Liberty Mutual car insurance sets the stage for this comprehensive exploration, offering readers a deep dive into a company known for its robust coverage options, competitive pricing, and commitment to customer satisfaction.

From its humble beginnings to its current position as a leading insurance provider, Liberty Mutual has consistently evolved to meet the ever-changing needs of its customers. With a diverse range of car insurance products tailored to various drivers and their unique circumstances, Liberty Mutual aims to provide peace of mind and financial protection in the event of an accident or unforeseen incident. This exploration delves into the company’s history, its offerings, pricing factors, customer experience, and commitment to safety and sustainability.

Safety and Security Features: Liberty Mutual Car Insurance

Liberty Mutual is committed to providing its customers with a safe and secure driving experience. The company offers a range of safety and security initiatives designed to protect drivers, passengers, and their vehicles.

Driver Safety Programs

Liberty Mutual offers a variety of driver safety programs to help its policyholders improve their driving skills and reduce the risk of accidents. These programs are designed to educate drivers about safe driving practices, promote responsible driving habits, and provide resources to help drivers stay safe on the road.

- Defensive Driving Courses: Liberty Mutual offers defensive driving courses that teach drivers how to avoid accidents and stay safe on the road. These courses cover topics such as hazard recognition, defensive driving techniques, and safe driving practices.

- Driver Education Programs: Liberty Mutual also offers driver education programs for young drivers. These programs teach new drivers the fundamentals of safe driving, including traffic laws, vehicle operation, and risk management.

- Telematics Programs: Liberty Mutual’s telematics programs use technology to monitor driving behavior and provide feedback to drivers. These programs can help drivers identify areas where they can improve their driving habits and potentially earn discounts on their insurance premiums.

Fraud Prevention Measures

Liberty Mutual has implemented a comprehensive fraud prevention program to protect its customers and its business from fraudulent activity. This program includes measures to detect and prevent fraudulent claims, protect customer data, and ensure the integrity of its insurance policies.

- Claims Verification Process: Liberty Mutual has a rigorous claims verification process to ensure that claims are legitimate and not fraudulent. This process includes verifying the identity of the claimant, the details of the accident, and the extent of the damage.

- Data Security Measures: Liberty Mutual has implemented strong data security measures to protect customer data from unauthorized access, use, or disclosure. These measures include encryption, access controls, and regular security audits.

- Fraud Detection Technologies: Liberty Mutual uses advanced fraud detection technologies to identify and prevent fraudulent activity. These technologies analyze data patterns and identify potential red flags that may indicate fraud.

Data Privacy and Security

Liberty Mutual is committed to protecting the privacy and security of its customers’ data. The company has a comprehensive data privacy policy that Artikels its practices for collecting, using, and disclosing customer information. Liberty Mutual complies with all applicable data privacy laws and regulations, including the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in California.

- Data Minimization: Liberty Mutual only collects and uses customer data that is necessary for its business operations, including providing insurance, managing claims, and improving customer service.

- Data Security: Liberty Mutual has implemented strong data security measures to protect customer data from unauthorized access, use, or disclosure. These measures include encryption, access controls, and regular security audits.

- Data Transparency: Liberty Mutual is transparent about its data privacy practices and provides customers with clear and concise information about how their data is collected, used, and disclosed.

Promoting Responsible Driving

Liberty Mutual actively promotes responsible driving through a variety of initiatives, including public awareness campaigns, partnerships with community organizations, and educational resources. These efforts aim to reduce the number of accidents and improve road safety.

- Public Awareness Campaigns: Liberty Mutual conducts public awareness campaigns to educate drivers about the importance of safe driving practices. These campaigns may focus on specific issues such as distracted driving, impaired driving, or speeding.

- Community Partnerships: Liberty Mutual partners with community organizations to promote safe driving and reduce accidents. These partnerships may involve sponsoring safety events, providing educational resources, or supporting traffic safety initiatives.

- Educational Resources: Liberty Mutual provides educational resources to help drivers learn about safe driving practices and improve their driving skills. These resources may include online articles, videos, and downloadable materials.

Future Outlook

Liberty Mutual, a leading player in the car insurance market, is well-positioned for continued growth in the years to come. The company’s commitment to innovation, customer-centricity, and adaptability will be key to navigating the evolving landscape of the industry.

Growth Opportunities, Liberty mutual car insurance

The car insurance market is expected to experience significant growth in the coming years, driven by factors such as increasing vehicle ownership, rising urbanization, and the adoption of new technologies. Liberty Mutual is poised to capitalize on these trends through strategic initiatives that focus on:

- Expanding into new markets: Liberty Mutual has a global presence, and it is actively seeking to expand its operations into new markets with high growth potential. For example, the company has recently entered the Chinese market, which is expected to be a major driver of growth in the car insurance sector.

- Developing innovative products and services: Liberty Mutual is investing heavily in research and development to create innovative products and services that meet the evolving needs of customers. For example, the company has launched a suite of telematics-based insurance products that leverage data from connected vehicles to provide personalized pricing and risk management solutions.

- Leveraging technology to enhance customer experience: Liberty Mutual is using technology to enhance the customer experience across all touchpoints. The company has invested in digital platforms that allow customers to manage their policies, file claims, and access support services online.

Adapting to Evolving Customer Needs

Customer expectations are constantly evolving, and Liberty Mutual is committed to staying ahead of the curve. The company is focusing on:

- Personalization: Liberty Mutual is using data analytics to understand customer needs and preferences better. This information is used to develop personalized products and services that meet individual requirements.

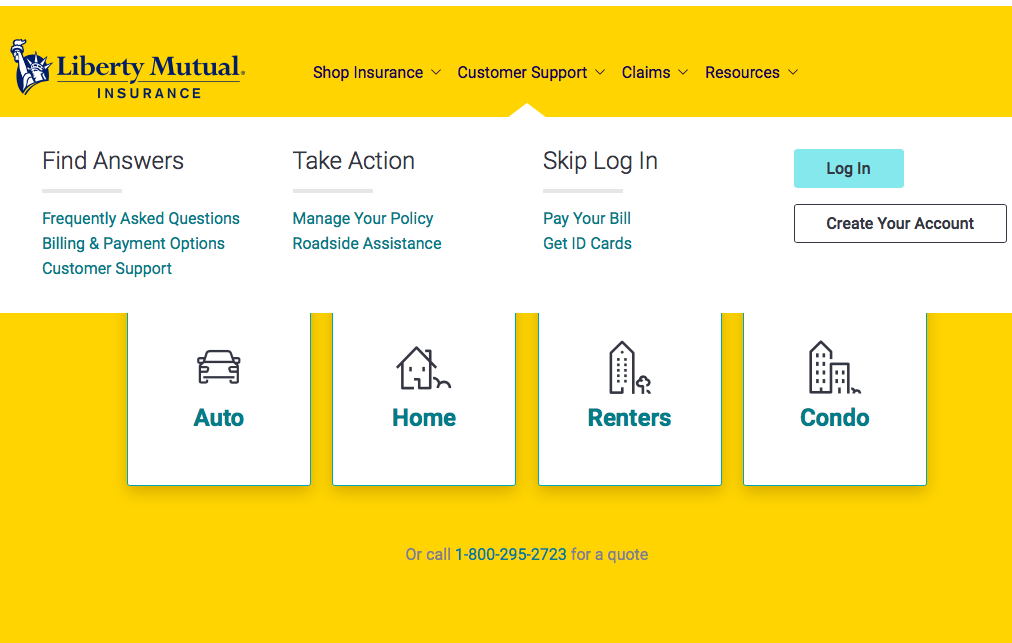

- Convenience: Liberty Mutual is making it easier for customers to interact with the company. The company is offering a variety of digital channels, such as mobile apps and online portals, to provide customers with convenient access to information and services.

- Transparency: Liberty Mutual is committed to providing customers with transparent and easy-to-understand information about their insurance policies. The company is using clear and concise language in its communications and is making it easier for customers to compare different insurance options.

The Future of Car Insurance

The car insurance industry is undergoing a period of significant transformation, driven by technological advancements, changing customer expectations, and the rise of new business models. Key trends shaping the future of car insurance include:

- Autonomous Vehicles: The widespread adoption of autonomous vehicles is expected to have a profound impact on the car insurance industry. Autonomous vehicles are expected to reduce accidents significantly, leading to lower insurance premiums. However, the liability and insurance models for autonomous vehicles are still being developed.

- Telematics: Telematics is a technology that uses sensors and data to track vehicle usage and driver behavior. This data can be used to provide personalized pricing, risk management solutions, and safety features. Telematics is expected to play a significant role in the future of car insurance.

- Data Analytics: Data analytics is becoming increasingly important in the car insurance industry. Insurance companies are using data to understand customer needs, identify risks, and develop more accurate pricing models.

Recommendations and Insights

Choosing the right car insurance provider is a crucial decision that can significantly impact your financial well-being and peace of mind. Liberty Mutual offers a comprehensive range of car insurance options, and this section will provide valuable insights to help you determine if it’s the right fit for your needs.

Factors to Consider When Choosing Car Insurance

When selecting a car insurance provider, it’s essential to consider several factors that directly influence your policy’s cost and coverage. This section Artikels key considerations to ensure you make an informed decision.

- Your individual needs and risk profile: Factors such as your driving history, age, location, and the type of vehicle you own play a significant role in determining your insurance premiums. A comprehensive assessment of your specific circumstances is crucial to finding a policy that meets your unique requirements.

- Coverage options and limits: Different insurers offer varying levels of coverage, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Carefully evaluate the coverage options and limits offered by each provider to ensure they align with your needs and financial capacity.

- Discounts and benefits: Many insurers offer discounts for safe driving, good grades, multiple policy bundling, and other factors. Explore the discounts available to you and factor them into your decision-making process.

- Customer service and claims handling: A reliable insurer should provide responsive and efficient customer service, especially when you need to file a claim. Research the insurer’s reputation for handling claims promptly and fairly.

- Financial stability and ratings: Ensure the insurer is financially stable and has a strong track record of paying claims. Check their ratings from independent agencies like AM Best and Standard & Poor’s to assess their financial health.

Liberty Mutual Car Insurance Assessment

Liberty Mutual is a reputable car insurance provider with a long history of serving customers. The company offers a range of coverage options, discounts, and benefits, making it a viable choice for many individuals.

- Strengths:

- Comprehensive coverage options: Liberty Mutual provides a variety of coverage options to cater to diverse needs, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. This ensures you can find a policy that adequately protects your assets and financial interests.

- Competitive pricing: Liberty Mutual is known for offering competitive rates, especially for individuals with good driving records and a low risk profile. They often offer discounts for safe driving, good grades, multiple policy bundling, and other factors.

- Strong financial stability: Liberty Mutual has a strong financial track record and is rated highly by independent agencies. This ensures they can meet their financial obligations and pay claims promptly.

- Excellent customer service: Liberty Mutual consistently receives positive reviews for its customer service. Their agents are knowledgeable and responsive, providing helpful guidance and assistance throughout the insurance process.

- Considerations:

- Higher premiums for high-risk drivers: Similar to other insurers, Liberty Mutual may charge higher premiums for drivers with poor driving records, multiple violations, or a history of accidents.

- Limited availability in some areas: While Liberty Mutual operates nationwide, its availability may be limited in certain regions. It’s essential to check if they offer services in your area before proceeding.

Recommendations

Based on the assessment of Liberty Mutual’s offerings, here are some recommendations for individuals considering their car insurance:

- Individuals with good driving records and a low risk profile: Liberty Mutual is an excellent option for individuals with a clean driving history and a low risk profile. Their competitive pricing and comprehensive coverage options make them a strong contender in this category.

- Individuals seeking comprehensive coverage: Liberty Mutual provides a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. If you prioritize comprehensive protection, they are worth considering.

- Individuals seeking discounts and benefits: Liberty Mutual offers various discounts for safe driving, good grades, multiple policy bundling, and other factors. If you are eligible for these discounts, they can significantly reduce your premiums.

- Individuals seeking excellent customer service: Liberty Mutual is known for its responsive and helpful customer service. If you value excellent customer support, they are a reliable choice.

Concluding Remarks

Liberty Mutual car insurance stands out as a comprehensive and reliable solution for drivers seeking peace of mind on the road. With a strong emphasis on customer service, a commitment to safety and security, and a wide array of coverage options, Liberty Mutual offers a compelling choice for individuals and families looking to protect themselves and their vehicles. Whether you’re a seasoned driver or a new motorist, understanding the ins and outs of Liberty Mutual’s offerings can empower you to make informed decisions and ensure you have the right coverage for your needs.

Liberty Mutual car insurance is known for its competitive rates and comprehensive coverage options. If you’re looking for an alternative, consider exploring aaa auto insurance , which offers a range of plans tailored to different needs. Ultimately, the best choice for you will depend on your individual circumstances and preferences, so it’s always a good idea to compare quotes from multiple providers, including Liberty Mutual, before making a decision.