Progressive Insurance Quotes: Get the Best Rate are a great way to find affordable car insurance. Progressive is known for its innovative approach to insurance, offering a wide range of coverage options and discounts. Whether you’re a new driver or a seasoned veteran, Progressive can help you find the right policy to meet your needs and budget.

Progressive uses a variety of factors to determine your insurance quote, including your driving history, vehicle type, and location. They also offer a variety of discounts, such as safe driver discounts, multi-policy discounts, and good student discounts. With their online quote system, you can get a personalized quote in minutes.

Progressive Insurance: Progressive Insurance Quote

Progressive Insurance is a major American insurance company specializing in auto insurance. It is known for its innovative approach to insurance, particularly its use of technology and data to personalize pricing and customer experiences.

History and Founding

Progressive Insurance was founded in 1937 by Jack Green, who started the company as a small agency in Cleveland, Ohio. The company initially focused on providing auto insurance to drivers in the Cleveland area. Over the years, Progressive has grown significantly, expanding its operations nationwide and diversifying its product offerings to include other types of insurance, such as homeowners, renters, and commercial insurance.

Core Business Model

Progressive’s core business model is based on a direct-to-consumer approach, which means that customers can purchase insurance policies directly from Progressive without the need for an insurance agent. This allows Progressive to keep its costs lower and pass those savings on to its customers.

Brand Positioning and Target Audience

Progressive has built a strong brand reputation based on its focus on innovation, customer service, and value. It is known for its quirky and memorable advertising campaigns, which often feature popular celebrities and characters. Progressive’s target audience is a wide range of consumers, including young adults, families, and older drivers.

Market Share and Financial Performance

Progressive is one of the largest auto insurance companies in the United States, with a significant market share. The company consistently ranks among the top performers in the industry in terms of financial performance. In 2022, Progressive generated over $50 billion in revenue and had a net income of over $5 billion.

Progressive Insurance Quotes

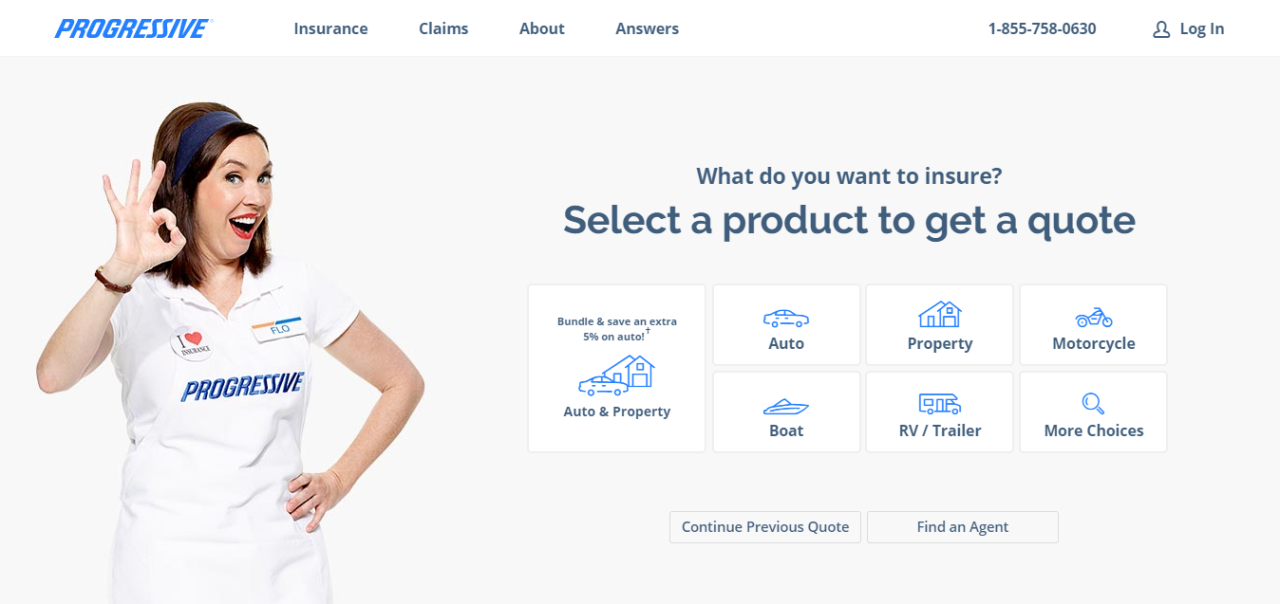

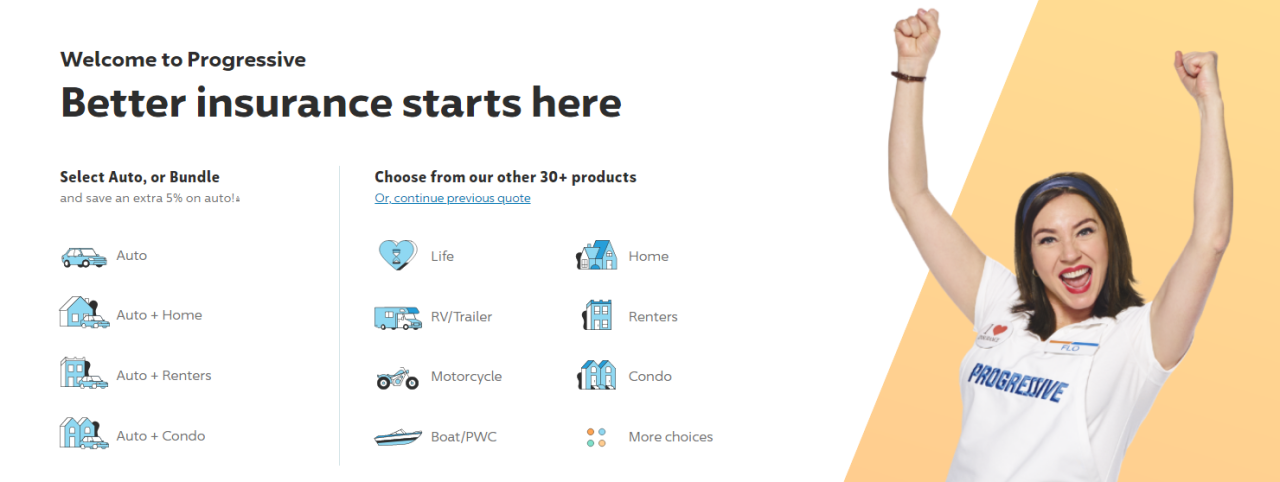

Progressive Insurance offers a variety of insurance products, including auto, home, motorcycle, and business insurance. Obtaining a quote for these insurance products is a straightforward process that can be done online, over the phone, or in person.

Progressive Insurance Quotes: The Process

Progressive offers multiple ways to obtain a quote. You can request a quote online through their website, over the phone by calling their customer service line, or in person by visiting a local Progressive insurance agent.

Obtaining a Quote Online

The online quote process is quick and convenient. You can start by visiting the Progressive website and entering your zip code. The website will then ask you to provide basic information about your vehicle, driving history, and desired coverage. You will also need to provide your personal information, such as your name, address, and contact details.

Once you have entered all of the required information, Progressive will generate a personalized quote. You can then compare different coverage options and choose the plan that best suits your needs.

Obtaining a Quote Over the Phone

If you prefer to obtain a quote over the phone, you can call Progressive’s customer service line. You will need to provide the same information that you would provide online, including your vehicle details, driving history, and desired coverage.

A Progressive representative will then ask you a series of questions to help them determine your insurance needs and generate a personalized quote.

Obtaining a Quote in Person

You can also obtain a quote in person by visiting a local Progressive insurance agent. This allows you to have a more personalized conversation with an agent who can answer your questions and help you choose the right coverage for your needs.

Information Required for a Quote

Regardless of how you choose to obtain a quote, Progressive will require certain information from you. This information helps them to accurately assess your risk and generate a personalized quote.

Here are some of the common types of information required:

- Personal Information: This includes your name, address, date of birth, and contact details.

- Vehicle Information: This includes the make, model, year, and VIN of your vehicle.

- Driving History: This includes your driving record, such as any accidents or violations.

- Desired Coverage: This includes the types of coverage you are interested in, such as liability, collision, and comprehensive.

- Other Factors: This may include your credit history, driving habits, and location.

Flow Chart Illustrating the Steps

The following flow chart illustrates the steps involved in obtaining a Progressive insurance quote:

This flow chart provides a visual representation of the quote process, highlighting the key steps involved in obtaining a quote.

Factors Influencing Progressive Insurance Quotes

Progressive, like other insurance companies, considers several factors to determine your insurance quote. These factors help them assess your risk and determine how much you’ll pay for coverage. Understanding these factors can help you make informed decisions that might impact your premium.

Factors Affecting Your Insurance Quote

The factors that influence your Progressive insurance quote can be categorized into several key areas. These include:

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance premium. For example, a high-performance sports car is more expensive to repair and replace than a compact car. Therefore, you’ll likely pay a higher premium for insuring a sports car.

- Driver Demographics: Your age, driving experience, and location all play a role in determining your insurance quote. Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents. Similarly, drivers residing in high-risk areas with higher accident rates may face higher premiums.

- Coverage Levels: The level of coverage you choose directly affects your premium. Higher coverage levels, such as comprehensive and collision coverage, provide more protection but come at a higher cost. You can save money by opting for lower coverage levels, but you’ll also have less protection in case of an accident.

- Driving History: Your driving history, including accidents, violations, and claims, plays a crucial role in determining your premium. Drivers with a clean driving record generally receive lower premiums than those with a history of accidents or violations.

Impact of Factors on Insurance Premiums

Here’s a table illustrating the potential impact of different factors on insurance premiums:

| Factor | Impact on Premium | Example |

|---|---|---|

| Vehicle Type | Higher premium for expensive, high-performance vehicles | A sports car will likely have a higher premium than a compact car. |

| Driver Age | Higher premium for younger drivers | A 18-year-old driver will generally pay a higher premium than a 35-year-old driver. |

| Driving History | Higher premium for drivers with accidents or violations | A driver with a recent speeding ticket will likely have a higher premium than a driver with a clean driving record. |

| Coverage Levels | Higher premium for higher coverage levels | Comprehensive and collision coverage will generally cost more than liability-only coverage. |

Progressive Insurance Quote Features and Options

A Progressive insurance quote offers a comprehensive range of coverage options, discounts, and add-ons tailored to your individual needs. Understanding these features can help you make informed decisions about your insurance policy.

Coverage Options

Progressive offers a variety of coverage options to protect you and your vehicle in the event of an accident or other unforeseen circumstances.

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to another person or property. It covers medical expenses, property damage, and legal defense costs.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, and floods.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who does not have adequate insurance or is uninsured.

Discounts and Benefits

Progressive offers a variety of discounts and benefits to help you save money on your insurance premiums.

- Safe Driver Discounts: These discounts are available to drivers with clean driving records.

- Multi-Policy Discounts: You can receive a discount if you bundle your auto insurance with other insurance policies, such as homeowners or renters insurance.

- Accident Forgiveness: This benefit prevents your insurance rates from increasing after your first at-fault accident.

Optional Add-ons

Progressive offers a range of optional add-ons that can provide additional protection and peace of mind.

- Roadside Assistance: This coverage provides help with roadside emergencies, such as flat tires, jump starts, and towing.

- Rental Car Reimbursement: This coverage helps pay for a rental car if your vehicle is being repaired after an accident.

- Gap Coverage: This coverage helps pay the difference between the actual cash value of your vehicle and the amount you owe on your auto loan if your vehicle is totaled.

Comparing Progressive Insurance Quotes to Competitors

It’s important to compare insurance quotes from multiple companies to find the best coverage at the most affordable price. While Progressive is known for its competitive rates, it’s essential to see how its quotes stack up against other major players in the insurance market. This section will compare and contrast Progressive’s quotes to those offered by Geico, State Farm, and Allstate, highlighting the strengths and weaknesses of each provider.

Key Strengths and Weaknesses of Progressive

Progressive is often praised for its innovative features, such as its Name Your Price tool, which allows customers to set their desired premium and see what coverage options fit within their budget. However, Progressive may not always be the most affordable option for all drivers, particularly those with a history of accidents or traffic violations.

- Strengths:

- Name Your Price Tool: Allows customers to set their desired premium and find coverage options that fit their budget.

- Online and Mobile Convenience: Offers easy-to-use online and mobile platforms for obtaining quotes, managing policies, and filing claims.

- Discount Availability: Offers a wide range of discounts, including those for good driving records, safety features, and bundling multiple insurance policies.

- Strong Customer Service: Generally receives positive feedback for its customer service, with agents available 24/7.

- Weaknesses:

- Higher Rates for Certain Drivers: May offer higher rates for drivers with a history of accidents or traffic violations.

- Limited Coverage Options: May have fewer coverage options compared to some competitors.

- Potential for Higher Deductibles: May require higher deductibles for certain coverage options.

Scenarios Where Progressive Might Be More or Less Competitive

The competitiveness of Progressive’s quotes can vary depending on factors such as your driving history, location, and the type of vehicle you own. Here are some scenarios where Progressive might be more or less competitive:

- More Competitive:

- Drivers with a Clean Driving Record: Progressive often offers competitive rates for drivers with a good driving history and no recent accidents or violations.

- Drivers in Certain Geographic Locations: Progressive’s pricing can vary by region, and it may be more competitive in certain areas than others.

- Drivers Seeking Specific Coverage Options: Progressive’s Name Your Price tool can be advantageous for drivers looking for specific coverage features or a particular price point.

- Less Competitive:

- Drivers with a History of Accidents or Violations: Progressive may charge higher rates for drivers with a less-than-perfect driving record.

- Drivers in Certain Vehicle Categories: Progressive’s pricing can vary by vehicle type, and it may be less competitive for certain types of cars or trucks.

- Drivers Seeking Comprehensive Coverage: While Progressive offers a range of coverage options, it may not be as competitive as other insurers for those seeking the most comprehensive coverage.

Comparison with Other Insurers

Here’s a brief comparison of Progressive’s quotes to those offered by Geico, State Farm, and Allstate:

| Insurer | Strengths | Weaknesses |

|---|---|---|

| Progressive | Innovative features, online convenience, discount availability, strong customer service | Higher rates for certain drivers, limited coverage options, potential for higher deductibles |

| Geico | Widely recognized for its affordability, extensive discount options, user-friendly website | May have limited customer service availability, fewer coverage options compared to some competitors |

| State Farm | Strong reputation for customer service, extensive agent network, wide range of coverage options | May have higher premiums compared to some competitors, limited online features |

| Allstate | Offers a variety of coverage options, strong customer service, competitive discounts | May have higher rates for certain drivers, limited online features compared to some competitors |

Progressive Insurance Quote Tools and Resources

Progressive offers a variety of tools and resources to help customers understand and compare insurance quotes, making the process of finding the right coverage more convenient and efficient. These tools empower customers to make informed decisions about their insurance needs.

Online Calculators, Progressive insurance quote

Progressive provides online calculators to help customers estimate their insurance premiums. These calculators allow customers to input information such as their vehicle type, driving history, and location to receive a personalized estimate. This helps customers get a general idea of their potential insurance costs before requesting a formal quote.

Quote Comparison Tools

Progressive’s quote comparison tools allow customers to compare quotes from different insurance providers side-by-side. This enables customers to easily evaluate different coverage options and pricing structures, making it easier to find the best value for their needs.

Educational Materials

Progressive offers a wealth of educational materials to help customers understand the intricacies of insurance coverage. These materials can include articles, videos, and FAQs that explain key concepts, such as deductibles, liability limits, and different types of coverage. This helps customers make informed decisions about the level of coverage they need.

Helpful Resources on Progressive’s Website and Mobile App

- Online Quote Request Form: Customers can easily request a quote online by filling out a simple form with their personal and vehicle information. This allows customers to receive a quote quickly and conveniently.

- Coverage Options and Explanations: Progressive’s website and mobile app provide detailed explanations of different coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. This helps customers understand the benefits and limitations of each coverage type.

- Policy Management Tools: Progressive’s website and mobile app allow customers to manage their policies online, including making payments, updating contact information, and accessing policy documents. This provides customers with convenient access to their insurance information.

- Customer Support Resources: Progressive offers various customer support resources, such as phone numbers, email addresses, and live chat options, to assist customers with any questions or concerns they may have.

The Future of Progressive Insurance Quotes

The insurance industry is constantly evolving, driven by technological advancements, changing customer expectations, and evolving risk profiles. These shifts are impacting how insurance companies like Progressive approach quote generation and pricing strategies. This section explores emerging trends and the potential role of technology in shaping the future of insurance quotes.

The Influence of Technology

Technology is playing a transformative role in the insurance industry, influencing quote processes, pricing strategies, and customer interactions.

- Artificial Intelligence (AI): AI is being used to automate various aspects of the quote process, from data analysis and risk assessment to personalized recommendations. AI algorithms can analyze vast amounts of data, identify patterns, and make predictions, leading to more accurate and efficient quote generation.

- Telematics: Telematics devices and smartphone apps collect driving data, such as speed, braking, and mileage, providing insights into driver behavior. This data can be used to personalize insurance quotes, rewarding safe drivers with lower premiums and encouraging better driving habits.

- Blockchain: Blockchain technology can streamline insurance processes, such as claims processing and fraud detection, potentially leading to faster and more transparent quote generation.

Progressive’s Adaptability

To stay competitive in this evolving landscape, Progressive will likely continue to adapt its quote offerings and customer experience.

- Personalized Quotes: Progressive will likely leverage AI and telematics to personalize quotes based on individual driving behavior and risk profiles, offering more competitive rates to safe drivers.

- Seamless Digital Experience: Progressive will likely continue to enhance its online and mobile platforms, making it easier for customers to obtain quotes, manage policies, and file claims.

- Value-Added Services: Progressive may offer additional services, such as telematics-based driving feedback and safety features, to enhance customer value and differentiate its offerings.

Closure

Getting a Progressive Insurance Quote is a simple and straightforward process. Whether you choose to get a quote online, over the phone, or in person, Progressive’s friendly and knowledgeable representatives are there to guide you every step of the way. By understanding the factors that influence your quote and taking advantage of available discounts, you can secure the best possible rate for your insurance needs.

Getting a Progressive insurance quote is a good starting point for comparing rates, but don’t forget to explore other options. You might find a better deal with citizens insurance , for example. Remember, comparing quotes from different insurers is crucial to finding the best coverage at the most affordable price.