Car insurance companies quotes are the foundation for securing the right coverage for your vehicle. Navigating this complex landscape requires understanding the various factors that influence pricing, comparing options, and making informed decisions. This comprehensive guide will equip you with the knowledge to confidently navigate the world of car insurance quotes.

From understanding the factors that impact quotes, like your driving history and vehicle type, to exploring the features and benefits of different insurance companies, we’ll delve into the intricacies of securing the best possible rates. We’ll also highlight essential coverage options, discuss common discounts, and emphasize the importance of comparing quotes from multiple providers.

Understanding Car Insurance Quotes

Getting a car insurance quote can feel overwhelming, but it doesn’t have to be. Understanding the factors that influence your quote can help you make informed decisions and find the best coverage for your needs at a price you can afford.

Factors Influencing Car Insurance Quotes

Several factors play a crucial role in determining your car insurance quote. These factors can vary depending on the insurance company and your individual circumstances.

- Vehicle Type: The make, model, year, and safety features of your car all influence the cost of insurance. Sports cars and luxury vehicles are generally more expensive to insure than sedans or hatchbacks because they are more likely to be involved in accidents and have higher repair costs.

- Driving History: Your driving record is a significant factor in determining your insurance premiums. Accidents, traffic violations, and driving under the influence convictions can all increase your insurance costs. A clean driving record can result in lower premiums.

- Location: Where you live can also affect your insurance rates. Areas with higher rates of car theft, accidents, and vandalism tend to have higher insurance premiums. Urban areas often have higher insurance rates compared to rural areas.

- Coverage Options: The amount of coverage you choose impacts your insurance premium. Higher coverage limits for liability, collision, and comprehensive coverage will result in higher premiums. However, it is essential to choose coverage that meets your individual needs and financial situation.

Examples of How Factors Affect Car Insurance Costs

Here are some examples of how different factors can affect the cost of car insurance:

- Vehicle Type: A 2023 Tesla Model S might have a significantly higher insurance premium compared to a 2015 Honda Civic, due to its higher value, performance, and repair costs.

- Driving History: A driver with a recent speeding ticket might face a 15% increase in their insurance premium compared to a driver with a clean driving record.

- Location: A driver living in a densely populated urban area with high traffic congestion might pay a 20% higher premium compared to a driver living in a rural area with lower traffic density.

- Coverage Options: A driver choosing higher liability limits might see a 10% increase in their premium compared to someone with lower limits, but they will be better protected financially in case of an accident.

Tips for Getting Accurate and Competitive Quotes

Here are some tips to help you get accurate and competitive car insurance quotes:

- Shop Around: Get quotes from multiple insurance companies to compare prices and coverage options. Don’t just rely on one company; use online comparison websites or contact insurers directly.

- Provide Accurate Information: Ensure you provide accurate information about your vehicle, driving history, and coverage needs when requesting quotes. Inaccurate information can lead to higher premiums or policy cancellations.

- Consider Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features, bundling policies, and paying premiums in full. Ask about available discounts and ensure you qualify for them.

- Review Your Policy Regularly: Your insurance needs may change over time, so it’s essential to review your policy annually to ensure it still meets your requirements. You may be able to adjust coverage or find better rates as your circumstances change.

Key Features of Car Insurance Companies

Choosing the right car insurance company can be a daunting task, as there are many options available, each with its own unique set of features. Understanding these key features will help you make an informed decision that best suits your needs and budget.

Coverage Options

Different insurance companies offer a variety of coverage options, ranging from basic liability coverage to comprehensive and collision coverage.

- Liability Coverage: This is the most basic type of car insurance, covering damages to other people’s property or injuries caused by an accident you are responsible for.

- Collision Coverage: This covers damages to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damages to your vehicle due to non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you are involved in an accident with a driver who does not have insurance or does not have enough coverage.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

It is essential to carefully consider your individual needs and driving habits when choosing coverage options.

Discounts

Car insurance companies offer various discounts to help you save money on your premiums.

- Safe Driving Discounts: These discounts are often available to drivers with clean driving records, such as no accidents or traffic violations.

- Good Student Discounts: Many insurers offer discounts to students who maintain good grades.

- Multi-Car Discounts: If you insure multiple vehicles with the same company, you can often get a discount.

- Bundling Discounts: You may be able to save money by bundling your car insurance with other types of insurance, such as homeowners or renters insurance.

- Anti-theft Device Discounts: Installing anti-theft devices in your car can qualify you for a discount.

Be sure to ask your insurance company about all available discounts you may be eligible for.

Customer Service

Customer service is an important factor to consider when choosing a car insurance company.

- Availability: Look for a company with 24/7 customer service options, including phone, email, and online chat.

- Responsiveness: Ensure that the company responds promptly to your inquiries and concerns.

- Friendliness and Professionalism: Choose a company with friendly and helpful customer service representatives.

Claims Processing

The claims processing experience can be stressful, so it is essential to choose a company with a streamlined and efficient claims process.

- Ease of Filing Claims: Look for a company that allows you to file claims online, over the phone, or through a mobile app.

- Speed of Processing: Choose a company with a proven track record of processing claims quickly and efficiently.

- Communication: Ensure the company keeps you informed throughout the claims process and provides clear explanations of any decisions made.

National vs. Regional Carriers

There are advantages and disadvantages to choosing a national or regional car insurance company.

National Carriers

- Pros:

- Wide availability and a strong national presence.

- Often offer more coverage options and discounts.

- May have a larger network of repair shops.

- Cons:

- Premiums may be higher due to higher overhead costs.

- May not be as familiar with local driving conditions.

- Customer service may be less personalized.

Regional Carriers

- Pros:

- May offer more competitive premiums due to lower overhead costs.

- More familiar with local driving conditions and regulations.

- May offer more personalized customer service.

- Cons:

- May have a smaller network of repair shops.

- May not offer as many coverage options or discounts.

- Limited availability in certain areas.

Reading Reviews and Researching Company Ratings

Before making a decision, it is crucial to read reviews and research company ratings from independent organizations.

- J.D. Power: Provides ratings for customer satisfaction with car insurance companies.

- A.M. Best: Rates the financial strength and stability of insurance companies.

- Consumer Reports: Offers ratings based on customer satisfaction and claims handling.

Reading reviews and researching company ratings can provide valuable insights into the reputation and performance of different insurance companies.

Navigating the Quoting Process

Getting car insurance quotes is the first step to securing the right coverage for your needs. It involves gathering information about your vehicle and driving history, and then presenting it to various insurance companies. You can choose to contact companies directly, use online comparison tools, or work with an insurance broker.

Contacting Insurance Companies Directly

This approach involves reaching out to individual insurance companies by phone, email, or visiting their websites. It allows you to get personalized attention and ask specific questions about their policies. However, it can be time-consuming to contact multiple companies and compare their offerings.

- Start by identifying insurance companies operating in your area. You can research online, ask for recommendations from friends or family, or consult industry rankings.

- Visit the company’s website, where you’ll typically find a “Get a Quote” button or a section dedicated to requesting quotes.

- Provide the necessary information, including your driver’s license details, vehicle information, and desired coverage levels.

- Be prepared to answer questions about your driving history, such as accidents, traffic violations, and prior insurance claims.

- Once you submit your information, the company will generate a quote based on their risk assessment.

Using Online Comparison Tools

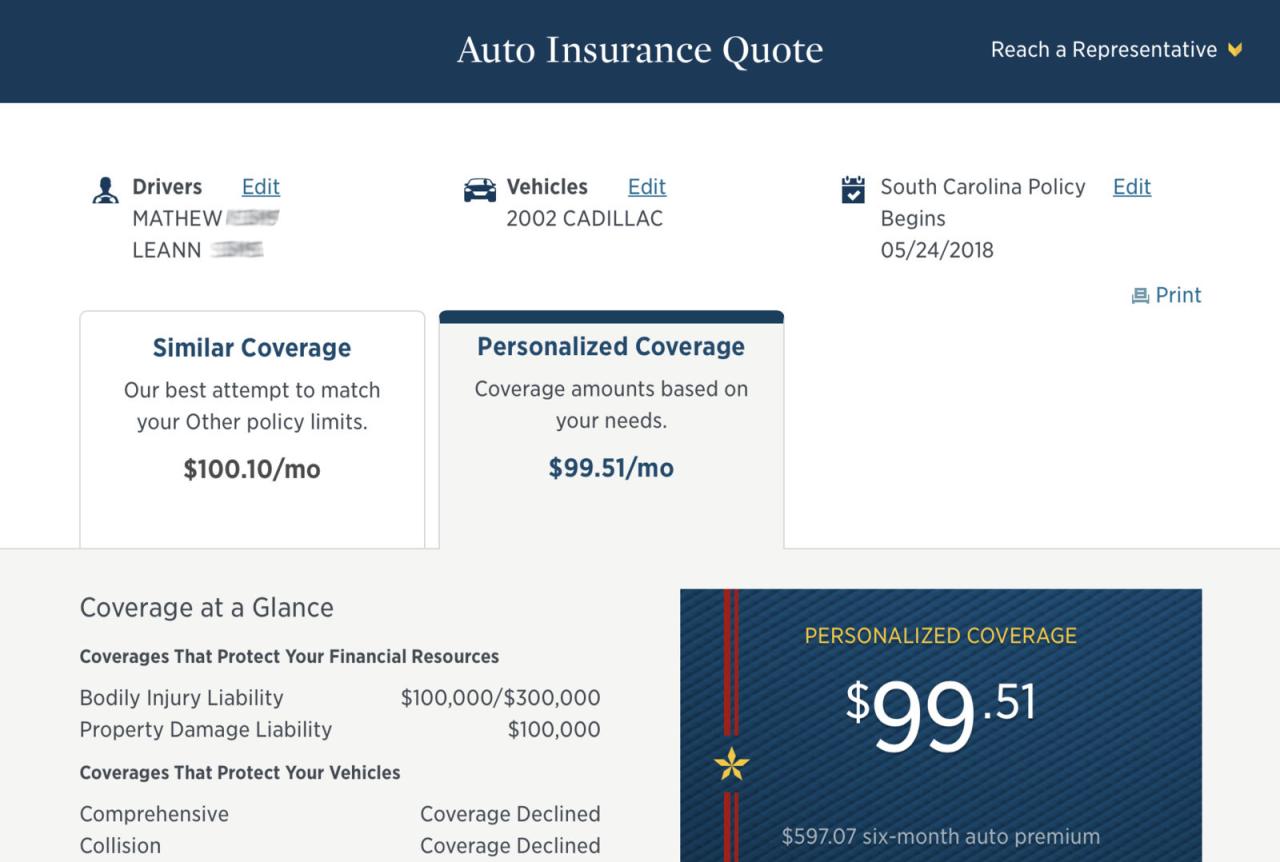

Online comparison tools streamline the quoting process by allowing you to request quotes from multiple companies simultaneously. These tools typically require basic information about your vehicle and driving history. They then present you with a side-by-side comparison of quotes from different insurers, making it easier to find the best deal.

- Popular online comparison tools include websites like NerdWallet, Bankrate, and The Zebra. These platforms aggregate quotes from various insurers, providing a comprehensive overview of available options.

- Use the comparison tool to input your vehicle information, driver details, and desired coverage levels. Most tools allow you to customize your coverage preferences, such as liability limits, collision and comprehensive coverage, and uninsured motorist coverage.

- Once you submit your information, the tool will generate a list of quotes from participating insurers. You can then compare premiums, coverage options, and other factors to find the most suitable policy.

- While comparison tools simplify the process, remember that they may not include quotes from all insurers. It’s still essential to contact individual companies if you want to ensure you’re considering all available options.

Working with an Insurance Broker

Insurance brokers act as intermediaries between you and insurance companies. They can provide personalized advice and help you navigate the complex world of car insurance. Brokers have access to a wide range of insurance companies and can often find you better rates and coverage options than you could find on your own.

- Brokers are independent agents who represent multiple insurance companies. They are not affiliated with any particular insurer, allowing them to offer unbiased advice and recommendations.

- When you work with a broker, you’ll typically provide them with your vehicle information, driving history, and coverage preferences. They will then contact several insurance companies on your behalf, obtaining quotes and comparing them to find the best match for your needs.

- Brokers can also provide valuable insights into different insurance policies and help you understand the nuances of coverage options. They can explain complex terms, answer your questions, and negotiate with insurers on your behalf.

- Working with a broker can be beneficial, especially if you have a complex insurance situation or are unfamiliar with the intricacies of car insurance.

Information Required for a Quote

To obtain accurate car insurance quotes, insurance companies will typically require the following information:

- Driver’s License Details: Your driver’s license number, date of birth, and address.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), and mileage of your vehicle.

- Coverage Preferences: The types of coverage you desire, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Driving History: Information about your driving record, including any accidents, traffic violations, or prior insurance claims.

- Other Relevant Information: Your credit history, driving habits (e.g., daily commute distance), and any other factors that might influence your risk profile.

Tips for Streamlining the Quoting Process

- Gather Your Information Beforehand: Having your driver’s license details, vehicle information, and driving history readily available will expedite the quoting process.

- Compare Quotes from Multiple Companies: Don’t settle for the first quote you receive. Compare quotes from several insurers to ensure you’re getting the best deal.

- Consider Different Coverage Options: Don’t assume that the cheapest policy is always the best. Evaluate different coverage options to determine the right balance of protection and affordability for your needs.

- Read the Fine Print: Carefully review the terms and conditions of each policy before making a decision. Pay attention to deductibles, coverage limits, and exclusions.

- Ask Questions: If you’re unsure about any aspect of the quoting process or the policy details, don’t hesitate to ask questions.

Understanding Coverage Options

Car insurance policies offer a range of coverage options to protect you financially in the event of an accident or other unforeseen circumstances. Understanding these options is crucial for making informed decisions about your coverage and ensuring you have the right protection.

Types of Car Insurance Coverage

The following table Artikels the common types of car insurance coverage and their purposes:

| Coverage Type | Purpose | Benefits | Potential Scenarios |

|—|—|—|—|

| Liability Coverage | Protects you from financial responsibility for injuries or damages you cause to others in an accident. | Covers medical expenses, property damage, and legal fees for the other party. | You cause an accident that injures another driver or damages their vehicle. |

| Collision Coverage | Covers damage to your own vehicle in an accident, regardless of fault. | Pays for repairs or replacement of your vehicle after an accident. | You hit a stationary object or another vehicle, causing damage to your car. |

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. | Covers repairs or replacement of your vehicle for non-collision incidents. | Your car is stolen, vandalized, or damaged by hail or a tree falling on it. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are injured by a driver without insurance or with insufficient insurance. | Covers your medical expenses, lost wages, and other damages. | You are hit by a driver who has no insurance or whose insurance is insufficient to cover your injuries. |

Impact of Coverage Options on Insurance Costs

The coverage options you choose significantly impact the overall cost of your car insurance. Choosing higher coverage limits or adding optional coverages will generally increase your premium. Conversely, reducing coverage limits or opting out of certain coverages can lower your premium. For example, if you have an older vehicle with a lower market value, you may choose to waive collision and comprehensive coverage, as the cost of repairs may exceed the vehicle’s value.

Discounts and Savings Opportunities

Car insurance companies offer a variety of discounts to help policyholders save money on their premiums. These discounts can be significant, and taking advantage of them can make a big difference in your overall cost of insurance.

Safe Driving Discounts

Safe driving discounts are one of the most common types of car insurance discounts. These discounts reward drivers who have a clean driving record, with no accidents or traffic violations.

To qualify for a safe driving discount, you typically need to have a certain number of years of driving experience without any accidents or violations. The specific requirements vary by insurance company.

For example, some companies may offer a discount to drivers who have been accident-free for three years, while others may require five years of accident-free driving.

The amount of the discount can also vary depending on the insurance company and your driving record. Some companies may offer a 10% discount, while others may offer a 20% or even higher discount.

Good Student Discounts

Good student discounts are available to students who maintain a certain grade point average (GPA). These discounts are designed to encourage students to focus on their education and reward them for their academic achievements.

To qualify for a good student discount, you typically need to have a GPA of 3.0 or higher. The specific requirements vary by insurance company, and some companies may offer discounts to students who are enrolled in college or university, while others may also offer discounts to high school students.

The amount of the discount can vary depending on the insurance company and your GPA. Some companies may offer a 10% discount, while others may offer a 20% or even higher discount.

Multi-Car Discounts

Multi-car discounts are offered to policyholders who insure multiple vehicles with the same insurance company. These discounts are designed to reward customers for their loyalty and encourage them to insure all of their vehicles with the same company.

To qualify for a multi-car discount, you typically need to insure at least two vehicles with the same insurance company. The amount of the discount can vary depending on the insurance company and the number of vehicles you insure. Some companies may offer a 10% discount for two vehicles, while others may offer a 20% discount or even higher for three or more vehicles.

Tips for Negotiating Discounts

When you are shopping for car insurance, it is important to ask about all of the discounts that are available to you. Some insurance companies may not automatically offer all of the discounts that you qualify for, so it is important to ask about them.

You should also be prepared to provide documentation to support your eligibility for discounts, such as your driving record, student transcripts, or proof of multiple vehicles.

You can also try to negotiate with insurance companies to get the best possible rates. For example, you can ask if they will offer you a lower rate if you agree to pay your premium in full or if you agree to increase your deductible.

It is also a good idea to compare quotes from multiple insurance companies to make sure you are getting the best possible rate.

The Importance of Comparing Quotes

In the realm of car insurance, securing the best possible coverage at a competitive price is paramount. Comparing quotes from multiple insurance companies is a crucial step in this process, offering a multitude of advantages that can significantly impact your financial well-being.

Potential Cost Savings

The primary benefit of comparing quotes lies in the potential for substantial cost savings. Insurance companies utilize various factors to determine premiums, including your driving history, vehicle type, location, and coverage levels. These factors can lead to significant variations in pricing across different companies, even for the same coverage.

Comparing car insurance quotes can be a tedious task, but it’s essential to find the best coverage for your needs. While you’re navigating those quotes, remember to secure your future with Prudential Life Insurance: Secure Your Future. Just like car insurance protects your vehicle, Prudential can safeguard your loved ones’ financial well-being. So, take the time to compare both car insurance and life insurance quotes, ensuring you have the right protection for every aspect of your life.

By obtaining quotes from multiple insurers, you can identify the most competitive rates and potentially save hundreds or even thousands of dollars annually on your car insurance premiums.

Discovering Hidden Benefits

Beyond cost savings, comparing quotes allows you to uncover hidden benefits offered by different insurance companies. These benefits may include:

- Enhanced Coverage Options: Some companies may provide unique or expanded coverage options, such as roadside assistance, rental car reimbursement, or accident forgiveness, which may not be available elsewhere.

- Discounts and Savings Opportunities: Each company may offer a distinct range of discounts, such as good driver discounts, safe driver discounts, or discounts for bundling multiple insurance policies.

- Exceptional Customer Service: Comparing quotes provides insights into the customer service reputation and responsiveness of different companies, helping you choose an insurer known for its reliability and support.

Illustrative Examples

Consider two hypothetical individuals, both seeking car insurance for a similar vehicle and coverage level. Company A offers a premium of $1,000 per year, while Company B provides a quote of $800 per year. By comparing quotes, the individual can save $200 annually by choosing Company B.

Getting car insurance quotes can feel like a chore, with endless forms and comparisons. But when it comes to life insurance, a modern approach like Ethos Life Insurance: A Modern Approach to Coverage can make the process smoother. Ethos’s digital platform streamlines the entire process, offering clear and transparent pricing, making it a refreshing alternative to traditional methods.

Just like you compare car insurance quotes, taking a look at Ethos Life Insurance might be worth your time.

Furthermore, suppose Company A offers a discount for bundling home and auto insurance, while Company B provides a discount for safe driving records. By comparing these benefits, the individual can choose the company that aligns best with their specific needs and circumstances, potentially unlocking further savings and advantages.

Factors Affecting Insurance Rates

Car insurance premiums are not a one-size-fits-all proposition. Several factors influence the cost of your car insurance, and understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Age is a significant factor in car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to inexperience and risk-taking behavior. As drivers gain experience and age, their insurance rates tend to decrease.

Gender

While gender-based pricing has been a topic of debate, it’s still a factor in some states. Historically, men have been found to be involved in more accidents and claims than women. This has led to higher premiums for men in certain areas.

Driving History

Your driving history plays a crucial role in determining your insurance rates. A clean driving record with no accidents or violations translates into lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Credit Score

This might seem surprising, but your credit score can influence your car insurance rates. Insurance companies use credit scores as an indicator of financial responsibility. A good credit score often indicates responsible behavior, which can translate to lower premiums.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance rates. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs, greater risk of theft, and higher potential for accidents.

Understanding Policy Terms and Conditions

It’s crucial to thoroughly review the terms and conditions of your car insurance policy before purchasing it. This document Artikels the details of your coverage, including what is covered, what is not covered, and the limitations of your policy. Understanding these terms will help you make informed decisions about your insurance and avoid any unpleasant surprises later.

Key Policy Provisions

Understanding key provisions like deductibles, limits, and exclusions is vital for making informed decisions about your car insurance.

- Deductibles: This is the amount you pay out of pocket for covered repairs or losses before your insurance kicks in. A higher deductible usually means lower premiums, but you’ll have to pay more in the event of a claim.

- Limits: These are the maximum amounts your insurer will pay for covered losses. You should ensure the limits are sufficient to cover your potential expenses.

- Exclusions: These are specific situations or events that are not covered by your insurance. For example, most policies exclude coverage for damages caused by wear and tear or intentional acts.

Implications of Not Understanding Policy Terms, Car insurance companies quotes

Not fully understanding the terms of your policy can lead to various problems, including:

- Unexpected Costs: You may be surprised by unexpected expenses if you don’t understand the deductibles, limits, and exclusions. For example, you might assume your insurance covers a specific type of damage, only to find out later that it’s excluded.

- Unnecessary Coverage: You might be paying for coverage you don’t need or using. This can lead to unnecessary expenses.

- Claim Denials: If you don’t understand the terms of your policy, you might make a claim that is ultimately denied. This can be frustrating and costly.

Choosing the Right Insurance Company: Car Insurance Companies Quotes

You’ve compared quotes and understand the coverage options, but the next step is choosing the right car insurance company. This decision involves more than just price; it’s about finding a company that aligns with your needs and provides long-term value.

Factors to Consider When Choosing a Car Insurance Company

Choosing the right car insurance company is crucial for your financial well-being and peace of mind. It’s more than just about getting the cheapest quote; it’s about finding a company that’s reliable, trustworthy, and offers the coverage you need. Here’s a checklist of factors to consider:

- Financial Stability: Look for companies with strong financial ratings, indicating their ability to pay claims. You can check ratings from organizations like A.M. Best or Standard & Poor’s.

- Customer Service Reputation: Read online reviews and check customer satisfaction ratings to gauge a company’s responsiveness and ability to resolve issues. Look for companies known for their quick claim processing and helpful customer support.

- Coverage Options: Ensure the company offers the coverage you need, such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage. Consider your driving habits and the value of your vehicle when deciding on coverage levels.

- Discounts and Savings Opportunities: Explore available discounts, such as safe driving, good student, or multi-policy discounts. These can significantly reduce your premiums.

- Technology and Convenience: Check if the company offers online tools for managing your policy, paying premiums, and filing claims. This can save you time and effort.

- Claims Handling Process: Inquire about the company’s claims handling process and its reputation for fairness and efficiency. Look for companies with a transparent and straightforward claims process.

Tips for Making an Informed Decision

Once you’ve considered the factors above, use these tips to make an informed decision:

- Get Multiple Quotes: Don’t settle for the first quote you receive. Get quotes from multiple companies to compare prices and coverage options.

- Read the Fine Print: Carefully review the policy documents, including the terms and conditions, to understand the coverage details, exclusions, and limitations.

- Ask Questions: Don’t hesitate to contact insurance companies directly to clarify any questions or concerns you have about their policies or services.

- Consider Your Long-Term Goals: Choose a company that aligns with your financial goals and long-term needs. For example, if you’re planning to purchase a new car in the future, consider a company with a good reputation for handling claims and providing competitive rates.

The Importance of Choosing a Company That Aligns with Long-Term Financial Goals

Choosing a car insurance company that aligns with your long-term financial goals is crucial. For example, if you’re planning to purchase a new car in the future, you might want to consider a company with a strong reputation for handling claims and providing competitive rates for new vehicles.

By understanding the nuances of car insurance quotes and leveraging the strategies Artikeld in this guide, you can effectively compare options, negotiate rates, and ultimately find the best car insurance policy to meet your needs. Remember, knowledge is power, and armed with the right information, you can make confident choices that safeguard your financial well-being and ensure peace of mind on the road.