Social insurance news delves into the ever-evolving world of social safety nets, exploring how governments and institutions are adapting to meet the changing needs of individuals and societies. From examining global trends and policy updates to analyzing the impact of technological advancements and the future of work, this field offers a comprehensive view of how social insurance systems are evolving to ensure a more secure and equitable future.

This exploration encompasses various aspects of social insurance, including coverage, access, financing, benefits, and its relationship with labor markets and social welfare. By understanding these intricate aspects, we gain valuable insights into how social insurance systems contribute to economic stability, social well-being, and the overall health of nations.

Social Insurance Trends

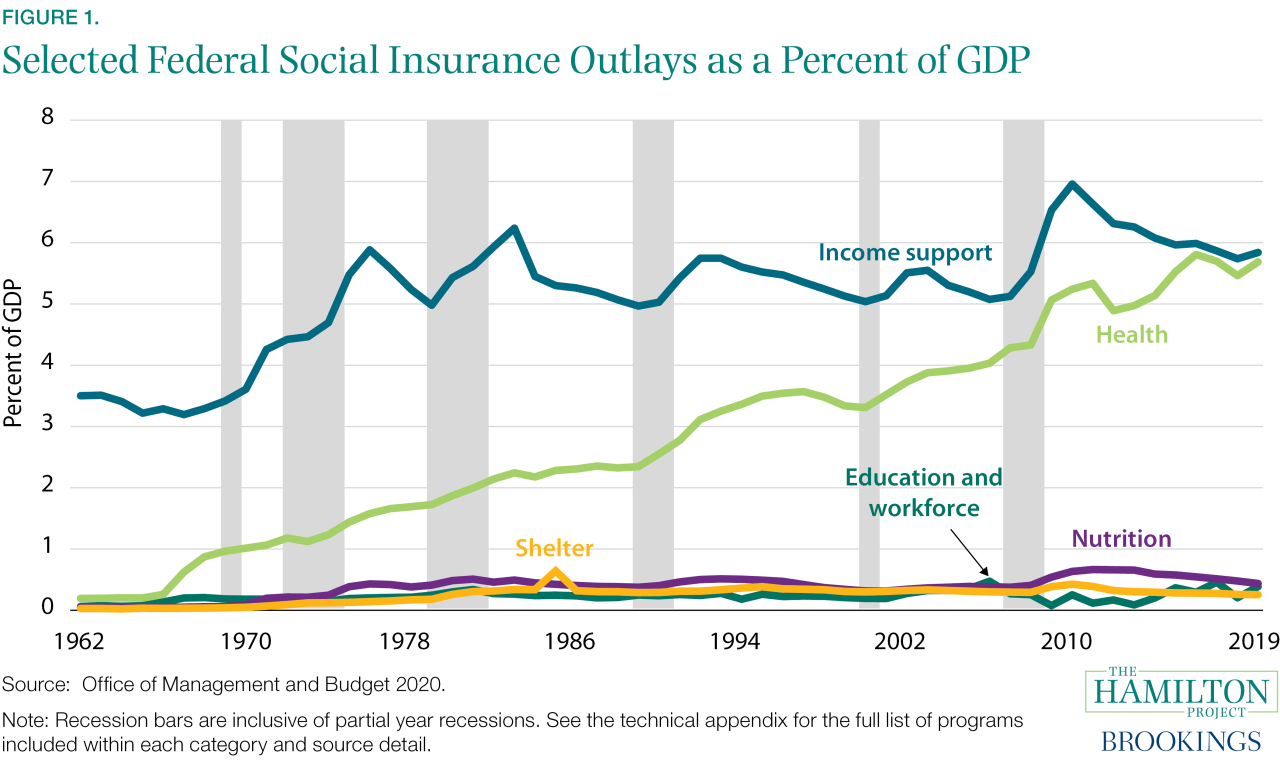

Social insurance systems are undergoing significant transformations globally, driven by evolving demographics, technological advancements, and the emergence of new social and economic challenges. These trends are shaping the future of social protection and have implications for governments, employers, and individuals alike.

Key Global Trends in Social Insurance Systems

Social insurance systems around the world are facing several key trends. These trends are influencing the design, implementation, and sustainability of social insurance programs.

- Aging Populations: As populations age, the number of retirees increases, putting pressure on social insurance systems to provide adequate benefits while maintaining financial sustainability. Many countries are addressing this challenge by raising retirement ages, adjusting benefit formulas, and exploring alternative funding mechanisms.

- Rising Healthcare Costs: Healthcare costs are rising rapidly in many countries, driven by technological advancements, aging populations, and chronic diseases. Social insurance systems are struggling to keep pace with these rising costs, leading to increased premiums, higher deductibles, and limitations on coverage.

- Growing Income Inequality: Income inequality is on the rise in many countries, leading to concerns about social justice and the adequacy of social insurance benefits for lower-income households. Governments are exploring ways to ensure that social insurance systems provide a sufficient safety net for all citizens.

- Globalization and Labor Market Changes: Globalization and technological advancements are transforming labor markets, leading to job displacement, wage stagnation, and the rise of the gig economy. Social insurance systems are adapting to these changes by providing unemployment benefits, retraining programs, and income support for self-employed workers.

Impact of Technological Advancements on Social Insurance Delivery

Technological advancements are having a profound impact on social insurance delivery, creating opportunities for greater efficiency, personalization, and accessibility.

- Digitalization: Governments are increasingly using digital platforms to deliver social insurance benefits, streamline administrative processes, and improve access to information for beneficiaries. Online portals, mobile apps, and automated systems are enhancing the user experience and reducing administrative burdens.

- Data Analytics: Data analytics tools are being used to identify trends, predict future needs, and personalize social insurance benefits. This data-driven approach enables governments to make more informed decisions about program design and resource allocation.

- Artificial Intelligence (AI): AI technologies are being used to automate tasks, improve fraud detection, and provide personalized support to beneficiaries. Chatbots, virtual assistants, and AI-powered decision-making systems are transforming the way social insurance services are delivered.

Evolving Role of Social Insurance in Addressing Emerging Social and Economic Challenges

Social insurance systems are playing an increasingly important role in addressing emerging social and economic challenges, such as climate change, pandemics, and the rise of automation.

- Climate Change: Social insurance systems are being adapted to provide support for individuals and communities affected by climate change-related disasters, such as floods, droughts, and wildfires. This includes providing disaster relief, insurance against climate risks, and programs to promote climate adaptation.

- Pandemics: The COVID-19 pandemic highlighted the importance of social insurance systems in providing income support, healthcare coverage, and other essential services during times of crisis. Governments are strengthening social safety nets and exploring new approaches to provide support during future pandemics.

- Automation: The rise of automation is leading to concerns about job displacement and the need for retraining programs. Social insurance systems are being adapted to provide support for workers transitioning to new careers, including unemployment benefits, retraining programs, and income support during periods of job search.

Social Insurance Coverage and Access: Social Insurance News

Social insurance programs are designed to provide a safety net for individuals and families facing economic hardship. However, the extent of coverage and access to these benefits varies significantly across regions and demographics. This section explores the challenges and strategies related to social insurance coverage and access.

Coverage Gaps and Disparities

Social insurance coverage often varies based on geographic location, income level, employment status, and other factors. For instance, some countries have universal coverage, while others have coverage limited to specific groups. Coverage gaps can be particularly pronounced in developing countries, where informal employment sectors are prevalent and access to social insurance schemes may be limited.

- Regional Differences: Coverage rates can differ significantly between urban and rural areas, as well as between developed and developing countries. In many developing countries, a substantial portion of the workforce is employed in the informal sector, with limited access to social insurance programs. For example, a 2020 study by the International Labour Organization found that only 25% of workers in the informal sector in developing countries had access to social insurance, compared to 75% in the formal sector.

- Income Inequality: Social insurance coverage often correlates with income levels. Low-income individuals and families may face greater challenges in accessing benefits, particularly in countries with means-tested programs. This can exacerbate existing inequalities and create a cycle of poverty.

- Demographic Factors: Coverage disparities can also be observed across different demographic groups, including gender, age, and ethnicity. For example, women may face challenges accessing social insurance due to gender discrimination in the workplace and limited participation in the formal economy.

Challenges in Accessing Benefits

Even when coverage exists, accessing social insurance benefits can pose significant challenges. These challenges include:

- Eligibility Requirements: Eligibility criteria for social insurance programs can be complex and difficult to navigate. These criteria may include factors such as age, employment history, income level, and residency status. For instance, some programs may require a minimum number of years of employment contributions to qualify for benefits.

- Administrative Barriers: Administrative procedures involved in applying for and receiving benefits can be cumbersome and time-consuming. This can include paperwork, bureaucratic delays, and a lack of information or support. In some cases, individuals may face language barriers or lack of access to technology, making it difficult to navigate the application process.

- Lack of Awareness: Many individuals may not be aware of their eligibility for social insurance benefits or the procedures for accessing them. This can be particularly true for vulnerable groups, such as immigrants, refugees, and people with disabilities.

Strategies for Expanding Coverage and Access

Addressing the challenges of social insurance coverage and access requires a multifaceted approach. Strategies for expanding coverage and ensuring equitable access include:

- Expanding Coverage to Informal Sector Workers: Governments can implement policies to extend social insurance coverage to workers in the informal sector. This can include promoting voluntary participation in social insurance schemes, establishing minimum contribution requirements, and providing subsidies to support low-income workers.

- Simplifying Eligibility Criteria: Eligibility requirements for social insurance programs can be simplified to make them more accessible. This can involve reducing the number of criteria, streamlining application procedures, and providing clear and concise information about eligibility requirements.

- Improving Administrative Efficiency: Governments can invest in improving the efficiency of social insurance programs by streamlining administrative processes, reducing bureaucratic delays, and increasing transparency. This can include digitizing application processes, providing online access to information, and establishing dedicated help desks for individuals seeking assistance.

- Raising Awareness and Education: Public awareness campaigns and educational programs can be implemented to inform individuals about their rights and entitlements under social insurance programs. This can include providing information on eligibility criteria, application procedures, and the benefits available.

Social Insurance and Labor Markets

Social insurance programs play a crucial role in shaping labor market dynamics, influencing employment rates, wages, and job mobility. They act as safety nets for workers during periods of economic hardship and transition, providing financial support and promoting stability in the workforce. Furthermore, social insurance can contribute to labor market flexibility and innovation by mitigating risks associated with job changes and entrepreneurship.

Impact on Employment Rates and Wages

Social insurance programs can have both positive and negative effects on employment rates and wages. For example, unemployment benefits can discourage job search efforts by providing a safety net, potentially leading to higher unemployment rates. Conversely, these benefits can also act as a buffer, allowing individuals to be more selective in their job search, leading to higher-paying jobs.

Social insurance programs can influence labor market dynamics by providing a safety net for workers during periods of economic hardship and transition.

The impact of social insurance on wages is complex and depends on various factors, such as the design of the program, the labor market conditions, and the specific industries involved. Some argue that social insurance programs can lead to higher wages by increasing workers’ bargaining power, while others suggest that they can lead to lower wages by increasing labor costs for employers.

Role in Supporting Workers During Economic Downturn and Transition

Social insurance programs provide crucial support to workers during periods of economic downturn and transition, helping to mitigate the negative impacts of job loss, wage reductions, and unemployment. These programs act as safety nets, ensuring basic income and healthcare for individuals and families facing financial hardship.

- Unemployment insurance provides temporary financial assistance to individuals who have lost their jobs through no fault of their own. This allows workers to maintain their living standards while searching for new employment, reducing the risk of poverty and financial instability.

- Disability insurance provides financial support to individuals who are unable to work due to disability, ensuring that they have access to essential resources and medical care.

- Early retirement programs can provide financial security to workers who choose to retire early, allowing them to transition smoothly out of the workforce.

Promoting Labor Market Flexibility and Innovation

Social insurance programs can also promote labor market flexibility and innovation by mitigating risks associated with job changes and entrepreneurship. For example, unemployment benefits can encourage workers to take risks and explore new career paths, knowing that they have a safety net in case of job loss.

Social insurance programs can promote labor market flexibility by mitigating risks associated with job changes and entrepreneurship.

Similarly, programs that support entrepreneurship, such as small business loans or training programs, can encourage individuals to start their own businesses, contributing to economic growth and job creation.

Social Insurance and International Cooperation

International cooperation is crucial in the realm of social insurance, fostering knowledge sharing, promoting best practices, and addressing global challenges. This collaboration enables countries to learn from each other’s experiences, strengthen their social protection systems, and ultimately improve the lives of their citizens.

Key International Organizations and Initiatives

International organizations and initiatives play a significant role in promoting social insurance cooperation.

- The International Labour Organization (ILO) is a specialized agency of the United Nations focused on promoting decent work and social justice. The ILO develops international labor standards, including those related to social security, and provides technical assistance to countries in strengthening their social insurance systems.

- The Organisation for Economic Co-operation and Development (OECD) is an intergovernmental organization that promotes economic and social progress among its member countries. The OECD conducts research and analysis on social insurance systems, provides policy recommendations, and facilitates peer learning among member countries.

- The World Bank is a global financial institution that provides financial and technical assistance to developing countries. The World Bank supports countries in developing and strengthening their social protection systems, including social insurance programs.

- The United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) is a regional commission of the United Nations that promotes economic and social development in Asia and the Pacific. UNESCAP supports countries in the region in developing and implementing social protection policies, including social insurance.

Challenges and Opportunities for International Cooperation, Social insurance news

International cooperation in social insurance faces several challenges, but also presents numerous opportunities.

- One challenge is the diversity of social insurance systems across countries. Different countries have different historical, economic, and social contexts, leading to variations in their social insurance programs and policies. This diversity can make it difficult to establish common standards or best practices.

- Another challenge is funding social insurance programs. Many countries face budgetary constraints, making it difficult to expand or improve their social insurance systems. This can lead to competition for resources and limited opportunities for international cooperation.

- Despite these challenges, there are also significant opportunities for international cooperation in social insurance. One opportunity is to share knowledge and best practices among countries. This can help countries learn from each other’s experiences and improve the effectiveness of their social insurance systems.

- Another opportunity is to develop joint initiatives to address common challenges. For example, countries can collaborate on research and development, capacity building, and policy advocacy.

Potential for Cross-Border Social Insurance Schemes

Cross-border social insurance schemes, such as portable social security, can provide social protection for individuals who move between countries.

- These schemes can help to reduce the risk of social security gaps for migrant workers and ensure that they have access to social insurance benefits regardless of their location.

- However, developing and implementing cross-border social insurance schemes can be complex, requiring coordination and cooperation between countries. This includes issues such as harmonizing social insurance legislation, coordinating benefit payments, and ensuring the portability of social security contributions.

Social Insurance and Digital Transformation

The rapid advancement of digital technologies is profoundly reshaping social insurance systems worldwide. From online claims processing to personalized benefits delivery, digital transformation is revolutionizing how governments and institutions manage social insurance programs.

Benefits of Digital Transformation in Social Insurance

Digitalization offers numerous benefits for social insurance delivery. It can enhance efficiency, improve accessibility, and promote inclusivity.

- Streamlined Processes: Digital platforms automate tasks like claim processing, eligibility verification, and benefit disbursement, reducing administrative burden and improving efficiency.

- Enhanced Accessibility: Online portals and mobile applications provide convenient access to social insurance services, allowing individuals to access information, submit claims, and receive updates remotely.

- Personalized Services: Digital technologies enable personalized benefits delivery, tailoring services to individual needs and preferences. This can include customized communication, targeted information, and tailored support programs.

- Data-Driven Insights: Digital platforms generate valuable data that can be analyzed to identify trends, optimize program design, and improve policy decisions.

Challenges of Digital Transformation in Social Insurance

While digitalization offers significant opportunities, it also presents challenges for social insurance systems.

- Digital Divide: Limited access to technology and digital literacy can exclude certain populations from benefiting from digital services. This digital divide can exacerbate existing inequalities.

- Data Privacy and Security: The collection and storage of sensitive personal data in digital platforms raise concerns about data privacy and security. Robust measures are essential to protect data from unauthorized access and breaches.

- System Integration and Interoperability: Integrating digital platforms with existing social insurance systems can be complex and require significant investment. Ensuring interoperability between different systems is crucial for seamless data flow and efficient service delivery.

- Trust and Transparency: Building public trust in digital platforms is essential for their successful adoption. Transparency about data usage, security measures, and system functionality is critical.

Impact of Digital Transformation on a Hypothetical Social Insurance Program

Imagine a hypothetical scenario where a national unemployment insurance program undergoes a digital transformation. The program adopts a user-friendly online portal for claim filing, eligibility verification, and benefit disbursement.

- Benefits: The digital portal streamlines claim processing, reducing waiting times for benefits. It also provides real-time updates on claim status, empowering individuals to track their progress.

- Challenges: The program needs to address the digital divide by offering alternative access channels for individuals without internet access. It also needs to implement robust security measures to protect sensitive data and ensure user privacy.

Social Insurance and the Future of Work

The rapid pace of technological advancement and evolving labor market dynamics are fundamentally reshaping the world of work. Automation, gig work, and other emerging trends are posing significant challenges and opportunities for social insurance systems, which are designed to protect workers from economic insecurity. Ensuring that social insurance remains relevant and effective in this rapidly changing landscape requires a proactive approach to policy design and implementation.

The Implications of Automation and Gig Work

Automation is rapidly transforming industries, displacing some jobs while creating new ones. Gig work, characterized by short-term contracts and freelance arrangements, is also gaining traction. These trends have profound implications for social insurance systems, which are often based on traditional employment models.

- Erosion of Traditional Employment: Automation and gig work are eroding traditional employment, making it increasingly difficult for workers to access traditional social insurance benefits, such as unemployment insurance and pensions. This is because these benefits are typically tied to formal employment relationships. For example, in the United States, gig workers are often classified as independent contractors, which makes them ineligible for unemployment insurance and other benefits.

- Income Volatility: Gig workers often experience income volatility, making it difficult to plan for the future and save for retirement. Traditional social insurance systems are not well-equipped to address this issue, as they are often based on a steady stream of income from a single employer.

- Fragmentation of Labor Markets: The rise of gig work is fragmenting labor markets, making it more difficult for workers to access social insurance benefits and to build up a strong work history.

Policy Responses to Ensure Social Insurance Relevance

In order to ensure that social insurance remains relevant and effective in the future of work, policymakers need to adopt a number of key policy responses. These responses should focus on:

- Expanding Coverage: Social insurance systems should be expanded to cover workers in non-traditional employment arrangements, such as gig workers and independent contractors. This could be achieved through a variety of mechanisms, such as mandatory contributions or a portable social insurance system that follows workers across different employers.

- Adapting Benefits: Social insurance benefits should be adapted to reflect the changing needs of workers. This could include offering more flexible benefits, such as unemployment insurance for gig workers, and introducing new benefits, such as income support for workers who are displaced by automation.

- Investing in Education and Training: Governments need to invest in education and training programs to help workers adapt to the changing demands of the labor market. This will help to ensure that workers have the skills they need to succeed in the future of work and to contribute to the economy.

- Promoting Social Dialogue: Social dialogue between government, employers, and workers is essential for developing effective social insurance policies for the future of work. This dialogue should focus on understanding the challenges and opportunities presented by automation and gig work, and on developing solutions that benefit all stakeholders.

Designing an Adaptable Social Insurance Framework

A social insurance framework that is adaptable to the evolving nature of work and the changing needs of workers should be designed with the following principles in mind:

- Universality: Social insurance should be universal, covering all workers, regardless of their employment status. This would ensure that all workers have access to a basic level of social protection.

- Portability: Social insurance benefits should be portable, meaning that workers can carry their benefits with them as they move between different jobs or employers. This would help to ensure that workers have access to social protection throughout their working lives.

- Flexibility: Social insurance benefits should be flexible, offering workers a range of options to meet their individual needs. This could include different types of benefits, such as unemployment insurance, income support, and retirement savings, as well as flexible payment schedules.

- Sustainability: Social insurance systems need to be sustainable, meaning that they can be financed over the long term. This will require careful planning and investment, as well as a commitment to ensuring that the system is fair and equitable.

Conclusive Thoughts

Social insurance news provides a platform for critical discussion, highlighting both the challenges and opportunities that lie ahead. As we navigate an increasingly complex world, understanding the dynamics of social insurance systems becomes essential for shaping policies that promote inclusivity, sustainability, and a brighter future for all.

Staying up-to-date on social insurance news is crucial for individuals and businesses alike. It’s important to understand how these changes might impact your financial security and career prospects. For those seeking a career in this field, colorado technical university programs offer specialized training and education that can equip you with the necessary knowledge and skills.

With a solid understanding of social insurance, you can navigate the complexities of this evolving landscape and make informed decisions about your future.