Car insurance companies are essential partners in navigating the unpredictable world of driving. They provide financial protection against accidents, theft, and other perils, ensuring peace of mind on the road. Understanding the intricacies of car insurance, from coverage types to premium calculations, is crucial for making informed decisions that safeguard your financial well-being and your vehicle.

This comprehensive guide delves into the world of car insurance, exploring key factors that influence costs, comparing top companies, and providing insights into managing your insurance effectively. We’ll also discuss emerging trends and innovations that are shaping the future of car insurance.

Introduction to Car Insurance

Car insurance is a crucial financial safeguard that protects you and your vehicle in the event of an accident, theft, or other unforeseen circumstances. It provides financial coverage for repairs, medical expenses, and other liabilities arising from road incidents.

Car insurance works by transferring the risk of financial loss from you to the insurance company. You pay a premium to the insurer, and in return, they agree to cover certain costs associated with your vehicle.

Types of Car Insurance Coverage

Car insurance policies typically include several types of coverage, each designed to address different aspects of potential risks.

- Liability Coverage: This is the most common type of car insurance and is usually required by law. It covers damages to other people’s property and injuries to others caused by you while driving. Liability coverage is typically divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other costs related to injuries sustained by others in an accident.

- Property Damage Liability: Covers damages to another person’s vehicle or property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It typically covers damages to your car caused by collisions with other vehicles, objects, or even hitting a pothole.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or animal strikes. It also covers damages caused by hitting objects like trees, fences, or mailboxes.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage if the other driver is unable to pay for the damages.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your own medical expenses and lost wages regardless of who is at fault in an accident. It is typically required in some states.

- Medical Payments Coverage: This coverage provides payment for medical expenses for you and your passengers, regardless of who is at fault in an accident. It is usually a smaller amount of coverage than PIP.

Car Insurance Premium Calculation

Car insurance premiums are calculated based on several factors that assess your risk of being involved in an accident.

The higher the risk you pose to the insurance company, the higher your premium will be.

Here are some key factors that insurers consider:

- Driving History: Your past driving record, including accidents, traffic violations, and driving convictions, significantly impacts your premium. Drivers with a clean driving record typically pay lower premiums.

- Age and Gender: Younger and inexperienced drivers tend to have higher premiums than older, more experienced drivers. Statistics show that males under the age of 25 are more likely to be involved in accidents. However, these statistics are subject to change as insurance companies continue to refine their risk assessment models.

- Vehicle Type: The type of vehicle you drive influences your premium. Higher-performance vehicles, luxury cars, and vehicles with a history of theft or accidents are generally considered higher risk and may have higher premiums.

- Location: Where you live can affect your insurance rates. Areas with higher traffic density, crime rates, and accident frequency tend to have higher premiums.

- Credit Score: In some states, insurers use your credit score as a factor in determining your premium. A good credit score may indicate responsible financial behavior, which can lead to lower premiums.

- Coverage Options: The type and amount of coverage you choose will also influence your premium. Choosing a higher deductible, for example, can lower your premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in.

- Driving Habits: Factors such as the number of miles you drive annually, your driving habits (e.g., commuting vs. recreational driving), and your driving purpose (e.g., business vs. personal) can also affect your premium. Insurers may offer discounts for good driving habits, such as safe driving courses or telematics programs that monitor your driving behavior.

Key Factors Influencing Car Insurance Costs

Car insurance premiums are not a one-size-fits-all proposition. They are carefully calculated based on various factors that determine your risk profile as a driver. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Driving History

Your driving history is a significant factor in determining your car insurance costs. Insurance companies meticulously track your driving record to assess your risk. A clean driving record with no accidents or violations typically translates into lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions will likely lead to higher premiums.

Insurance companies use a system called a “risk score” to evaluate your driving history. This score is based on the frequency and severity of your accidents, violations, and other driving-related incidents. A lower risk score means you are considered a safer driver and will generally qualify for lower premiums.

Credit Score

While it may seem surprising, your credit score can also influence your car insurance rates. Insurance companies have found a correlation between credit score and driving behavior. Drivers with lower credit scores tend to have a higher risk of accidents and claims.

However, it is important to note that credit score is not the only factor considered, and it is not always a decisive factor in determining your premium. Many states have laws that restrict the use of credit score in insurance pricing.

Vehicle Make, Model, and Age

The type of car you drive plays a significant role in your insurance costs. Some vehicles are considered more expensive to repair or replace, and their safety features may vary. This translates into different risk levels for insurance companies.

- Make and Model: Sports cars and luxury vehicles often have higher insurance premiums due to their higher repair costs and potential for more severe accidents.

- Age: Newer vehicles generally have more advanced safety features and are less likely to be involved in accidents, resulting in lower premiums. Older vehicles may have outdated safety technology and are more prone to mechanical issues, potentially leading to higher premiums.

Location

Where you live can also affect your car insurance premiums. Insurance companies analyze accident statistics and crime rates in different areas. Areas with higher rates of accidents and theft will typically have higher insurance premiums.

Driving Habits

Your driving habits can also impact your insurance costs. Insurance companies may offer discounts for drivers who:

- Drive fewer miles: If you drive less frequently, you are less likely to be involved in an accident, resulting in lower premiums.

- Maintain a safe driving record: Drivers with a clean driving history are considered safer and may qualify for discounts.

- Take defensive driving courses: Completing a defensive driving course demonstrates your commitment to safe driving and can earn you discounts.

Coverage Levels

The amount of coverage you choose can significantly affect your premiums. Higher coverage limits typically mean higher premiums. It is essential to balance your coverage needs with your budget.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. Higher liability limits provide greater protection in case of significant damages or injuries.

- Collision and Comprehensive Coverage: These coverages protect your vehicle from damage due to accidents and other events like theft or vandalism. Opting for higher deductibles can lower your premiums, but you will be responsible for paying more out-of-pocket in case of a claim.

Choosing the Right Car Insurance Company: Car Insurance Companies

Selecting the right car insurance company is crucial to ensure you have adequate coverage at a competitive price. Finding the best fit involves considering various factors and comparing different providers.

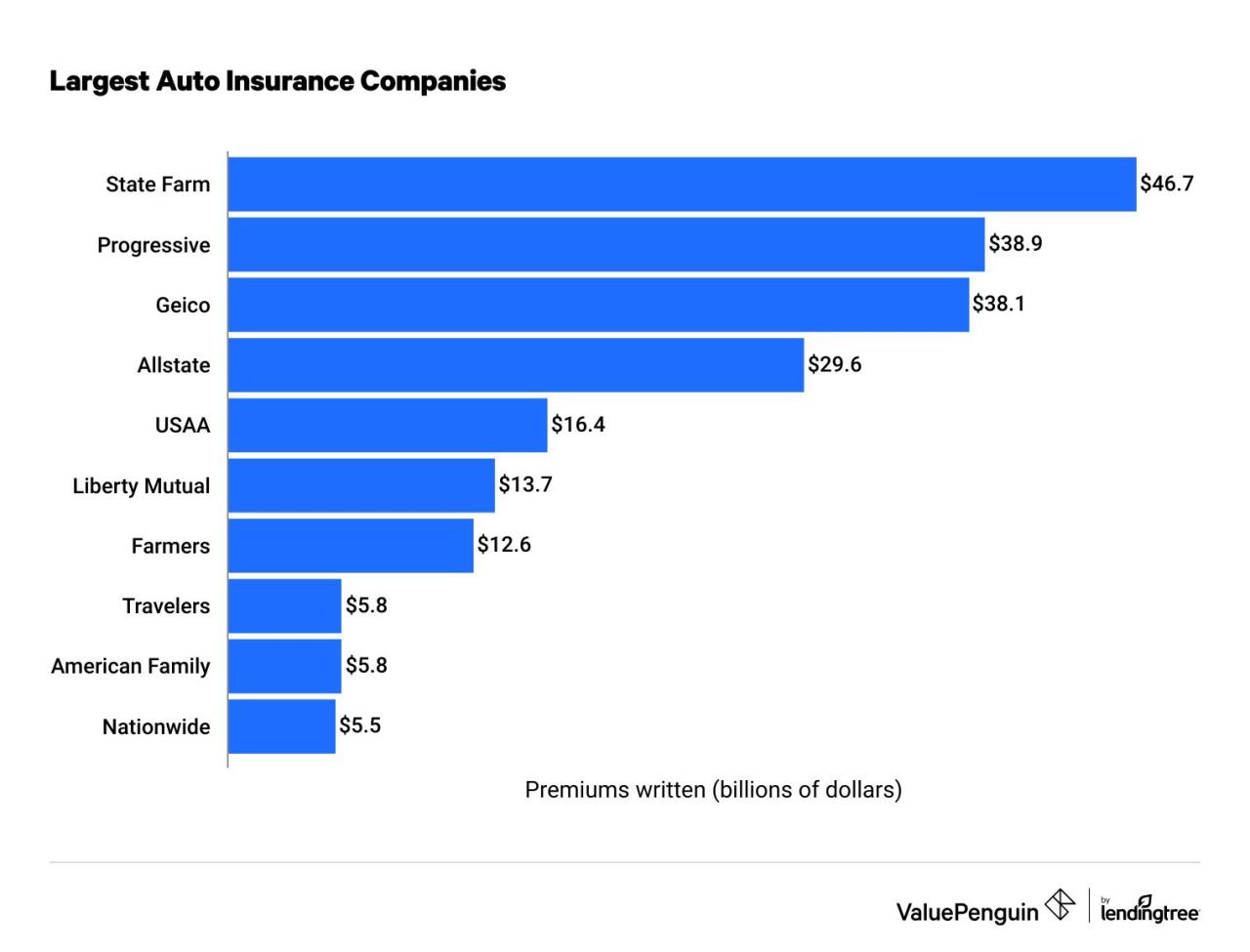

Top Car Insurance Companies

It’s important to research and compare top car insurance companies to find the best fit for your needs. Some of the leading car insurance providers in the US, based on market share and customer satisfaction, include:

- State Farm: Known for its strong customer service and wide range of coverage options.

- GEICO: Often recognized for its competitive rates and easy online purchasing process.

- Progressive: Offers a variety of discounts and personalized insurance plans.

- Allstate: Offers a strong reputation for customer service and financial stability.

- Liberty Mutual: Provides a wide range of coverage options and has a strong focus on customer satisfaction.

Key Features and Pricing

To make an informed decision, it’s essential to compare key features and pricing across different insurance companies. The following table highlights some important factors to consider:

| Company | Coverage Options | Average Annual Premium | Customer Service Rating |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,500 | 4.5/5 |

| GEICO | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,400 | 4.2/5 |

| Progressive | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,350 | 4.0/5 |

| Allstate | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,600 | 4.3/5 |

| Liberty Mutual | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | $1,550 | 4.1/5 |

Note: Average annual premiums are estimates and can vary based on factors like location, driving history, and vehicle type.

Tips for Choosing the Right Insurance Company, Car insurance companies

- Compare Quotes: Obtain quotes from multiple companies to ensure you’re getting the best possible rate.

- Review Coverage Options: Carefully consider the coverage options offered by each company and choose a plan that meets your specific needs.

- Check Customer Service Ratings: Research customer service ratings and reviews to gauge the company’s responsiveness and reliability.

- Look for Discounts: Many companies offer discounts for safe driving, good student records, and other factors. Ask about available discounts.

- Read the Fine Print: Before signing up, carefully review the policy documents to understand the terms and conditions, including exclusions and limitations.

Understanding Insurance Policies and Coverage

Car insurance policies can vary significantly in terms of coverage, terms, and conditions. It is crucial to carefully review and understand the details of your policy to ensure you have the right protection in case of an accident or other covered event.

Coverage Options

Car insurance companies offer a variety of coverage options to suit different needs and budgets. The most common types of coverage include:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault coverage, covers your medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. It is typically required in some states.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of fault, up to a certain limit.

Terms and Conditions

Each insurance policy includes terms and conditions that Artikel the specific details of your coverage. Some key terms to understand include:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means a lower premium.

- Limits: The maximum amount your insurance company will pay for a covered loss.

- Exclusions: Specific events or circumstances that are not covered by your policy. Common exclusions include driving under the influence of alcohol or drugs, using your vehicle for commercial purposes, and racing or participating in illegal activities.

Insurance Claims Scenarios

Insurance claims are handled differently depending on the type of coverage and the specific circumstances of the incident. Here are some common claim scenarios:

- Accident with Another Vehicle: In case of an accident, you should immediately contact your insurance company and file a claim. Provide them with all the necessary information, including details of the accident, the other driver’s information, and any witnesses.

- Vehicle Theft: If your vehicle is stolen, you should report it to the police and then file a claim with your insurance company. They will investigate the theft and determine if your policy covers the loss.

- Natural Disaster Damage: If your vehicle is damaged due to a natural disaster, such as a flood or earthquake, you should file a claim with your insurance company. They will assess the damage and determine if your policy covers the loss.

Managing Your Car Insurance

Managing your car insurance effectively can help you save money and ensure you have adequate coverage in case of an accident. By understanding your policy, exploring discounts, and taking steps to maintain a good driving record, you can make the most of your insurance.

Obtaining Discounts and Reducing Premiums

There are various ways to lower your car insurance premiums. By taking advantage of these discounts, you can significantly reduce your annual costs.

- Good Driving Record: Maintaining a clean driving record with no accidents or traffic violations is one of the most significant factors in determining your premium. Insurers reward safe drivers with lower rates.

- Safe Vehicle Features: Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts. These features reduce the risk of accidents and injuries, making your car more appealing to insurers.

- Bundling Policies: Combining your car insurance with other policies like homeowners or renters insurance can often result in a bundled discount. This is because insurers reward customers who purchase multiple policies from them.

- Payment Options: Choosing to pay your premiums annually or semi-annually instead of monthly can sometimes lead to a discount. This is because insurers have lower administrative costs when processing fewer payments.

- Loyalty Programs: Some insurance companies offer discounts to long-term customers who have maintained their policies for several years. This loyalty is often rewarded with lower rates.

- Other Discounts: Depending on your insurer, you may qualify for additional discounts based on factors like your occupation, education level, or membership in certain organizations.

Filing a Claim and Resolving an Accident

Accidents are unfortunate events, but knowing how to file a claim and handle the aftermath can make a significant difference.

- Report the Accident: Immediately contact your insurer to report the accident. Provide details about the incident, including the date, time, location, and any injuries involved.

- Gather Information: Collect information from all parties involved, including names, contact details, insurance information, and vehicle details. Take pictures of the damage to all vehicles and the accident scene.

- File a Claim: Follow your insurer’s instructions for filing a claim. Provide all the necessary information and documentation. Be prepared to answer questions about the accident.

- Cooperate with the Insurance Company: Be honest and transparent with your insurer. Respond to all requests promptly and provide any requested documents or information.

- Seek Medical Attention: If you or anyone else is injured, seek medical attention immediately. Report all injuries to your insurer.

- Negotiate with the Other Party: If the other party’s insurance company offers a settlement, carefully review it before accepting. You may need to consult with an attorney if you are unsure about the terms of the settlement.

Maintaining a Good Driving Record

Your driving record is a crucial factor in determining your insurance premiums. Avoiding accidents and traffic violations can significantly reduce your costs.

- Defensive Driving: Taking a defensive driving course can teach you valuable skills to avoid accidents and improve your driving habits. These courses often offer discounts on your insurance premiums.

- Avoid Distractions: Distracted driving is a leading cause of accidents. Avoid using your phone, eating, or engaging in other activities that take your attention away from the road.

- Maintain Your Vehicle: Regularly servicing your car and addressing any maintenance issues can help prevent breakdowns and accidents. Make sure your tires are properly inflated, your brakes are working, and your lights are functioning correctly.

- Drive Defensively: Always be aware of your surroundings and anticipate potential hazards. Leave enough space between you and other vehicles, and be prepared to react quickly to unexpected situations.

- Follow Traffic Laws: Obey all traffic laws and regulations. Avoid speeding, driving under the influence, and other risky behaviors that can lead to accidents and penalties.

Car Insurance Trends and Innovations

The car insurance industry is undergoing a significant transformation, driven by technological advancements and evolving customer expectations. These changes are leading to new insurance models, personalized pricing, and a more connected and data-driven approach to risk assessment.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to collect and analyze data related to vehicle usage. Usage-based insurance (UBI) leverages this data to personalize insurance premiums based on driving behavior.

- How it works: UBI programs typically involve installing a telematics device in the vehicle, which tracks driving patterns such as speed, acceleration, braking, time of day, and mileage. This data is then used to calculate a personalized insurance premium, rewarding safe and responsible drivers with lower rates.

- Benefits: UBI programs offer several advantages, including:

- Lower premiums: Safe drivers can benefit from lower premiums, as they are rewarded for their responsible driving habits.

- Increased awareness: Telematics devices can provide drivers with feedback on their driving habits, helping them identify areas for improvement.

- Enhanced safety features: Some UBI programs offer additional safety features, such as emergency assistance or stolen vehicle recovery.

- Examples: Several car insurance companies offer UBI programs, including Progressive’s Snapshot, State Farm’s Drive Safe & Save, and Liberty Mutual’s RightTrack.

Impact of Technology on Insurance Policies and Pricing

Technological advancements are revolutionizing the car insurance industry, leading to more personalized and data-driven insurance policies and pricing models.

- Data analytics: Insurance companies are using data analytics to better understand risk factors and develop more accurate pricing models. This includes analyzing data from telematics devices, social media, and other sources to create a comprehensive picture of individual driving behavior.

- Artificial intelligence (AI): AI is being used to automate tasks, improve risk assessment, and personalize customer interactions. For example, AI-powered chatbots can provide instant answers to customer queries, while AI algorithms can analyze claims data to streamline the claims process.

- Blockchain technology: Blockchain technology is being explored for its potential to improve transparency and security in the insurance industry. It could be used to create a secure and tamper-proof record of insurance policies and claims data.

The Future of Car Insurance

The future of car insurance is likely to be characterized by increased automation, personalization, and a focus on preventing accidents.

- Autonomous vehicles: The rise of autonomous vehicles is expected to significantly impact the car insurance industry. As self-driving cars become more prevalent, insurance companies will need to adapt their policies and pricing models to account for the unique risks and benefits associated with autonomous driving.

- Pay-per-mile insurance: Pay-per-mile insurance, where drivers pay based on the number of miles driven, is becoming increasingly popular. This model is particularly attractive for drivers who drive less frequently, as it can offer significant savings compared to traditional insurance policies.

- Predictive analytics: Insurance companies are using predictive analytics to identify drivers at risk of accidents and develop targeted safety programs. This could involve using data from telematics devices, social media, and other sources to identify potential hazards and intervene before accidents occur.

Epilogue

Navigating the car insurance landscape can be complex, but with careful research and an understanding of your needs, you can find the right coverage at the right price. By leveraging the information provided in this guide, you can confidently choose a car insurance company that meets your requirements and provides the protection you need.

Car insurance companies often offer discounts for safe driving habits. You might also find yourself saving money if you’re able to program your remote controls for multiple devices, like your TV and sound system. To learn how to program an RCA universal remote, you can check out this helpful guide: program rca universal remote.

While it might seem unrelated, having a functional remote can make your home entertainment more enjoyable, which can reduce stress and potentially even lead to safer driving habits.