Geico car insurance has become a household name, synonymous with affordable coverage and innovative solutions. From its humble beginnings as a government insurance program, Geico has evolved into a major player in the insurance industry, known for its distinctive marketing campaigns and commitment to customer satisfaction.

This comprehensive guide delves into the world of Geico car insurance, exploring its history, products, pricing, customer experience, brand, technology, financial performance, social responsibility, and future prospects. We’ll examine the factors that make Geico a popular choice for drivers and uncover the key elements that contribute to its success.

Geico Overview

Geico, short for Government Employees Insurance Company, is a renowned American insurance company specializing in auto insurance. Founded in 1936, Geico has steadily evolved from a small, government-focused insurer to a leading force in the car insurance market. Its journey is marked by strategic innovation, marketing prowess, and a commitment to customer satisfaction.

Early Years and Growth

Geico’s origins can be traced back to 1936 when it was established as a non-profit insurance company catering to federal employees. In its initial years, Geico focused on providing affordable car insurance to government workers, building a strong reputation for its competitive rates and reliable service. The company’s success was further fueled by its unique direct-to-consumer model, eliminating the need for agents and keeping operational costs low. This strategy enabled Geico to offer lower premiums compared to traditional insurance companies.

Key Milestones and Achievements

- 1990s: Geico’s growth accelerated in the 1990s, driven by its adoption of advanced technology and innovative marketing campaigns. The company invested heavily in telecommunications and online platforms, making it easier for customers to obtain quotes, purchase policies, and manage their accounts. This digital transformation significantly expanded Geico’s reach and customer base.

- 2000s: Geico continued its aggressive expansion in the 2000s, leveraging its marketing expertise to create memorable and engaging advertising campaigns. These campaigns featured iconic characters like the gecko, the cavemen, and the pig, which resonated with audiences and helped solidify Geico’s brand identity. The company’s innovative marketing strategies, coupled with its competitive pricing, resulted in substantial market share gains.

- 2010s: Geico further strengthened its position in the insurance market by expanding its product offerings beyond auto insurance. The company introduced insurance options for motorcycles, homeowners, renters, and boats, diversifying its revenue streams and catering to a wider customer base.

Current Market Position and Competitive Landscape

Geico currently ranks among the top five largest auto insurers in the United States. Its strong brand recognition, competitive pricing, and customer-centric approach have contributed to its sustained success. The company faces intense competition from other major insurance providers like State Farm, Progressive, and Allstate. The auto insurance market is characterized by fierce price wars, technological advancements, and evolving customer preferences. To maintain its competitive edge, Geico continues to invest in technology, optimize its operations, and innovate its product offerings.

Geico Products and Services

Geico offers a comprehensive suite of car insurance products designed to cater to diverse needs and budgets. These products are designed to provide financial protection against various risks associated with car ownership, while also offering additional services for enhanced convenience and peace of mind.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance that protects you financially if you are at fault in an accident that causes injury or damage to another person or property. It covers the costs associated with the other party’s medical expenses, lost wages, property repairs, and legal fees.

Collision Coverage

Collision coverage protects your vehicle against damage resulting from a collision with another vehicle or object. This coverage pays for repairs or replacement of your car, regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, and falling objects. It covers repairs or replacement of your car, minus a deductible.

Uninsured/Underinsured Motorist Coverage

This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage, up to the limits of your policy.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. It helps you access medical treatment and financial support while recovering from injuries.

Medical Payments Coverage (Med Pay)

Med Pay coverage provides additional medical expense coverage for you and your passengers, regardless of fault, in case of an accident. It supplements your health insurance and provides peace of mind knowing you have additional financial support for medical costs.

Rental Car Coverage

If your vehicle is damaged in an accident and requires repairs, rental car coverage helps you pay for a rental car while your vehicle is being repaired. This coverage provides convenience and allows you to maintain your mobility while your car is out of commission.

Roadside Assistance

Geico offers roadside assistance services, including towing, flat tire changes, jump starts, and lockout assistance. This service provides peace of mind knowing you have help available in case of unexpected breakdowns or emergencies.

Discounts

Geico offers a wide range of discounts to help you save money on your car insurance premiums. These discounts include:

- Good driver discount

- Multi-car discount

- Safe driver discount

- Anti-theft device discount

- Defensive driving course discount

- Homeowner discount

- Military discount

- Good student discount

Geico Pricing and Cost Factors

Understanding the factors that influence Geico’s car insurance premiums is crucial for determining whether their rates align with your individual needs and budget. Several key factors contribute to your Geico insurance cost, including your vehicle, driving history, location, and age.

Factors Influencing Geico Premiums

Geico, like other insurance companies, uses a variety of factors to determine your car insurance premiums. These factors are designed to assess your risk profile and provide you with a fair and competitive rate.

- Vehicle Type: The make, model, year, and safety features of your vehicle significantly impact your premium. Vehicles with higher repair costs, a history of theft, or poor safety ratings typically result in higher premiums. For instance, a luxury sports car might have a higher premium than a compact sedan due to its higher repair costs and potential for higher risk.

- Driving History: Your driving record plays a crucial role in determining your premium. A clean driving record with no accidents, tickets, or violations usually translates to lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums. Geico may also consider the severity of the accidents and the time elapsed since the incidents.

- Location: Your location, including your state and zip code, impacts your premium due to factors like the frequency of accidents, theft rates, and average repair costs in the area. Urban areas with higher traffic density and more congested roads often have higher insurance premiums than rural areas with lower traffic volumes.

- Age: Your age is a significant factor in premium calculations. Younger drivers, particularly those under 25, tend to have higher premiums due to their higher risk of accidents. As you age and gain more driving experience, your premiums typically decrease. However, older drivers (typically over 75) may also face higher premiums due to potential health concerns or declining driving abilities.

- Coverage Levels: The amount of coverage you choose, including liability limits, collision and comprehensive coverage, and uninsured/underinsured motorist coverage, will also affect your premium. Higher coverage levels generally result in higher premiums, but they also provide greater financial protection in the event of an accident.

- Discounts: Geico offers a wide range of discounts that can lower your premium. These discounts may include good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling insurance policies with Geico (e.g., home and auto). It’s essential to inquire about available discounts to potentially reduce your premium.

Geico Pricing Compared to Other Insurers, Geico car insurance

Geico is known for its competitive pricing and has often been ranked among the most affordable insurance providers. However, it’s important to remember that insurance rates vary widely based on individual circumstances and factors discussed above.

- Competitive Advantages: Geico’s competitive pricing is often attributed to its efficient operations, streamlined claims process, and extensive use of technology. They also have a strong focus on customer satisfaction, which helps to reduce claims costs and maintain competitive rates.

- Potential Disadvantages: While Geico generally offers competitive pricing, it’s essential to compare quotes from multiple insurance providers to ensure you’re getting the best possible rate. Some individuals may find that other insurance companies offer more favorable rates depending on their specific risk profile and coverage needs. It’s always recommended to shop around and compare quotes before making a decision.

Geico Pricing Transparency and Online Quote Tools

Geico prioritizes transparency in its pricing and offers a user-friendly online quote tool. This tool allows you to quickly and easily obtain a personalized quote by providing basic information about yourself, your vehicle, and your desired coverage levels. The online quote tool helps you understand the factors influencing your premium and provides a clear breakdown of your coverage options and costs.

“Geico’s online quote tool is designed to be user-friendly and provide transparent pricing information, empowering customers to make informed decisions about their insurance needs.”

Geico Customer Experience

Geico’s customer experience is a crucial aspect of its overall success, as satisfied customers are more likely to remain loyal and recommend the company to others. This section will explore Geico’s customer service channels, analyze customer reviews and feedback, and discuss its claim handling process.

Geico’s Customer Service Channels

Geico offers a variety of customer service channels to cater to different preferences and needs. These channels include:

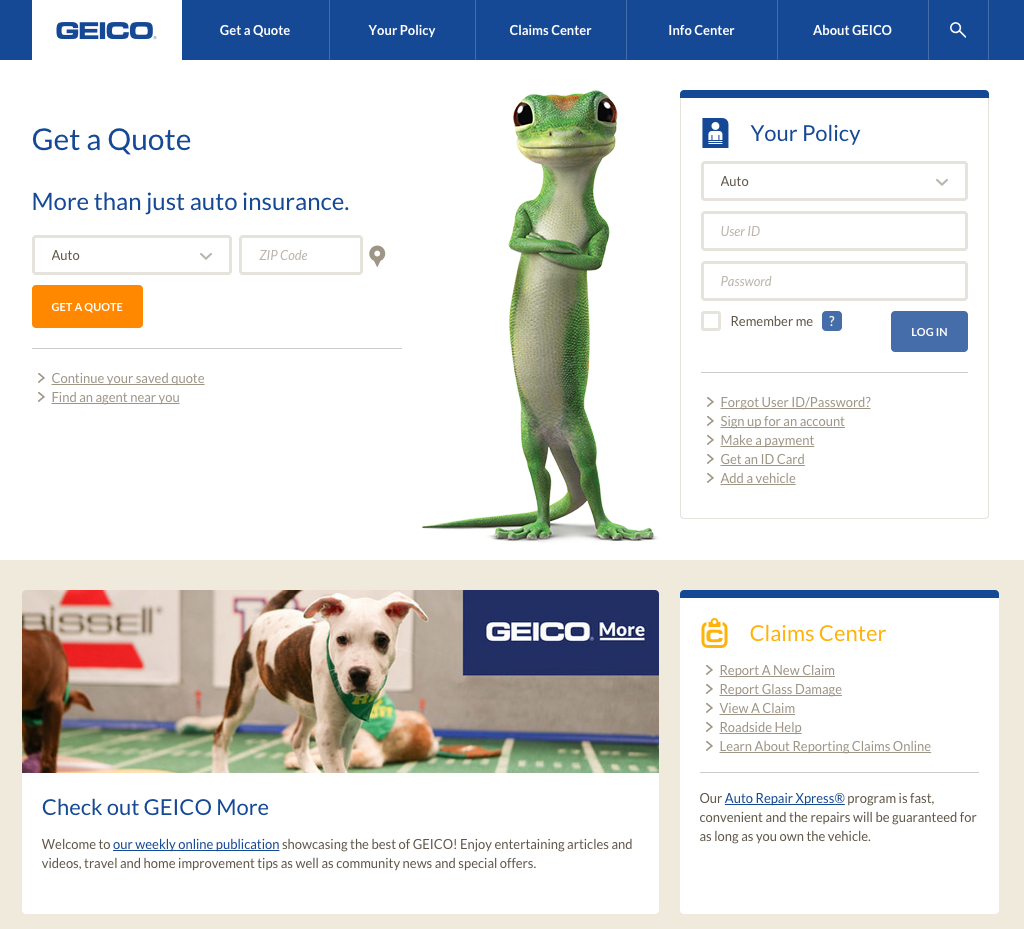

- Online Platforms: Geico’s website and mobile app provide customers with a convenient way to manage their policies, make payments, file claims, and access other services. The website features a comprehensive FAQ section, online chat support, and a secure portal for policyholders.

- Phone Support: Geico offers 24/7 phone support, allowing customers to speak directly with a representative for immediate assistance. The company’s phone lines are known for their relatively short wait times and helpful agents.

- Physical Offices: While Geico primarily operates online, it also maintains a network of physical offices across the United States. Customers can visit these offices for in-person assistance with policy inquiries, claims, and other matters.

Customer Reviews and Feedback

Customer reviews and feedback are valuable indicators of customer satisfaction levels. Geico generally receives positive reviews for its customer service, with many customers praising the company’s efficiency, helpfulness, and responsiveness.

- Positive Feedback: Many customers appreciate Geico’s online platforms for their user-friendliness and accessibility. The company’s phone support is also highly regarded for its availability and helpful agents.

- Negative Feedback: Some customers have reported difficulties navigating the online platform or experiencing long wait times on the phone. Occasionally, there are complaints about claim handling processes, with some customers expressing dissatisfaction with the speed or communication during the process.

Geico’s Claim Handling Process

Geico aims to provide a smooth and efficient claim handling process for its customers. The company offers a variety of options for filing claims, including online, phone, and mobile app. Geico utilizes a network of adjusters and repair shops to assist customers with the claim process.

- Claim Filing: Customers can file claims online, by phone, or through the mobile app. Geico’s online platform provides detailed instructions and guidance for filing claims, while phone support is available for assistance.

- Claim Processing: Once a claim is filed, Geico assigns an adjuster to investigate the claim and determine the extent of the damage. The adjuster will communicate with the customer throughout the process, providing updates and answering questions.

- Claim Resolution: Geico aims to resolve claims promptly and fairly. Customers can choose to have their vehicle repaired at a Geico-approved repair shop, or they can receive a cash settlement.

Geico Brand and Marketing

Geico has cultivated a distinct brand identity and employs unique marketing strategies that have contributed to its immense success in the insurance industry. The company’s approach to branding and marketing has been instrumental in shaping its image and building strong customer loyalty.

Geico’s Brand Identity

Geico’s brand identity is characterized by its focus on affordability, convenience, and a playful, memorable personality. The company’s iconic gecko mascot has become synonymous with Geico, serving as a recognizable and endearing symbol of the brand’s values. This playful mascot has helped to humanize the insurance industry and make Geico seem approachable and relatable.

Geico’s Marketing Strategies

Geico has employed a diverse range of marketing strategies, with a strong emphasis on humor and memorable advertising campaigns. The company’s commercials often feature quirky scenarios and catchphrases, aiming to create a positive and engaging brand experience. These campaigns have been highly effective in building brand recognition and driving customer acquisition.

Effectiveness of Geico’s Advertising Campaigns

Geico’s advertising campaigns have consistently ranked among the most effective in the industry. Their high recall rates and ability to generate positive brand associations demonstrate the effectiveness of their marketing approach. The company’s use of humor, memorable characters, and catchy jingles has made its commercials highly engaging and effective in capturing audience attention.

Geico’s Use of Social Media and Digital Marketing

Geico has actively embraced social media and digital marketing channels to engage with customers and build brand awareness. The company maintains a strong presence on platforms such as Facebook, Twitter, and YouTube, using these channels to share humorous content, promote its products and services, and respond to customer inquiries. Geico also leverages digital marketing tools such as search engine optimization () and pay-per-click (PPC) advertising to reach a wider audience online.

Geico’s Financial Performance

Geico’s financial performance is a key indicator of its stability and ability to meet its obligations to policyholders. This section analyzes Geico’s financial performance metrics, including revenue, profitability, and market capitalization, and discusses its financial stability and investment strategies.

Revenue and Profitability

Geico’s revenue and profitability have consistently grown over the years, reflecting its strong market position and efficient operations. The company’s revenue has grown steadily, driven by factors such as increased policy sales, higher premiums, and a growing customer base. This revenue growth has translated into strong profitability, with Geico consistently generating significant profits.

Financial Stability

Geico’s financial stability is evident in its strong capital position and consistent profitability. The company maintains a high level of capital reserves, which act as a cushion against unexpected losses and ensure its ability to meet its obligations to policyholders. This financial stability is crucial for Geico’s long-term success and its ability to compete effectively in the insurance market.

Investment Strategies

Geico’s investment strategies are designed to generate returns while managing risk. The company invests a significant portion of its assets in fixed-income securities, such as bonds and government securities, which provide a stable stream of income and relatively low risk. Geico also invests in equities, but with a focus on diversification and risk management.

Market Capitalization

Geico’s market capitalization is a reflection of its financial performance and investor confidence. The company’s market capitalization has grown steadily over the years, indicating strong investor interest and belief in its long-term growth prospects.

Final Conclusion: Geico Car Insurance

Geico car insurance stands as a testament to the power of innovation, customer-centricity, and a commitment to providing affordable coverage. Its evolution from a government program to a leading insurance provider reflects its ability to adapt to changing market conditions and leverage technology to enhance the customer experience. Whether you’re seeking comprehensive coverage, competitive pricing, or a seamless claims process, Geico offers a compelling solution for your insurance needs.