Cheap insurance – the words conjure up images of bargain deals and significant savings. But is it truly as straightforward as it seems? While the allure of low premiums is undeniable, a deeper dive into the world of insurance reveals that “cheap” is a relative term, often carrying hidden trade-offs. This exploration delves into the intricacies of finding affordable insurance, examining the factors that influence cost, the types of policies available, and the importance of assessing value beyond price alone.

The journey to secure affordable insurance is not a simple one. It involves understanding the various components that contribute to insurance premiums, such as your age, location, driving history, and the level of coverage you choose. We’ll navigate the complexities of these factors, helping you understand how they can significantly impact your insurance costs. We’ll also explore the different types of insurance often perceived as “cheap,” analyzing their pros and cons and highlighting potential risks associated with limited coverage.

Understanding “Cheap” Insurance

When searching for insurance, you’ll often encounter the term “cheap.” But what does “cheap” really mean in the context of insurance? It’s more than just a low price tag. It involves a careful consideration of price, coverage, and the overall value you receive.

The Relationship Between Price and Coverage, Cheap insurance

It’s important to understand that there’s often a trade-off between price and coverage. Lower-priced insurance policies might have limited coverage, while more comprehensive policies come with a higher premium.

For example, a cheap car insurance policy might only offer basic liability coverage, leaving you responsible for significant out-of-pocket expenses in the event of an accident. On the other hand, a more expensive policy might provide comprehensive coverage, including collision and theft protection.

Examples of Misleading “Cheap” Insurance

In some cases, the term “cheap” can be misleading. Here are a few examples:

- Health Insurance with High Deductibles: A health insurance plan with a low monthly premium might have a high deductible, meaning you’ll have to pay a significant amount out of pocket before your insurance kicks in. This can make the policy seem cheap initially, but it could be costly in the long run if you have a major health event.

- Life Insurance with Limited Coverage: A cheap life insurance policy might only offer a small death benefit, which may not be sufficient to cover your family’s needs after your passing. A more comprehensive policy with a higher death benefit, although more expensive, might provide greater financial security for your loved ones.

- Home Insurance with Low Coverage Limits: A low-priced home insurance policy might have low coverage limits for specific events, such as fire or flood. This could leave you with significant financial losses if your home is damaged or destroyed. A more comprehensive policy with higher coverage limits, while pricier, could provide better protection for your investment.

Factors Influencing Insurance Costs

Insurance premiums are not a one-size-fits-all proposition. Several factors come into play when determining how much you’ll pay for coverage. Understanding these factors can help you make informed decisions and potentially save money on your insurance.

Age

Your age is a significant factor in determining your insurance premium. Younger drivers, especially those under 25, tend to have higher premiums due to their inexperience and higher risk of accidents. As you age and gain more experience, your premiums typically decrease.

Location

Where you live can significantly impact your insurance costs. Areas with higher population density, traffic congestion, and crime rates often have higher insurance premiums. This is because insurance companies assess the risk of accidents and claims in different locations.

Driving History

Your driving history plays a crucial role in determining your insurance premium. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having accidents, speeding tickets, or DUI convictions can lead to significantly higher premiums.

Coverage Level

The amount of coverage you choose will directly affect your insurance costs. Higher coverage levels, such as comprehensive and collision coverage, offer greater protection but also come with higher premiums. If you have an older vehicle with a lower value, you might opt for lower coverage levels to save on premiums.

Vehicle Type

The type of vehicle you drive can also influence your insurance costs. Sports cars, luxury vehicles, and high-performance cars tend to have higher premiums due to their higher repair costs and increased risk of accidents. On the other hand, smaller, less expensive vehicles typically have lower premiums.

Table of Insurance Cost Variations

| Factor | Low Cost | High Cost |

|---|---|---|

| Age | Over 65 | Under 25 |

| Location | Rural area with low traffic | Urban area with high traffic |

| Driving History | Clean driving record | Multiple accidents and violations |

| Coverage Level | Liability only | Comprehensive and collision |

| Vehicle Type | Small, fuel-efficient car | Sports car or luxury vehicle |

Types of Cheap Insurance

When searching for affordable insurance, you’ll often encounter options that seem “cheap” at first glance. However, it’s crucial to understand that these policies might come with trade-offs, potentially leaving you with insufficient coverage in case of an unexpected event.

Let’s delve into some common types of insurance often perceived as “cheap” and examine their pros and cons.

Basic Liability Coverage

Basic liability coverage, also known as “minimum coverage,” is the least expensive option for auto insurance. It typically covers damages to other people’s property or injuries caused by you in an accident, but it doesn’t cover your own vehicle.

While this option is affordable, it leaves you financially responsible for repairs or replacement of your own vehicle. It’s advisable to consider if this minimal protection is sufficient for your needs, especially if you have an older car or significant financial assets.

High Deductibles

A deductible is the amount you pay out-of-pocket before your insurance policy starts covering costs. Choosing a high deductible can significantly lower your premiums, but it also means you’ll need to shoulder a larger portion of the cost in case of a claim.

High deductibles can be advantageous if you’re comfortable with financial risk and have a good emergency fund. However, if you’re prone to accidents or face financial constraints, a higher deductible might not be the best choice.

Limited Coverage Options

Insurance policies can be customized with various coverage options, such as collision, comprehensive, and uninsured motorist coverage. Opting for limited coverage options, like only having liability insurance, can reduce your premium but leave you vulnerable to substantial out-of-pocket expenses in case of an accident or other covered events.

Consider your individual needs and the potential risks you face. If you’re driving an older vehicle or have limited financial resources, comprehensive coverage might be a worthwhile investment, despite the higher premium.

Examples of “Cheap” Insurance Products

Several insurance products are marketed as “cheap” options. These might include:

- Short-term health insurance: Offers temporary coverage at a lower cost but typically has limited benefits and higher deductibles.

- Limited liability insurance: Provides minimal protection for specific situations, such as rental property or professional liability.

- “Bare bones” car insurance: Offers only the state-mandated minimum liability coverage, leaving you responsible for other costs.

Remember that “cheap” insurance doesn’t always mean “best” insurance. Carefully evaluate your needs and consider the potential risks before settling for a policy solely based on its low price.

Finding Affordable Insurance: Cheap Insurance

Finding the right insurance at the right price can feel like a daunting task. But, with a little research and effort, you can find affordable insurance that meets your needs.

Comparison Websites

Comparison websites provide a convenient way to compare quotes from multiple insurance providers. They typically allow you to enter your information once and receive quotes from several insurers. This can save you time and effort, and you can easily see which insurers offer the best rates.

- Benefits: They offer a quick and easy way to compare quotes from multiple insurers, helping you find the most competitive rates.

- Drawbacks: Not all insurers are listed on every comparison website, and they may not always provide the most accurate or up-to-date information. Additionally, they might not include all available discounts or special offers.

Insurance Brokers

Insurance brokers act as intermediaries between you and insurance companies. They can help you find the right insurance policy and negotiate a good price. They have access to a wide range of insurance products and can provide expert advice.

- Benefits: They have in-depth knowledge of the insurance market and can provide personalized advice, helping you find the best policy for your needs. They can also negotiate with insurers on your behalf, potentially securing better rates.

- Drawbacks: You might have to pay a fee for their services, and they may not be able to access all insurers or products.

Direct Insurers

Direct insurers sell insurance policies directly to customers, without using brokers or agents. They often offer lower premiums than traditional insurers because they have lower operating costs.

- Benefits: They can often offer lower premiums than traditional insurers, as they eliminate the need for intermediaries. They also offer convenient online and mobile services.

- Drawbacks: You may have limited options in terms of policy customization, and you might not have access to the same level of personalized advice as you would with a broker.

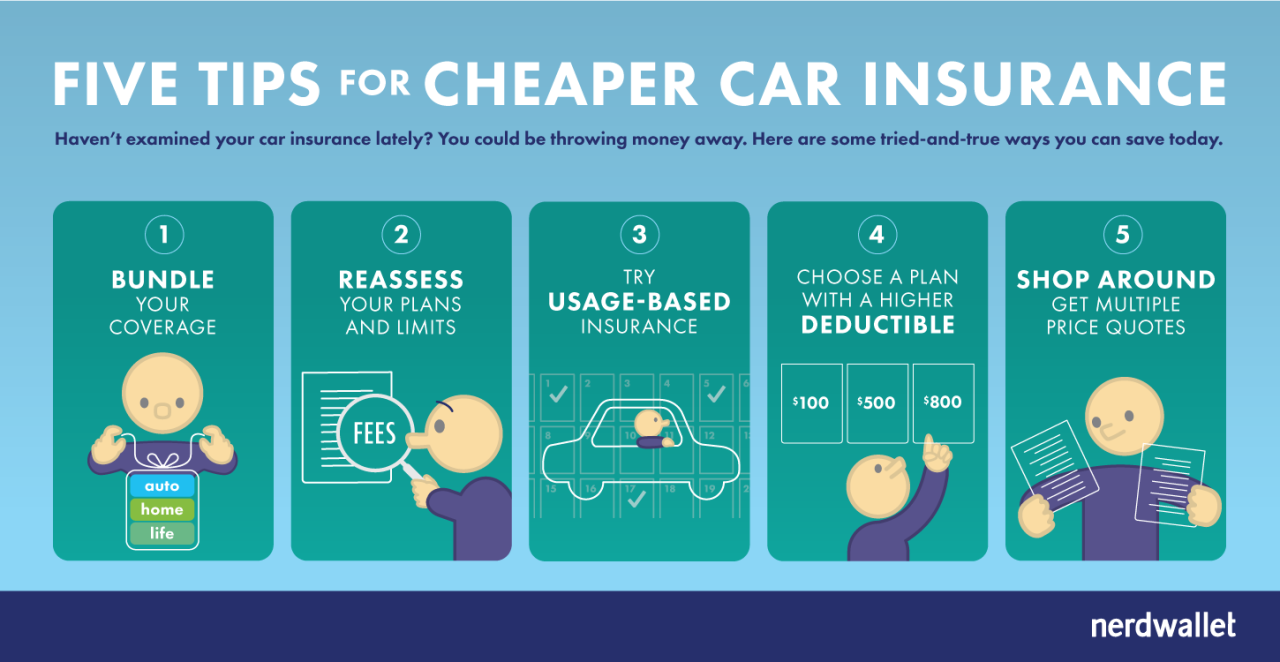

Tips for Negotiating Insurance Premiums

- Shop around: Compare quotes from multiple insurers before making a decision. This can help you find the best rates and ensure you’re getting the best value for your money.

- Bundle your policies: Consider bundling your home, auto, and other insurance policies with the same insurer. This can often result in significant discounts.

- Ask about discounts: Many insurers offer discounts for things like good driving records, safety features in your car, and home security systems. Ask about all available discounts and make sure you’re taking advantage of them.

- Consider increasing your deductible: A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can also result in lower premiums. This strategy might be beneficial if you have a good driving record and are confident in your ability to manage a higher deductible.

- Negotiate with your insurer: Don’t be afraid to negotiate with your insurer. They may be willing to lower your premium if you demonstrate that you’re a good customer and are willing to shop around.

Assessing Insurance Value

While finding cheap insurance is a priority for many, it’s crucial to understand that the cheapest option isn’t always the best. A comprehensive assessment of insurance value goes beyond just the price tag, considering various factors that impact your overall protection and financial security.

Coverage Limits

Understanding the coverage limits of your insurance policy is essential. These limits define the maximum amount your insurer will pay for covered losses. Inadequate coverage limits can leave you financially responsible for exceeding expenses, leading to significant out-of-pocket costs.

For instance, a low liability limit on your car insurance could leave you personally liable for substantial damages if you’re involved in an accident that exceeds the limit. Similarly, insufficient coverage for medical expenses could result in hefty medical bills after an accident or illness.

Claim Handling Processes

A crucial aspect of insurance value is the insurer’s claim handling process. A smooth and efficient claims process can significantly impact your experience during a challenging time.

Factors to consider include:

- Speed of processing: How quickly does the insurer respond to claims and process payments?

- Transparency: Does the insurer provide clear communication throughout the claims process?

- Fairness: Does the insurer handle claims fairly and objectively?

A reputable insurer with a streamlined claims process can make a significant difference in your overall satisfaction and financial security.

Customer Service Quality

Customer service plays a vital role in the insurance experience, especially during stressful situations. A responsive and helpful customer service team can provide support and guidance when you need it most.

Look for insurers with:

- Availability: Accessible customer service channels like phone, email, and online chat.

- Responsiveness: Prompt responses to inquiries and concerns.

- Professionalism: Courteous and knowledgeable representatives.

Investing in a policy with excellent customer service can provide peace of mind and ensure you receive the support you need when facing unexpected events.

Avoiding Insurance Scams

The allure of cheap insurance can sometimes lead unsuspecting individuals into the clutches of scammers. It’s essential to be vigilant and informed to protect yourself from fraudulent schemes that exploit the desire for affordable coverage.

Recognizing Common Scams

Scammers often employ deceptive tactics to lure unsuspecting individuals into their traps. Being aware of these common scams can help you avoid becoming a victim.

- Phishing Emails and Texts: Scammers may send emails or text messages that appear to be from legitimate insurance companies, asking for personal information or directing you to fake websites. These messages often contain links to malicious websites designed to steal your identity or financial data.

- Fake Insurance Companies: Scammers may create fake insurance companies or websites that mimic legitimate ones. They may offer unrealistically low premiums to entice you, but they have no intention of providing actual coverage.

- Bait-and-Switch Tactics: Some scammers may advertise extremely low insurance rates but then switch to a much higher price once you’re ready to purchase the policy. They may also try to sell you additional, unnecessary coverage.

- Misrepresentation of Coverage: Scammers may misrepresent the scope of coverage provided by their policies, leading you to believe you have more protection than you actually do. This can leave you financially vulnerable in the event of a claim.

Protecting Yourself from Scams

Here are some tips to protect yourself from insurance scams:

- Verify the Company’s Legitimacy: Always check the legitimacy of an insurance company by contacting your state’s insurance department or the National Association of Insurance Commissioners (NAIC). You can also look for the company’s license number on their website or marketing materials.

- Be Wary of Unrealistic Offers: If an insurance quote seems too good to be true, it probably is. Be cautious of companies that offer extremely low premiums without providing clear explanations for the pricing.

- Read the Fine Print: Thoroughly review the policy documents before signing anything. Pay attention to the coverage details, exclusions, and limitations. Don’t hesitate to ask questions if you don’t understand anything.

- Avoid High-Pressure Sales Tactics: Legitimate insurance companies don’t pressure you into making a quick decision. If a salesperson is aggressive or tries to rush you into signing, it could be a red flag.

- Report Suspicious Activity: If you suspect you’ve been targeted by an insurance scam, report it to your state’s insurance department or the NAIC. You can also file a complaint with the Federal Trade Commission (FTC).

Consequences of Insurance Fraud

Falling victim to insurance fraud can have severe consequences, including:

- Financial Loss: You may lose money if you pay premiums for a fake policy or if your claim is denied because of misrepresented coverage.

- Denial of Coverage: If you’re found to have participated in insurance fraud, you may be denied coverage by legitimate insurance companies in the future.

- Legal Penalties: Insurance fraud is a serious crime that can result in fines, imprisonment, or both.

Insurance for Specific Needs

Insurance isn’t a one-size-fits-all solution. Different life stages, circumstances, and needs require tailored insurance coverage. This section explores insurance options for specific demographics and situations.

Insurance Needs of Young Drivers

Young drivers are statistically more likely to be involved in accidents due to factors like lack of experience, risk-taking behavior, and higher speed limits. This translates to higher insurance premiums for young drivers.

- Higher Premiums: Young drivers typically face higher premiums due to their increased risk profile.

- Defensive Driving Courses: Completing defensive driving courses can demonstrate a commitment to safe driving, potentially leading to discounts.

- Good Student Discounts: Maintaining good grades can earn discounts as insurers often see it as an indicator of responsibility.

- Limited Coverage: Starting with basic liability coverage and gradually increasing coverage as experience and financial stability grow is a common approach.

Insurance Needs of Seniors

Seniors may face different insurance needs compared to younger individuals. While their driving experience is generally higher, factors like age-related health conditions and reduced mobility can impact their insurance premiums.

- Specialized Insurance Products: Some insurers offer specialized insurance products tailored for seniors, including discounts for safe driving records, senior-specific coverage options, and medical transportation benefits.

- Driving Assessments: Senior drivers can benefit from driving assessments to evaluate their abilities and identify any potential risks. These assessments can help insurers determine appropriate premiums and coverage.

- Reviewing Coverage: Regularly reviewing insurance coverage to ensure it aligns with current needs and budget is essential for seniors, as their needs and financial situations may change over time.

Insurance Needs of Families

Families have unique insurance needs, encompassing various aspects like health, property, and personal liability.

- Family Health Insurance: Comprehensive health insurance plans are essential for families, covering medical expenses, hospital stays, and preventive care.

- Life Insurance: Life insurance provides financial security for families in case of the death of a breadwinner, ensuring financial stability for surviving family members.

- Home and Auto Insurance: Families need adequate coverage for their home and vehicles, protecting them from financial losses due to accidents, theft, or natural disasters.

Insurance for Specific Situations

Beyond demographic needs, specific situations require tailored insurance solutions.

- Renters Insurance: Renters insurance provides coverage for personal belongings and liability in case of accidents or damage to the rented property.

- Travel Insurance: Travel insurance protects against unexpected events during trips, such as medical emergencies, flight delays, or lost luggage.

- Business Insurance: Business insurance offers various types of coverage, including liability, property, and workers’ compensation, depending on the nature and size of the business.

The Future of Affordable Insurance

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements and evolving consumer expectations. These changes are poised to significantly impact the affordability and accessibility of insurance in the years to come.

The Role of Emerging Technologies

Emerging technologies are reshaping the insurance landscape, creating opportunities for greater efficiency, personalization, and affordability.

- Telematics: Telematics devices, often integrated into smartphones or dedicated hardware, track driving behavior, providing insurers with valuable data to assess risk and offer personalized pricing. This data-driven approach can reward safe drivers with lower premiums, making insurance more affordable for responsible individuals.

- Artificial Intelligence (AI): AI algorithms are being used to automate tasks, streamline processes, and personalize insurance offerings. AI-powered chatbots can provide instant customer support, while predictive analytics can help insurers identify potential risks and offer tailored policies.

- Blockchain Technology: Blockchain technology promises to enhance transparency, security, and efficiency in insurance transactions. This can potentially reduce administrative costs and make insurance more accessible to underserved populations.

Personalized Pricing and Risk Assessment

The rise of data-driven insights and advanced analytics is enabling insurers to develop more personalized pricing models. This means that individuals will be charged premiums based on their specific risk profiles, rather than relying on broad demographic categories.

- Usage-Based Insurance (UBI): UBI programs leverage telematics data to tailor premiums based on actual driving behavior. This can incentivize safe driving practices and reward responsible individuals with lower premiums.

- Risk-Based Pricing: Insurers are increasingly using AI and machine learning to assess risk factors beyond traditional demographics. This can lead to more accurate pricing, making insurance more affordable for individuals with lower risk profiles.

Potential Future Scenarios

The convergence of emerging technologies and evolving consumer preferences is likely to lead to several potential future scenarios for affordable insurance.

- Increased Affordability: Personalized pricing models and the use of telematics could make insurance more affordable for a wider range of individuals. This could be particularly beneficial for younger drivers and those with good driving records.

- Greater Accessibility: Technology-driven solutions can help to expand access to insurance for underserved populations, such as those in rural areas or with limited credit history. This can be achieved through online platforms, mobile applications, and alternative payment options.

- Enhanced Customer Experience: The use of AI and other technologies can improve the customer experience by providing personalized recommendations, instant support, and seamless transactions.

Impact on Consumers

The future of affordable insurance will have significant implications for consumers.

- Increased Transparency: Consumers will have greater access to information about their insurance policies and pricing models. This can empower them to make more informed decisions and choose policies that best meet their needs.

- Greater Control: Individuals will have more control over their insurance costs by adopting safe driving practices and utilizing technology to track their behavior. This can encourage a sense of personal responsibility and reward those who take proactive steps to manage risk.

- New Opportunities: The rise of innovative insurance products and services can create new opportunities for consumers to access tailored coverage that meets their specific needs. This could include insurance for specific activities, such as ride-sharing or e-commerce.

Responsible Insurance Choices

Insurance is a crucial aspect of financial planning, protecting you from unforeseen events and financial hardship. While seeking cheap insurance is understandable, it’s equally important to make responsible choices that ensure you have adequate coverage to meet your needs.

Understanding the Risks of Under-Insurance

Under-insuring can have severe consequences, leaving you financially vulnerable in case of an unexpected event. For example, if you have an insufficient amount of car insurance, you might be responsible for covering repair costs exceeding your policy limits. Similarly, inadequate health insurance can lead to overwhelming medical bills, putting a strain on your finances.

Balancing Affordability with Adequate Protection

Finding the right balance between affordability and adequate protection is essential. Consider these strategies:

- Assess Your Needs: Determine your specific insurance needs based on your assets, liabilities, and potential risks. For instance, if you own a valuable home, comprehensive homeowners insurance is crucial.

- Compare Quotes: Obtain quotes from multiple insurers to compare prices and coverage options.

- Consider Deductibles: Higher deductibles often lead to lower premiums. However, ensure you can afford the deductible in case of a claim.

- Bundle Policies: Bundling multiple insurance policies, such as home and auto insurance, with the same insurer can often result in discounts.

- Explore Discounts: Many insurers offer discounts for good driving records, safety features, or home security systems.

Making Informed Decisions

Making informed decisions about insurance involves:

- Understanding Policy Language: Carefully review policy terms and conditions, including exclusions, limitations, and deductibles.

- Seeking Professional Advice: Consult with an insurance broker or agent who can provide personalized guidance and help you choose the right coverage.

- Staying Updated: Insurance needs can change over time. Review your policies regularly to ensure they still meet your current requirements.

Ultimate Conclusion

Navigating the world of cheap insurance requires a blend of informed decision-making and a clear understanding of your individual needs. Remember, the most affordable insurance isn’t necessarily the best value. By weighing factors like coverage limits, claim handling processes, and customer service quality, you can make responsible choices that provide adequate protection without breaking the bank. With careful research, comparison, and a touch of negotiation, you can secure insurance that fits your budget and offers peace of mind.

Finding cheap insurance can be a real challenge, especially for young adults. However, if you’re a student looking for some hands-on experience, consider checking out a university co-op training program in San Diego. These programs often offer valuable skills and connections that can help you land a job in the insurance industry, potentially leading to discounts on your future policies.