Car insurance quote south carolina – navigating the world of car insurance in South Carolina can feel like a maze, but it doesn’t have to be. This guide aims to demystify the process, equipping you with the knowledge you need to find the best coverage at the right price. Whether you’re a new driver, a seasoned veteran, or simply looking for ways to save, we’ll explore everything from mandatory coverage requirements to strategies for getting the most out of your insurance.

Understanding your options, comparing quotes, and knowing your rights are crucial steps in securing the right car insurance policy. We’ll delve into the factors that influence your premium, the different types of coverage available, and tips for saving money on your insurance. By the end of this guide, you’ll be well-prepared to navigate the South Carolina car insurance landscape with confidence.

Understanding South Carolina Car Insurance Requirements

Driving a car in South Carolina comes with certain responsibilities, and one of the most important is having the required car insurance. The state mandates specific coverage to protect you, your passengers, and other drivers on the road. Let’s delve into the details of these requirements to ensure you’re fully covered.

Minimum Liability Limits

It’s crucial to understand the minimum liability limits set by the state. These limits determine the maximum amount your insurance company will pay for damages caused by an accident. South Carolina requires the following minimum liability coverage:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident. This coverage pays for medical expenses, lost wages, and other damages incurred by someone injured in an accident caused by you.

- Property Damage Liability: $25,000 per accident. This coverage pays for damages to another person’s vehicle or property if you cause an accident.

These minimum limits are the bare minimum required by law. However, it’s highly recommended to consider increasing your coverage limits to provide better protection in case of a serious accident.

Consequences of Driving Without Insurance

Driving without the required car insurance in South Carolina is a serious offense with significant consequences. Here are some of the penalties you may face:

- Fines and Penalties: You could face a fine of up to $1,000, suspension of your driver’s license, and even jail time. These penalties can be substantial and affect your driving privileges.

- Financial Responsibility: If you cause an accident without insurance, you will be held personally liable for all damages, including medical bills, property repairs, and legal fees. This can lead to significant financial hardship and even bankruptcy.

- Insurance Rate Increases: Even if you don’t get caught driving without insurance, your future insurance rates will likely increase if you have a lapse in coverage. Insurance companies consider driving history and coverage gaps when determining premiums.

Factors Influencing Car Insurance Quotes in South Carolina

In South Carolina, like in any other state, various factors influence the price of car insurance. These factors are used by insurance companies to assess your risk profile, ultimately determining your premium. Understanding these factors can help you make informed decisions about your insurance coverage and potentially lower your premiums.

Driving History

Your driving history is a crucial factor in determining your car insurance quote. This includes your past driving record, including any accidents, traffic violations, and DUI convictions. A clean driving record with no accidents or violations will typically result in lower premiums. On the other hand, a history of accidents or violations will increase your premiums.

For example, a driver with a DUI conviction may face significantly higher premiums than a driver with a clean record. Similarly, multiple accidents within a short period can also lead to a substantial increase in premiums.

Age

Age is another significant factor that influences car insurance rates. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. Therefore, insurance companies often charge higher premiums for younger drivers. As drivers age and gain more experience, their premiums tend to decrease.

For instance, a 18-year-old driver will likely pay higher premiums than a 35-year-old driver with a similar driving record. However, as the 18-year-old driver gains experience and reaches their mid-20s, their premiums may decrease.

Credit Score

Surprisingly, your credit score can also impact your car insurance premiums in South Carolina. While this may seem counterintuitive, insurance companies use credit scores as an indicator of financial responsibility. A good credit score generally suggests that you are more likely to pay your insurance premiums on time, making you a less risky customer.

For instance, a driver with a credit score of 700 or above may qualify for lower premiums compared to a driver with a credit score below 600. However, it’s important to note that credit score is not the only factor considered, and other factors like driving history and age still play a significant role.

Vehicle Type

The type of vehicle you drive is a key factor in determining your insurance premiums. Sports cars and luxury vehicles are often considered higher risk due to their higher performance capabilities and potential for more expensive repairs.

For example, a driver with a high-performance sports car will likely pay higher premiums than a driver with a standard sedan. Similarly, a driver with a new luxury vehicle will likely pay higher premiums than a driver with an older, less expensive vehicle.

Location

Your location in South Carolina can also impact your car insurance rates. Insurance companies consider factors such as population density, crime rates, and traffic congestion. Areas with higher crime rates or more traffic congestion may have higher insurance premiums.

For example, a driver living in a densely populated city with high crime rates may pay higher premiums than a driver living in a rural area with lower crime rates.

Coverage Options

The type and amount of coverage you choose can also significantly affect your premiums. Comprehensive and collision coverage, which protect you from damage caused by non-collision events and accidents, respectively, will generally increase your premiums.

For instance, a driver with full coverage, including comprehensive and collision, will likely pay higher premiums than a driver with liability-only coverage. However, it’s essential to consider your individual needs and financial situation when choosing coverage options.

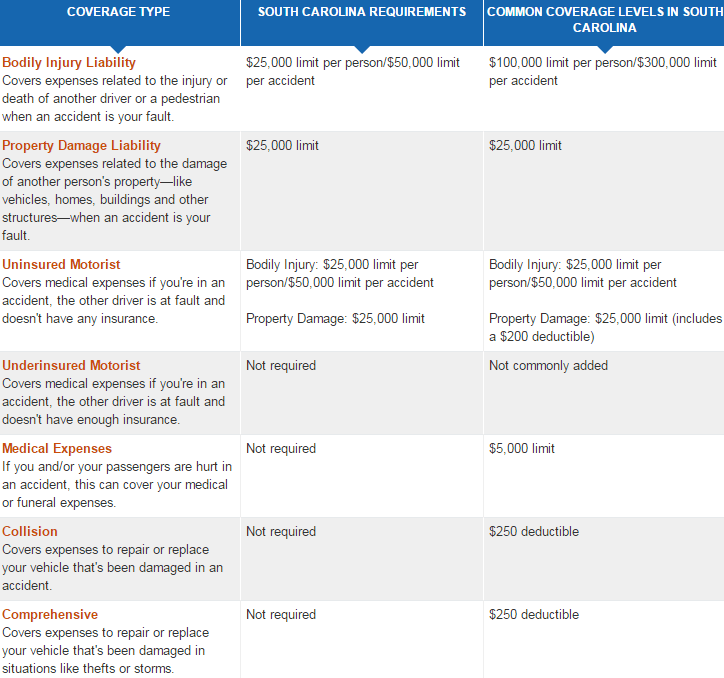

Types of Car Insurance Coverage Available in South Carolina

South Carolina law requires all drivers to carry liability insurance. However, you can choose additional coverage to protect yourself and your vehicle. Here’s a detailed look at the various types of car insurance coverage available in South Carolina:

Liability Coverage

Liability insurance is mandatory in South Carolina. It covers the other party’s damages in case of an accident that you cause. This includes bodily injury and property damage. There are two main types of liability coverage:

* Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for the other driver and passengers if you cause an accident.

* Property Damage Liability: Covers repairs or replacement costs for the other driver’s vehicle or property if you cause an accident.

The minimum liability coverage requirements in South Carolina are:

* $25,000 per person for bodily injury

* $50,000 per accident for bodily injury

* $25,000 per accident for property damage

However, it’s generally advisable to have higher liability limits than the minimum requirements to protect yourself from significant financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of who is at fault. This coverage is optional, but it’s highly recommended if you have a financed or leased vehicle.

* Benefits: Collision coverage helps protect you from financial burdens in case of an accident. It can cover repairs or replacement costs for your vehicle, regardless of fault.

* Drawbacks: Collision coverage can be expensive, especially for newer vehicles. If your vehicle is older and worth less, it might not be financially worthwhile to purchase collision coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than collisions, such as:

* Theft

* Vandalism

* Fire

* Natural disasters (hail, flood, etc.)

This coverage is optional, but it can be beneficial for newer vehicles or those with high value.

* Benefits: Comprehensive coverage provides peace of mind by protecting your vehicle from unexpected damages. It can help cover repairs or replacement costs for your vehicle, even if you are not at fault.

* Drawbacks: Comprehensive coverage can be expensive, especially for newer vehicles. It may not be necessary for older vehicles with lower value.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and other damages.

* Benefits: UM/UIM coverage provides financial protection in case of an accident with an uninsured or underinsured driver. It can help cover your medical expenses, lost wages, and other damages.

* Drawbacks: UM/UIM coverage can be expensive, but it’s essential for protecting yourself from financial losses in the event of an accident with an uninsured or underinsured driver.

Table Comparing Coverage Options

| Coverage Type | Cost | Benefits |

|---|---|---|

| Liability | Mandatory | Protects you from financial losses in case you cause an accident by covering the other party’s damages. |

| Collision | Optional | Covers repairs or replacement costs for your vehicle if you are involved in an accident, regardless of fault. |

| Comprehensive | Optional | Covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, and natural disasters. |

| Uninsured/Underinsured Motorist | Optional | Protects you from financial losses if you are involved in an accident with an uninsured or underinsured driver. |

Finding the Best Car Insurance Quotes in South Carolina: Car Insurance Quote South Carolina

Getting the best car insurance quote in South Carolina involves a strategic approach to comparing different providers and understanding the factors that influence pricing. This process involves researching various insurance companies, obtaining quotes, comparing them side-by-side, and exploring available discounts.

Obtaining Car Insurance Quotes

To find the best car insurance quotes in South Carolina, you’ll need to contact multiple insurance providers. Here’s a step-by-step guide:

- Identify Potential Providers: Start by researching reputable car insurance companies operating in South Carolina. You can explore online resources, read customer reviews, and seek recommendations from friends or family.

- Gather Required Information: Before contacting providers, gather essential information about your vehicle, driving history, and personal details. This includes your vehicle’s make, model, year, VIN, your driving record, age, address, and contact information.

- Request Quotes Online: Many insurance companies offer online quote tools. These tools allow you to enter your information and receive a preliminary quote within minutes. This is a convenient way to compare quotes from multiple providers.

- Contact Providers Directly: If you prefer personalized assistance, contact insurance providers directly by phone or email. This allows you to discuss your specific needs and receive tailored quotes.

- Compare Quotes Side-by-Side: Once you’ve obtained quotes from several providers, compare them side-by-side. Pay attention to the coverage offered, deductibles, premiums, and any additional features or discounts.

Comparing Car Insurance Quotes Effectively

When comparing quotes, consider the following factors to ensure you’re getting the best value:

- Coverage Levels: Compare the coverage offered by each provider. Ensure that the quotes you’re comparing include the same level of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductibles: Higher deductibles generally result in lower premiums. However, ensure that the deductible amount is within your budget in case of an accident.

- Premiums: Compare the monthly or annual premiums for each quote. Consider the overall cost of insurance and how it fits into your budget.

- Discounts: Explore available discounts from each provider. These can include discounts for good driving records, safety features, bundling policies, or being a member of certain organizations.

- Customer Service: Read customer reviews and consider the reputation of each provider for customer service. This can be important if you need to file a claim or make changes to your policy.

Considering Discounts and Special Offers

Insurance companies often offer discounts to reduce premiums. Here are some common discounts to explore:

- Good Driver Discount: Drivers with a clean driving record and no accidents or traffic violations may qualify for a good driver discount.

- Safety Feature Discount: Vehicles equipped with safety features like anti-theft devices, airbags, or anti-lock brakes may qualify for a discount.

- Bundling Discount: Bundling multiple insurance policies, such as car insurance and homeowners insurance, can often lead to a discount.

- Loyalty Discount: Some insurance companies offer discounts to existing customers who renew their policies.

- Student Discount: Good students with high GPAs may be eligible for a discount.

- Military Discount: Active duty military personnel or veterans may qualify for a discount.

- Group Discount: Membership in certain organizations, such as professional associations or alumni groups, may qualify for a discount.

Tips for Saving on Car Insurance in South Carolina

Saving money on your car insurance in South Carolina is possible with a few strategic steps. By understanding the factors that influence your premiums and taking advantage of available discounts, you can lower your costs without compromising your coverage.

Improving Driving Habits and Maintaining a Good Driving Record

A clean driving record is a key factor in determining your insurance rates. Maintaining a good driving record is crucial for lowering your premiums.

- Avoid Traffic Violations: Speeding tickets, reckless driving, and DUI convictions can significantly increase your insurance rates.

- Practice Defensive Driving: Learning defensive driving techniques can help you avoid accidents and maintain a clean driving record.

- Take Defensive Driving Courses: Completing a defensive driving course can sometimes earn you a discount on your insurance premiums.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant savings.

- Bundling with Homeowners or Renters Insurance: Insurance companies often offer discounts for bundling multiple policies. By insuring your home and car with the same company, you can potentially save on both premiums.

Taking Advantage of Discounts

Insurance companies offer a variety of discounts to their customers. These discounts can significantly reduce your premiums.

- Good Student Discount: Maintaining good grades in school can earn you a discount on your car insurance.

- Safe Driver Discount: Many insurance companies offer discounts to drivers with a clean driving record.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS tracking systems, can qualify you for a discount.

- Loyalty Discount: Insurance companies often reward loyal customers with discounts for staying with them for a certain period of time.

- Multi-Car Discount: If you insure multiple cars with the same company, you may be eligible for a multi-car discount.

Understanding South Carolina’s No-Fault System

South Carolina operates under a modified no-fault insurance system, which means that drivers are primarily responsible for covering their own losses after an accident, regardless of who is at fault. This system aims to streamline the claims process and reduce the number of lawsuits.

In a no-fault system, your own insurance company handles your medical expenses and lost wages, up to a certain limit, regardless of who caused the accident. This limit is known as the Personal Injury Protection (PIP) coverage, which is mandatory in South Carolina. However, there are exceptions to this rule.

Finding the right car insurance quote in South Carolina can be a challenge, especially with so many options available. While you’re securing your car’s future, remember to also consider your own financial security with Prudential Life Insurance: Secure Your Future. A comprehensive life insurance plan can provide peace of mind knowing your loved ones are protected, even in unforeseen circumstances.

Just like getting the best car insurance quote, securing the right life insurance policy is a crucial step towards a financially stable future.

When Fault is Considered

There are specific circumstances where fault is considered in South Carolina’s no-fault system. If your injuries exceed the PIP coverage limit, or if you have been seriously injured, you can sue the at-fault driver to recover additional damages.

Here are some situations where fault is considered:

- Serious Injuries: If your injuries are deemed serious, such as permanent disfigurement, death, or loss of a bodily function, you can pursue a claim against the at-fault driver.

- Exceeding PIP Coverage: If your medical expenses or lost wages exceed your PIP coverage limit, you can seek compensation from the at-fault driver for the remaining amount.

- Uninsured or Underinsured Motorists: If the at-fault driver is uninsured or underinsured, you can file a claim against your own insurance policy for uninsured/underinsured motorist (UM/UIM) coverage.

Filing a Claim Under the No-Fault System

If you are involved in an accident, you should contact your insurance company as soon as possible to report the incident and file a claim. You will need to provide them with details of the accident, including the date, time, location, and any other relevant information.

Your insurance company will then investigate the claim and determine your eligibility for benefits. If your claim is approved, they will begin processing your payments for medical expenses and lost wages. If your injuries are severe or exceed your PIP coverage limit, you may need to consult with an attorney to determine your options for pursuing a claim against the at-fault driver.

Getting a car insurance quote in South Carolina can feel like navigating a maze of options. But just as you can find modern, streamlined solutions for your car insurance, you can also find them for your life insurance. Check out Ethos Life Insurance: A Modern Approach to Coverage , which offers a simple and transparent online experience. Similarly, when comparing car insurance quotes in South Carolina, make sure to consider factors like your driving history and the type of coverage you need.

Navigating South Carolina’s Insurance Laws and Regulations

South Carolina has a comprehensive set of laws and regulations governing car insurance, designed to protect both drivers and consumers. Understanding these rules is essential for navigating the insurance landscape and ensuring you have the right coverage.

South Carolina’s Compulsory Insurance Requirements

South Carolina requires all drivers to carry a minimum amount of liability insurance. This means you must have insurance that covers damages to other people and their property if you are found at fault in an accident. The minimum requirements are:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $25,000 per accident

It’s important to note that these are minimums, and you may want to consider higher coverage limits to protect yourself financially in case of a serious accident.

The Role of the South Carolina Department of Insurance, Car insurance quote south carolina

The South Carolina Department of Insurance (SCDOI) plays a crucial role in regulating the state’s insurance industry. It ensures that insurance companies operate fairly and transparently, protects consumers from unfair practices, and provides information and resources to help people understand their insurance options.

Filing Complaints and Resolving Disputes

If you have a dispute with your insurance company, the SCDOI offers a complaint resolution process. You can file a complaint online, by mail, or by phone. The SCDOI will investigate your complaint and attempt to mediate a resolution between you and the insurance company. If the dispute cannot be resolved through mediation, you may have the option to pursue legal action.

Exploring Car Insurance Options for Specific Situations

Finding the right car insurance policy can be a challenge, especially if you have a unique situation. Whether you have a DUI conviction, drive a high-risk vehicle, or have other special needs, there are insurance options available to you. This section will explore some of these options and provide guidance on navigating the insurance landscape.

Car Insurance for Drivers with a DUI Conviction or a Poor Driving Record

Drivers with a DUI conviction or a poor driving record are considered high-risk by insurance companies. This means they may have to pay higher premiums or face difficulty finding coverage.

- Consider a SR-22 Filing: If you’ve been convicted of a DUI, your state may require you to file an SR-22 form with your insurance company. This form certifies that you have the minimum required liability insurance coverage and helps ensure that you remain insured.

- Shop Around for Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurance companies, as some may be more lenient with drivers who have a DUI or a poor driving record.

- Improve Your Driving Record: Taking defensive driving courses, maintaining a clean driving record, and avoiding traffic violations can help you improve your driving record and potentially lower your insurance premiums over time.

- Consider a High-Risk Insurance Company: Specialized insurance companies cater to high-risk drivers and may be more willing to offer coverage than standard insurance providers.

Car Insurance for High-Risk Vehicles or Drivers with Unique Needs

High-risk vehicles, such as sports cars, modified cars, or vehicles with a high horsepower rating, may be more expensive to insure. Additionally, drivers with unique needs, such as those who frequently drive in high-traffic areas or have a history of accidents, may also face higher premiums.

- Choose the Right Coverage: You may not need every type of car insurance coverage available. Review your needs and consider opting for the minimum coverage required by your state.

- Explore Discounts: Insurance companies offer discounts for various factors, such as good driving records, safety features, and bundling multiple insurance policies.

- Consider a Specialty Insurance Company: Specialty insurance companies often specialize in insuring high-risk vehicles or drivers with unique needs. These companies may have more flexible underwriting guidelines and offer competitive rates.

Car Insurance for Classic Cars and Other Specialty Vehicles

Classic cars, antique cars, and other specialty vehicles often require specialized insurance coverage. Standard car insurance policies may not adequately cover these vehicles due to their unique value and restoration costs.

- Seek Out a Specialty Insurance Provider: Specialty insurance providers offer policies tailored to classic cars and other specialty vehicles. These policies may include agreed value coverage, which ensures you receive the full value of your vehicle in case of a total loss.

- Consider a Stated Value Policy: A stated value policy allows you to set the value of your vehicle, which can be helpful for classic cars and other specialty vehicles that have a unique or fluctuating market value.

- Choose the Right Coverage: You may need additional coverage for your classic car, such as coverage for agreed value, restoration costs, or transportation expenses.

Understanding the Importance of Car Insurance in South Carolina

Driving without car insurance in South Carolina can lead to significant financial and legal consequences. It’s crucial to understand the risks involved and the benefits of having adequate coverage.

Financial Risks of Driving Without Car Insurance

Driving without car insurance exposes you to substantial financial risks. In the event of an accident, you could be held personally liable for all damages, including medical expenses, property repairs, and lost wages. This could potentially bankrupt you, especially if you’re involved in a serious accident.

Legal Consequences of Driving Without Insurance in South Carolina

South Carolina law requires all drivers to have a minimum amount of liability insurance. If you’re caught driving without insurance, you can face a variety of legal penalties. These penalties include:

- Fines of up to $1,000

- Suspension of your driver’s license

- Impoundment of your vehicle

- Jail time (in some cases)

Furthermore, driving without insurance can also affect your ability to register your vehicle and obtain a driver’s license in the future.

Real-Life Examples of Car Insurance Benefits

Car insurance has helped countless individuals in South Carolina navigate difficult situations. For instance, a driver involved in an accident might face significant medical bills and property damage. Their car insurance policy would cover these expenses, preventing them from financial ruin. Another example could be a driver who accidentally hits a parked car. Car insurance would cover the cost of repairs, protecting them from legal action and financial hardship.

Resources for Car Insurance Information in South Carolina

Navigating the world of car insurance can feel overwhelming, especially with the various regulations and options available in South Carolina. Fortunately, several resources can help you understand your coverage needs and find the best rates.

Government Websites

Government websites are excellent starting points for understanding the legal requirements and regulations surrounding car insurance in South Carolina. These websites provide official information and resources, ensuring accuracy and reliability.

- South Carolina Department of Insurance: This website provides information on car insurance requirements, consumer rights, and how to file complaints. It also offers a directory of licensed insurance companies in the state.

- South Carolina Department of Motor Vehicles: This website provides information on vehicle registration, licensing, and other related matters. It also offers resources on car insurance requirements and how to obtain proof of insurance.

Consumer Advocacy Groups

Consumer advocacy groups can provide unbiased information and guidance on car insurance, helping you make informed decisions about your coverage.

- Consumer Reports: This organization provides independent ratings and reviews of car insurance companies, helping you compare different providers based on customer satisfaction and financial stability.

- National Association of Insurance Commissioners (NAIC): This organization provides information on insurance regulations and consumer protection issues, offering resources and tools for navigating the insurance landscape.

Insurance Industry Organizations

Insurance industry organizations can offer insights into the industry and provide information on different types of coverage and insurance companies.

- Insurance Information Institute (III): This organization provides information on various insurance topics, including car insurance, and offers resources for consumers to understand their coverage options.

- American Insurance Association (AIA): This organization represents property and casualty insurance companies, providing information on industry trends and consumer protection issues.

Seeking Advice from a Qualified Insurance Agent or Broker

While online resources are valuable, seeking advice from a qualified insurance agent or broker can be crucial for finding the best car insurance coverage for your needs. They can help you understand your options, compare different policies, and find the most suitable coverage at a competitive price.

- Independent Insurance Agents: These agents represent multiple insurance companies, allowing them to compare different policies and find the best fit for your needs.

- Insurance Brokers: These professionals act as intermediaries between you and insurance companies, helping you navigate the process and negotiate the best terms.

Armed with the information provided in this guide, you’re now equipped to confidently navigate the car insurance landscape in South Carolina. Remember, understanding your options, comparing quotes, and taking advantage of discounts are key to finding the best policy for your needs and budget. By being informed and proactive, you can ensure you have the right coverage to protect yourself, your vehicle, and your financial well-being on the road.