USAA car insurance stands out as a top choice for military families and veterans, offering a unique blend of competitive rates, comprehensive coverage, and dedicated customer service tailored to their specific needs. USAA’s deep understanding of the military lifestyle translates into policies designed to protect those who serve and their families, whether they’re stationed domestically or deployed overseas.

This guide explores the ins and outs of USAA car insurance, covering everything from eligibility and membership to coverage options, discounts, and the claims process. We’ll also delve into customer service, online tools, and pricing comparisons to help you make an informed decision about whether USAA is the right fit for your insurance needs.

Pricing and Cost Comparison

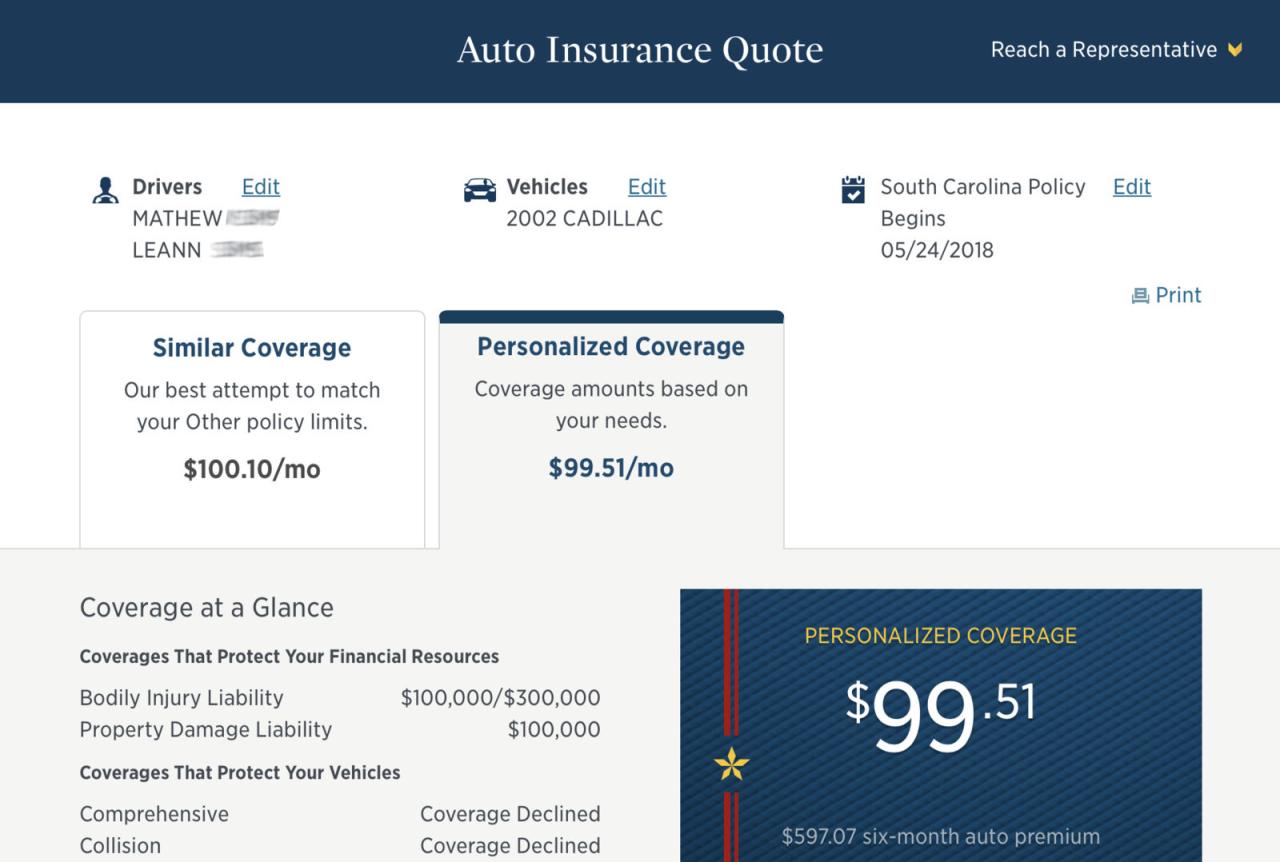

USAA car insurance is known for its competitive pricing, especially for military members and their families. However, the cost of car insurance can vary significantly based on several factors, making it essential to compare prices with other major providers to find the best deal.

Factors Influencing USAA Car Insurance Pricing

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance premium. A clean driving record usually results in lower premiums.

- Vehicle Type: The make, model, year, and safety features of your car influence its insurance cost. Luxury or high-performance vehicles generally have higher premiums than standard models.

- Location: The state and zip code where you live can affect your insurance rates due to variations in crime rates, traffic congestion, and weather conditions.

- Coverage Options: The type and amount of coverage you choose, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, influence your premium. Higher coverage limits generally result in higher premiums.

- Age and Gender: Younger and inexperienced drivers typically pay higher premiums than older drivers due to higher risk factors. In some states, gender can also play a role in pricing.

- Credit Score: Some insurance companies, including USAA, use credit scores as a factor in determining insurance rates. A good credit score can lead to lower premiums.

- Military Status: As a military-focused insurer, USAA often offers discounts and competitive rates to active-duty military personnel, veterans, and their families.

Comparison with Other Providers

USAA often offers competitive rates, especially for military members, but it’s essential to compare quotes from other major providers like Geico, Progressive, State Farm, and Allstate. Factors such as your individual risk profile and location can influence which insurer offers the best price.

Strategies for Obtaining Competitive Pricing, Usaa car insurance

- Shop Around: Get quotes from multiple insurers to compare rates and coverage options. Online comparison tools can simplify this process.

- Bundle Insurance: Consider bundling your car insurance with other policies, such as home or renters insurance, as insurers often offer discounts for multiple policies.

- Explore Discounts: Ask about available discounts, such as safe driver discounts, good student discounts, and military discounts.

- Review Coverage Needs: Ensure you have the right amount of coverage and that you’re not paying for unnecessary coverage.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to keep your premiums low.

- Improve Your Credit Score: A higher credit score can lead to lower insurance premiums with some insurers.

Comparison with Competitors

USAA, a renowned insurance provider, stands out with its exclusive focus on serving military members, veterans, and their families. While it offers competitive rates and excellent customer service, understanding how it compares to other prominent insurers is crucial for making an informed decision. This section will delve into the key differences between USAA and its competitors, highlighting their coverage, pricing, and customer service.

Coverage Comparison

Comparing USAA’s coverage offerings with those of other major insurers reveals both similarities and differences. USAA generally provides comprehensive coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, some specific features and limitations may vary. For instance, USAA offers military-specific benefits like coverage for damage to military vehicles during deployment. In contrast, some other insurers might offer specialized discounts for certain professions or demographics.

Pricing Comparison

Pricing is a significant factor in choosing an insurance provider. USAA’s pricing is generally competitive, particularly for its target audience. However, rates can vary depending on factors such as location, driving history, and vehicle type. Comparing USAA’s quotes with those of other insurers like Geico, State Farm, and Progressive is essential to identify the most cost-effective option.

Customer Service Comparison

USAA consistently receives high praise for its exceptional customer service. Its focus on serving military families translates to a commitment to providing personalized support and prompt assistance. However, other insurers like Nationwide and Liberty Mutual also boast strong customer service reputations, offering various channels for communication and support.

Comparison Table

The following table summarizes the key differences between USAA and its competitors across coverage, pricing, and customer service:

| Feature | USAA | Geico | State Farm | Progressive |

|---|---|---|---|---|

| Coverage | Comprehensive, military-specific benefits | Comprehensive, various discounts | Comprehensive, various discounts | Comprehensive, various discounts |

| Pricing | Competitive for military members | Known for competitive rates | Generally competitive rates | Offers competitive rates and discounts |

| Customer Service | Highly rated, personalized support | Strong reputation for customer service | Known for its friendly and helpful agents | Offers various communication channels and support |

Wrap-Up: Usaa Car Insurance

Choosing the right car insurance is crucial for protecting yourself and your loved ones on the road. USAA car insurance has earned its reputation for reliability and customer satisfaction, particularly among military families. By understanding the benefits and features of USAA’s policies, you can determine if it aligns with your individual needs and budget. Whether you’re a current service member, veteran, or family member, USAA’s commitment to serving those who serve extends to providing peace of mind on the road.

USAA car insurance is known for its competitive rates and excellent customer service, especially for military members and their families. While they offer a wide range of coverage options, some may find it beneficial to explore other avenues for higher education, like the liberty university doctoral programs , which could potentially lead to a more lucrative career path.

Ultimately, the decision of whether to pursue a doctoral degree or focus on insurance needs depends on individual goals and priorities.