Renters insurance quotes are essential for safeguarding your belongings and financial well-being. While it might seem like an extra expense, renters insurance provides peace of mind knowing you’re protected against unforeseen events that could leave you financially vulnerable. From fire and theft to natural disasters, renters insurance can help you rebuild your life after a loss.

This comprehensive guide delves into the intricacies of renters insurance quotes, equipping you with the knowledge to make informed decisions about your coverage. We’ll explore factors that influence quotes, explain how to obtain the best rates, and highlight key elements of a renters insurance policy.

What is Renters Insurance?

Renters insurance is a valuable policy that protects your belongings and financial well-being in case of unexpected events. It provides financial coverage for losses caused by various perils, ensuring peace of mind and financial security.

Types of Coverage

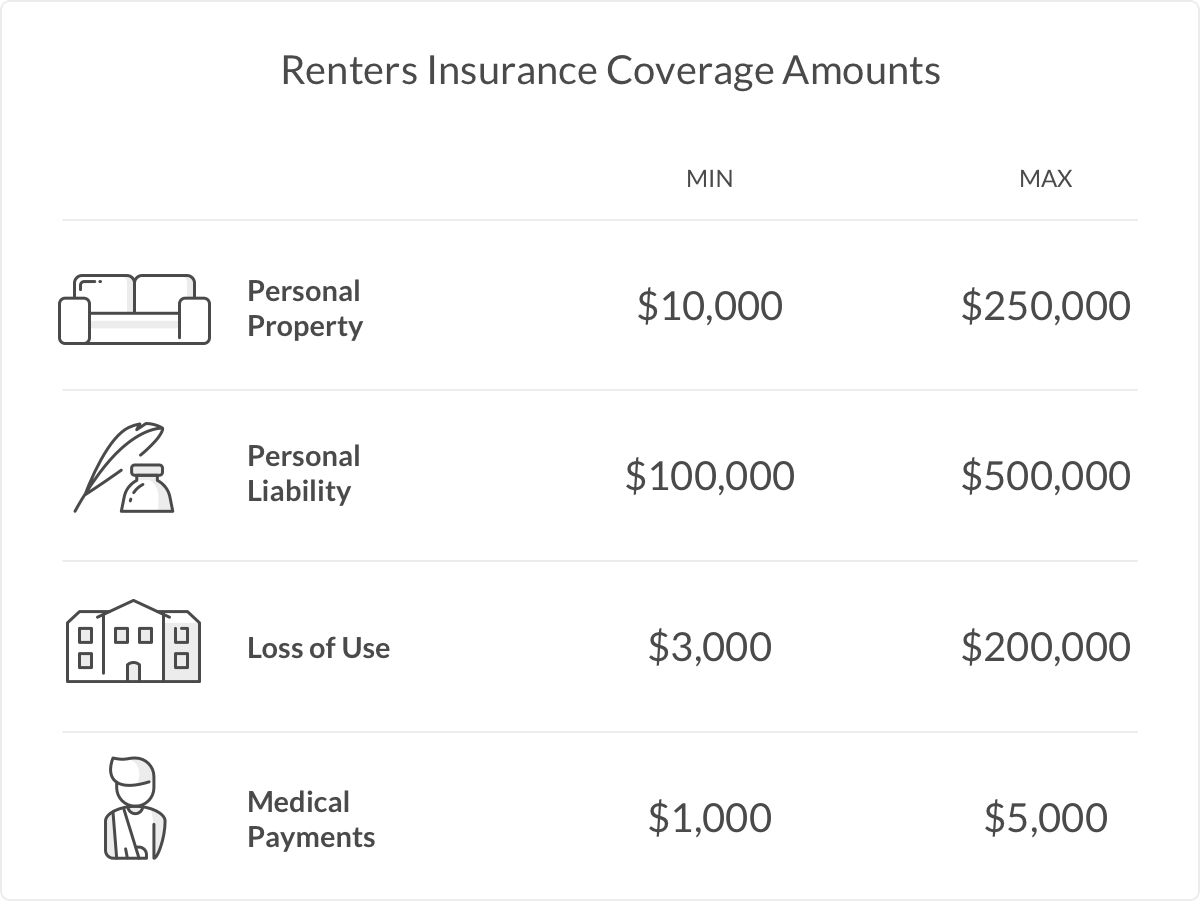

Renters insurance policies typically offer a range of coverage options to cater to different needs and budgets. Here are some common types of coverage:

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, clothing, and other personal items, against loss or damage due to covered perils. The coverage amount is usually determined by the actual cash value (ACV) or replacement cost value (RCV) of your belongings.

- Liability Coverage: This coverage protects you from financial liability if someone is injured or their property is damaged on your premises. For example, if a guest trips and falls in your apartment, liability coverage can help cover medical expenses and legal costs.

- Additional Living Expenses (ALE): If your apartment becomes uninhabitable due to a covered event, ALE coverage can help cover temporary housing expenses, such as hotel stays or rental fees, until your apartment is repaired or rebuilt.

- Personal Injury Coverage: This coverage protects you from financial losses due to slander, libel, or other personal injuries caused by you.

Scenarios Where Renters Insurance is Beneficial, Renters insurance quotes

Renters insurance can be a valuable asset in various situations. Here are some examples:

- Fire or Smoke Damage: If a fire breaks out in your apartment building, renters insurance can help cover the cost of replacing your belongings that were damaged or destroyed.

- Theft: In the unfortunate event of a burglary, renters insurance can help reimburse you for stolen items, such as electronics, jewelry, or valuable artwork.

- Water Damage: If a pipe bursts or a storm causes water damage to your apartment, renters insurance can help cover the cost of repairs and replacement of damaged belongings.

- Natural Disasters: Renters insurance can provide coverage for losses caused by natural disasters such as hurricanes, tornadoes, earthquakes, or floods (depending on the specific policy).

- Liability Claims: If someone is injured on your property, renters insurance can help cover legal expenses and medical costs associated with the claim.

Closure: Renters Insurance Quotes

By understanding the ins and outs of renters insurance quotes, you can secure the right coverage at a price that fits your budget. Remember, investing in renters insurance is an investment in your future, protecting you from financial hardship and ensuring you can rebuild your life in the event of an unexpected event.