment helps cover medical expenses, lost income, and other financial burdens associated with these conditions.

* Long-term care insurance: American General offers long-term care insurance policies to help individuals cover the expenses associated with long-term care needs. These policies provide financial assistance for nursing homes, assisted living facilities, or in-home care, ensuring individuals can receive the care they need without depleting their savings.

American General also provides excellent customer service, financial planning resources, and educational materials to help individuals understand their insurance needs and make informed decisions.

Distribution Channels

American General Life Insurance utilizes a multi-channel distribution strategy to reach a broad customer base. This approach involves leveraging various channels, each catering to specific customer needs and preferences.

Independent Agents

Independent agents play a crucial role in American General’s distribution network. These agents are self-employed individuals who represent multiple insurance companies, including American General. They are compensated on a commission basis, earning a percentage of the premiums they sell.

Independent agents offer several advantages:

- Personalized service: Independent agents are often deeply rooted in their communities and have established relationships with clients, enabling them to provide personalized advice and support.

- Local expertise: They possess local market knowledge, understanding the specific needs and challenges of their communities, allowing them to tailor insurance solutions accordingly.

- Flexibility: Independent agents operate independently, offering flexibility in scheduling appointments and tailoring their services to meet client preferences.

However, independent agents also have some drawbacks:

- Limited product knowledge: Due to representing multiple companies, they may not have in-depth knowledge of all American General products.

- Potential conflicts of interest: Agents may prioritize selling products from companies that offer higher commissions, potentially leading to conflicts of interest.

- Lack of consistency: The quality of service can vary depending on the individual agent’s skills and dedication.

Brokers

Brokers, like independent agents, are self-employed individuals who represent multiple insurance companies. They are typically compensated on a commission basis, earning a percentage of the premiums they sell. However, brokers often specialize in specific insurance products or industries, providing more focused expertise.

Brokers offer several advantages:

- Specialized expertise: Brokers often possess deep knowledge of specific insurance products or industries, allowing them to provide tailored advice and solutions.

- Access to multiple options: By representing multiple companies, brokers can offer clients a wider range of insurance options to choose from.

- Objective advice: Brokers are not tied to any specific insurance company, allowing them to provide more objective recommendations based on client needs.

Brokers also have some drawbacks:

- Higher costs: Brokers often charge higher fees than direct sales channels due to their specialized expertise and broader market access.

- Limited customer support: Brokers may not offer the same level of ongoing customer support as direct sales channels.

- Potential for conflicts of interest: Brokers may prioritize selling products from companies that offer higher commissions, potentially leading to conflicts of interest.

Direct Sales Channels, American general life insurance

Direct sales channels allow customers to purchase insurance products directly from American General, bypassing intermediaries like agents or brokers. This can be done through various means, including online platforms, call centers, and company-owned retail locations.

Direct sales channels offer several advantages:

- Lower costs: Direct sales channels often offer lower premiums than those sold through agents or brokers due to the elimination of commissions.

- Convenience: Customers can purchase insurance products at their convenience, 24/7, through online platforms or call centers.

- Greater transparency: Direct sales channels provide customers with direct access to American General’s products and information.

Direct sales channels also have some drawbacks:

- Limited personalization: Direct sales channels may not offer the same level of personalized service as agents or brokers.

- Potential for misinterpretation: Customers may not fully understand the complexities of insurance products without the guidance of an agent or broker.

- Lack of local expertise: Direct sales channels may not possess the same level of local market knowledge as agents or brokers.

Customer Experience

American General Life Insurance strives to provide a positive customer experience throughout the entire insurance lifecycle. From the initial inquiry to policy management and claims processing, the company aims to deliver a seamless and satisfying journey for its policyholders.

Customer Service Reputation

American General Life Insurance has a reputation for providing excellent customer service. The company has consistently received high ratings for customer satisfaction from independent organizations, such as J.D. Power. This positive reputation is built upon several key factors:

- Responsive and knowledgeable agents: American General employs a team of well-trained agents who are readily available to answer questions, address concerns, and provide personalized support.

- Multiple communication channels: Customers can reach out to American General through various channels, including phone, email, and online chat. This accessibility ensures that customers can connect with the company in a way that is convenient for them.

- Commitment to resolving issues promptly: American General prioritizes resolving customer issues quickly and efficiently. The company has established processes to ensure that complaints are addressed in a timely manner, and customers are kept informed throughout the resolution process.

Claims Processing Experience

American General Life Insurance is known for its efficient and transparent claims processing procedures. The company aims to make the claims process as smooth as possible for policyholders.

- Clear and concise guidelines: American General provides detailed information about its claims process, including the necessary documentation and timelines. This transparency helps customers understand what to expect and prepare accordingly.

- Dedicated claims specialists: The company has a team of dedicated claims specialists who are trained to handle various types of claims. These specialists provide personalized support and guidance throughout the claims process.

- Prompt payment: American General aims to process claims promptly and pay out benefits as quickly as possible. The company utilizes advanced technology and streamlined processes to expedite the claims payment process.

Positive Customer Experiences

Many customers have shared positive experiences with American General Life Insurance. Some common themes include:

- Friendly and helpful agents: Numerous customers have praised the friendliness and helpfulness of American General agents. They appreciate the personalized support and guidance provided by these agents.

- Smooth claims processing: Customers have consistently commended the company’s efficient and transparent claims process. They appreciate the clear communication, prompt processing, and timely payment of benefits.

- Overall satisfaction: Many customers have expressed overall satisfaction with their experience with American General Life Insurance. They appreciate the company’s commitment to providing quality products, excellent service, and a positive customer experience.

Negative Customer Experiences

While American General Life Insurance generally receives positive feedback, some customers have reported negative experiences. These experiences often stem from:

- Long wait times: Some customers have reported experiencing long wait times when contacting customer service. This can be frustrating, especially during peak hours or when dealing with complex issues.

- Challenges with claims processing: While the claims process is generally smooth, some customers have encountered challenges with specific claims. These challenges could be related to documentation requirements, processing delays, or communication issues.

- Limited online resources: Some customers have expressed a desire for more comprehensive online resources, such as FAQs, online claim filing, and digital policy management tools.

Financial Stability and Ratings

American General Life Insurance Company’s financial stability is a key factor for potential customers seeking reliable and secure insurance products. The company’s credit ratings from independent agencies provide valuable insights into its financial strength and ability to meet its obligations.

Understanding these ratings is crucial for consumers, as they indicate the level of risk associated with investing in or purchasing insurance from a particular company. Higher ratings generally signify a more financially sound and stable company, offering greater confidence in its ability to fulfill its commitments to policyholders.

Credit Ratings and Their Significance

Credit ratings are assigned by independent agencies such as AM Best, Standard & Poor’s, and Moody’s. These agencies evaluate a company’s financial performance, risk profile, and overall business operations to determine its creditworthiness.

American General Life Insurance Company has consistently received strong credit ratings from these agencies, indicating its robust financial position and commitment to responsible risk management.

- AM Best: A+ (Superior)

- Standard & Poor’s: A+ (Strong)

- Moody’s: A1 (High-Quality)

These ratings reflect American General’s ability to withstand economic downturns, maintain sufficient capital reserves, and meet its financial obligations to policyholders.

Competition

The life insurance market is highly competitive, with numerous players vying for market share. American General faces competition from a wide range of companies, including large national insurers, regional carriers, and specialized providers.

Major Competitors in the Life Insurance Market

The major competitors in the life insurance market can be broadly categorized into:

- Large National Insurers: These companies operate nationwide and offer a wide range of life insurance products. Examples include MetLife, Prudential, New York Life, and Northwestern Mutual.

- Regional Carriers: These insurers focus on specific geographic regions and may have a strong presence in their local markets. Examples include State Farm, Nationwide, and Blue Cross Blue Shield.

- Specialized Providers: These companies focus on specific types of life insurance, such as term life, whole life, or universal life. Examples include Banner Life, Protective Life, and Transamerica.

Comparison of American General’s Products and Services with Competitors

American General offers a diverse range of life insurance products, including term life, whole life, universal life, and variable life. It also provides other financial products, such as annuities and retirement plans.

- Term Life Insurance: American General’s term life insurance products are competitive in terms of premiums and coverage options. However, some competitors, such as Term Life Insurance Company, may offer lower premiums for similar coverage.

- Whole Life Insurance: American General’s whole life insurance products are known for their cash value accumulation features. However, competitors like Northwestern Mutual and MassMutual may offer higher cash value growth potential.

- Universal Life Insurance: American General’s universal life insurance products provide flexibility in premium payments and death benefit options. However, competitors like Guardian Life and Lincoln Financial may offer more competitive interest rates on the cash value component.

Unique Strengths and Weaknesses of American General

American General possesses several strengths that differentiate it from its competitors. These include:

- Strong Financial Stability: American General is a subsidiary of AIG, a major financial services company with a strong financial track record. This provides customers with confidence in the company’s ability to meet its obligations.

- Wide Distribution Network: American General has a vast network of agents and brokers, making it easy for customers to access its products and services.

- Comprehensive Product Suite: American General offers a wide range of life insurance products and other financial solutions, providing customers with diverse options to meet their needs.

American General also faces some weaknesses in relation to its competition:

- Limited Brand Recognition: Compared to some of its larger competitors, American General may have lower brand recognition, particularly among younger generations.

- High Premiums: In some cases, American General’s premiums may be higher than those of its competitors for similar coverage levels.

- Complex Products: Some of American General’s products, such as universal life and variable life, can be complex and difficult for customers to understand.

Industry Trends

The life insurance industry is constantly evolving, driven by factors such as technological advancements, changing consumer preferences, and economic conditions. These trends present both opportunities and challenges for American General, requiring the company to adapt and innovate to remain competitive.

Impact of Technology on Life Insurance

Technological advancements are reshaping the life insurance landscape, impacting how companies operate, interact with customers, and deliver products. The rise of online platforms, mobile apps, and artificial intelligence (AI) is making it easier for consumers to compare policies, get quotes, and purchase coverage digitally. This trend has led to increased transparency and competition in the market, with insurers needing to provide seamless and personalized customer experiences.

- Digitalization: The shift towards digital channels has created opportunities for insurers to reach a wider audience, improve efficiency, and reduce costs. For example, American General can leverage online platforms to offer personalized quotes, streamline the application process, and provide 24/7 customer support.

- Artificial Intelligence (AI): AI is playing a growing role in underwriting, claims processing, and customer service. AI-powered chatbots can handle basic inquiries, while advanced algorithms can analyze risk profiles and personalize policy recommendations. This can help insurers improve efficiency, accuracy, and customer satisfaction.

- Data Analytics: Data analytics is becoming increasingly important for insurers to understand customer behavior, identify emerging trends, and optimize pricing strategies. By analyzing vast amounts of data, American General can develop more tailored products and services, personalize marketing campaigns, and enhance risk management practices.

Shifting Consumer Preferences

Consumer preferences are changing, with a growing demand for personalized products, flexible payment options, and value-added services. This shift is driving insurers to adapt their offerings and marketing strategies to meet these evolving needs.

- Customization: Consumers are looking for life insurance policies that are tailored to their specific needs and circumstances. American General can respond to this trend by offering a wider range of coverage options, including term life, whole life, and universal life, as well as riders and add-ons that cater to different individual preferences.

- Convenience and Flexibility: Consumers are seeking convenient and flexible payment options, such as monthly installments, online payments, and mobile wallets. American General can cater to these preferences by offering a variety of payment methods and providing access to online account management tools.

- Value-Added Services: Consumers are looking for more than just basic life insurance coverage. They are seeking value-added services, such as financial planning, estate planning, and health and wellness programs. American General can differentiate itself by offering these services, which can enhance customer loyalty and provide a more comprehensive solution.

Economic Uncertainty and Rising Interest Rates

Economic uncertainty and rising interest rates can impact the life insurance industry in several ways. For example, during periods of economic downturn, consumers may be more likely to reduce their insurance coverage or delay purchasing new policies.

“The impact of economic uncertainty and rising interest rates on the life insurance industry can be significant, as it influences consumer purchasing behavior and investment strategies.”

- Consumer Spending: Economic uncertainty can lead to a decrease in consumer spending, as individuals prioritize essential expenses and may postpone non-essential purchases, including life insurance. American General can mitigate this challenge by emphasizing the importance of financial security and highlighting the value of life insurance as a crucial part of a comprehensive financial plan.

- Investment Returns: Rising interest rates can affect the investment returns on life insurance products, particularly those with cash value components. American General can address this by exploring alternative investment strategies and diversifying its portfolio to mitigate the impact of interest rate fluctuations.

Social Responsibility

American General Life Insurance (AGL) is committed to operating ethically and responsibly, recognizing that its success is interconnected with the well-being of its stakeholders and the communities it serves. The company’s social responsibility initiatives extend beyond its core business operations, encompassing environmental sustainability, diversity and inclusion, and community engagement.

Sustainability Initiatives

AGL recognizes the importance of environmental stewardship and has implemented several initiatives to minimize its environmental footprint.

- AGL has reduced its energy consumption by implementing energy-efficient practices in its offices and data centers.

- The company has also reduced its paper consumption through digitalization and promoting paperless communication.

- AGL actively supports renewable energy sources and has invested in solar panels for its facilities.

Diversity and Inclusion

AGL is committed to fostering a diverse and inclusive workplace, believing that a diverse workforce brings fresh perspectives and enhances innovation.

- AGL has established diversity and inclusion programs to promote equal opportunities for all employees.

- The company has also implemented policies to prevent discrimination and harassment in the workplace.

- AGL actively recruits and supports employees from underrepresented groups.

Community Involvement

AGL believes in giving back to the communities it serves. The company actively supports various non-profit organizations and initiatives that address critical social needs.

- AGL sponsors financial literacy programs for low-income families, aiming to improve their financial well-being.

- The company also supports disaster relief efforts, providing financial aid and resources to communities affected by natural disasters.

- AGL encourages its employees to volunteer their time and skills to local charities and organizations.

Impact on Reputation and Brand Image

AGL’s social responsibility initiatives have had a positive impact on its reputation and brand image.

- These initiatives demonstrate AGL’s commitment to ethical and responsible business practices.

- They also enhance the company’s brand image by associating it with positive social impact.

- By actively engaging in social responsibility, AGL attracts and retains talented employees who value these principles.

Ending Remarks

American General Life Insurance stands as a reliable and reputable provider of life insurance solutions. The company’s commitment to financial stability, coupled with its dedication to customer service and product innovation, has solidified its place in the industry. Whether you are seeking basic life insurance coverage or a comprehensive financial plan, American General offers a range of options to meet your specific needs and goals.

American General Life Insurance offers a variety of products designed to meet the diverse needs of individuals and families. While their focus is on providing comprehensive life insurance solutions, they also recognize the importance of broader financial security. This is why they often partner with other providers, such as citizens insurance , to offer a holistic approach to financial planning.

This collaboration allows American General Life Insurance to provide clients with a wider range of options, including health insurance, which is essential for overall well-being.