Car insurance quotes OH are essential for any Ohio resident who wants to drive legally. Understanding how these quotes work and what factors influence them is crucial to securing the best coverage at the most affordable price.

Ohio’s car insurance market is competitive, with numerous providers offering a wide range of coverage options and discounts. This means you have the power to compare quotes and choose a policy that meets your individual needs and budget.

Understanding Car Insurance Quotes in Ohio

Navigating the world of car insurance quotes in Ohio can be a bit overwhelming. There are many factors that affect your rates, and understanding them can help you find the best coverage at the most affordable price. This guide will help you understand how car insurance quotes work in Ohio.

Factors Influencing Car Insurance Quotes in Ohio

The price of car insurance is determined by several factors. Insurance companies use these factors to assess your risk and determine how much to charge you for coverage.

- Your Driving Record: This is one of the most significant factors. A clean driving record with no accidents or violations will lead to lower rates. However, if you have had accidents or traffic violations, your rates will be higher. The severity of the violations or accidents also plays a role in determining your rates.

- Your Age and Gender: Younger drivers, especially those under 25, typically pay higher premiums. This is because they have less experience on the road and are statistically more likely to be involved in accidents. Gender can also play a role, as insurance companies have found that young men are more likely to be involved in accidents than young women.

- Your Vehicle: The type of car you drive can significantly affect your insurance rates. Sports cars and luxury vehicles are generally more expensive to insure because they are more likely to be stolen or involved in accidents. The safety features of your car, such as anti-lock brakes and airbags, can also influence your rates.

- Your Location: Where you live can impact your car insurance rates. Cities with higher crime rates and more traffic congestion tend to have higher insurance premiums. This is because the risk of accidents and theft is higher in these areas.

- Your Credit Score: In some states, including Ohio, insurance companies can use your credit score to determine your insurance rates. People with good credit scores are typically considered lower risk and are often offered lower premiums. However, this practice is controversial, and some states have banned it.

- Your Coverage: The type and amount of coverage you choose will also impact your premiums. More extensive coverage, such as comprehensive and collision coverage, will cost more than basic liability coverage.

- Your Driving History: This includes factors such as your driving record, the number of miles you drive, and where you drive. For example, if you have a long commute, you may pay higher premiums because you are more likely to be involved in an accident.

Differences in Car Insurance Quotes

Car insurance quotes can vary significantly between different providers in Ohio. Here are some key differences you should consider:

- Coverage Options: Different insurance companies offer various coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. It’s important to compare the coverage options offered by different providers to ensure you’re getting the right protection for your needs.

- Discounts: Insurance companies often offer discounts for safe drivers, good students, and those who bundle their insurance policies. Make sure to ask about available discounts when you’re getting quotes.

- Customer Service: It’s also essential to consider the customer service experience offered by different providers. Look for companies that have a good reputation for responsiveness and helpfulness.

- Financial Stability: Before choosing an insurance company, it’s wise to research their financial stability. You want to make sure the company can pay out claims if you need them.

Ohio’s Legal Requirements for Car Insurance

In Ohio, all drivers are required to have at least the following minimum liability insurance coverage:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

This means that if you cause an accident that injures someone or damages their property, your insurance company will pay up to these limits. However, it’s important to note that these minimum limits may not be enough to cover all of your potential liability. You may want to consider purchasing higher limits to protect yourself financially in case of a serious accident.

Obtaining Car Insurance Quotes in Ohio

Getting car insurance quotes in Ohio is a crucial step in finding the right coverage at the best price. You can obtain quotes from various insurance companies online, making the process convenient and efficient.

Getting Car Insurance Quotes Online in Ohio

To obtain car insurance quotes online in Ohio, you can follow these steps:

- Visit the Insurance Company’s Website: Start by visiting the website of the insurance company you’re interested in. Most major insurance providers have user-friendly online quote forms.

- Provide Basic Information: You’ll be asked to provide some basic information, including your name, address, date of birth, and driving history. This information helps the insurance company assess your risk profile.

- Enter Vehicle Details: You’ll need to provide details about your vehicle, such as the year, make, model, and VIN (Vehicle Identification Number). This helps the insurance company determine the value of your car and the potential cost of repairs.

- Choose Coverage Options: You’ll have the opportunity to select the type of coverage you want, such as liability, collision, and comprehensive coverage. The more coverage you choose, the higher your premium will be.

- Get Your Quote: Once you’ve provided all the necessary information, the insurance company will generate a quote for you. You can compare quotes from different insurance companies to find the best deal.

Comparing Multiple Quotes, Car insurance quotes oh

Comparing multiple car insurance quotes is essential to ensure you’re getting the best possible price. You can use online comparison websites, which allow you to enter your information once and receive quotes from multiple insurance companies simultaneously.

It’s important to compare quotes from at least three to five different insurance companies.

This helps you get a better understanding of the market and find the most competitive rates.

Types of Car Insurance Coverage in Ohio

Ohio requires all drivers to have at least the following minimum liability coverage:

- Bodily Injury Liability: This coverage protects you financially if you injure someone in an accident. The minimum coverage required in Ohio is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage protects you financially if you damage someone else’s property in an accident. The minimum coverage required in Ohio is $25,000 per accident.

In addition to the minimum liability coverage, you may also want to consider the following optional coverages:

- Collision Coverage: This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs to your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, or a natural disaster.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault.

Factors Affecting Car Insurance Rates in Ohio

Car insurance premiums in Ohio are determined by a variety of factors, including your driving history, the type of vehicle you drive, and your personal characteristics. Understanding these factors can help you make informed decisions about your car insurance coverage and potentially save money on your premiums.

Driving History

Your driving history is one of the most significant factors influencing your car insurance rates in Ohio. Insurance companies consider your driving record, including accidents, traffic violations, and driving convictions, to assess your risk as a driver. A clean driving record with no accidents or violations will typically result in lower premiums.

For instance, a driver with multiple speeding tickets or a DUI conviction is likely to pay higher premiums compared to a driver with a clean record.

Vehicle Type and Age

The type and age of your vehicle also play a crucial role in determining your car insurance rates in Ohio.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance vehicles are generally considered riskier to insure due to their higher speeds and potential for damage. As a result, they often come with higher premiums compared to standard sedans or hatchbacks.

- Vehicle Age: Newer vehicles typically have more safety features and are less prone to breakdowns, resulting in lower insurance rates. Older vehicles, on the other hand, may have higher premiums due to increased risk of accidents and repairs.

Personal Characteristics

Personal characteristics, such as your age, gender, credit score, and location, can also affect your car insurance rates in Ohio.

- Age: Younger drivers, especially those under 25, often face higher premiums due to their lack of experience and higher risk of accidents.

- Gender: In some cases, insurance companies may consider gender when determining rates. For example, in Ohio, males may pay slightly higher premiums than females, reflecting historical trends in accident rates.

- Credit Score: Your credit score can impact your car insurance rates in some states, including Ohio. This is because insurance companies use credit scores as an indicator of financial responsibility, and a higher credit score may lead to lower premiums.

- Location: Your location can influence your car insurance rates due to factors like traffic density, crime rates, and weather conditions. For example, drivers in urban areas with high traffic and crime rates may pay higher premiums compared to those in rural areas.

Tips for Getting Affordable Car Insurance in Ohio

Finding affordable car insurance in Ohio can be a challenge, but there are strategies you can implement to reduce your premiums. Here are some tips for getting the best rates.

Driving Record and Safety Features

A clean driving record is crucial for lower car insurance rates. In Ohio, drivers with traffic violations, accidents, or DUI convictions will face higher premiums.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents, as these significantly impact your insurance rates. Drive defensively and follow traffic laws to minimize risks.

- Enroll in Defensive Driving Courses: Completing a defensive driving course can sometimes lower your insurance premiums, demonstrating your commitment to safe driving practices. Check with your insurer for available discounts.

- Invest in Safety Features: Cars equipped with advanced safety features like anti-theft devices, airbags, and anti-lock brakes often qualify for discounts. Consider these features when purchasing a new vehicle.

Shopping Around and Comparing Quotes

Obtaining quotes from multiple insurers is essential for finding the best rates. Avoid settling for the first quote you receive, as rates can vary significantly.

- Compare Quotes from Multiple Insurers: Use online comparison tools or contact insurers directly to get quotes. Compare rates, coverage options, and discounts offered.

- Consider Different Coverage Levels: Evaluate your coverage needs and consider whether you can reduce coverage levels, such as decreasing your collision or comprehensive coverage, to lower premiums.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-policy discounts, and ensure you qualify for all applicable discounts.

Negotiating Rates with Providers

Negotiating with insurance providers can be effective in securing lower rates. Be prepared to discuss your driving record, vehicle details, and coverage needs.

- Negotiate Your Premium: Contact your insurer and explain your situation, highlighting your good driving record and any safety features in your vehicle. Be prepared to discuss alternative coverage options or higher deductibles to reduce premiums.

- Explore Bundling Options: Bundling your car insurance with other insurance policies, such as home or renter’s insurance, can lead to significant discounts. Inquire about bundling options and compare rates.

Understanding Ohio’s Car Insurance Laws

Ohio has specific car insurance laws that all drivers must comply with. These laws are designed to protect drivers, passengers, and pedestrians in case of accidents. Understanding these laws is crucial for all Ohio drivers.

Mandatory Car Insurance Coverage Requirements in Ohio

Ohio requires all drivers to carry a minimum amount of liability insurance coverage. This mandatory coverage is intended to protect others in case of an accident caused by the insured driver. These minimum coverage requirements are as follows:

- Bodily Injury Liability: This covers injuries to others in an accident you cause. Ohio law requires a minimum of $25,000 per person and $50,000 per accident. This means that if you cause an accident that injures one person, your insurance will pay up to $25,000 for their medical expenses and lost wages. If multiple people are injured, your insurance will pay up to $50,000 total.

- Property Damage Liability: This covers damage to another person’s property in an accident you cause. Ohio law requires a minimum of $25,000 per accident. This means that if you cause an accident that damages someone else’s car or property, your insurance will pay up to $25,000 for repairs or replacement.

Consequences of Driving Without Insurance in Ohio

Driving without the required minimum car insurance in Ohio is illegal and can have serious consequences. Here are some of the penalties you could face:

- Fines: You could face fines of up to $500 for driving without insurance.

- Suspension of Driver’s License: Your driver’s license could be suspended until you provide proof of insurance.

- Impoundment of Vehicle: Your vehicle could be impounded until you provide proof of insurance.

- Jail Time: In some cases, driving without insurance could result in jail time, especially if you are involved in an accident.

- Financial Responsibility: Even if you don’t have insurance, you are still legally responsible for any damages or injuries you cause in an accident. This means you could be sued and held personally liable for all costs associated with the accident, including medical expenses, property damage, and lost wages.

Filing a Car Insurance Claim in Ohio

If you are involved in a car accident, you will need to file a claim with your insurance company to seek compensation for damages or injuries. Here are the general steps involved in filing a car insurance claim in Ohio:

- Report the Accident: Immediately contact your insurance company to report the accident. Provide them with all the necessary details, including the date, time, location, and the other driver’s information.

- Gather Information: Collect as much information as possible about the accident, including:

- The names and contact information of all drivers and passengers involved

- The license plate numbers of all vehicles involved

- The names and contact information of any witnesses

- Photographs or videos of the accident scene and any damage to vehicles

- Police report number, if applicable

- Submit a Claim: Your insurance company will provide you with a claim form to fill out. Make sure to provide accurate and complete information.

- Cooperate with Your Insurance Company: Be prepared to answer your insurance company’s questions and provide any requested documentation.

- Negotiate a Settlement: Once your insurance company has reviewed your claim, they will offer you a settlement. You have the right to negotiate this settlement if you believe it is not fair. If you cannot reach an agreement with your insurance company, you may need to seek legal advice.

Car Insurance Discounts Available in Ohio

In Ohio, numerous car insurance discounts are available, potentially saving you money on your premiums. These discounts vary by insurer and can significantly reduce your overall costs.

Common Car Insurance Discounts in Ohio

Here are some common car insurance discounts offered in Ohio:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically for three to five years, without accidents, violations, or claims.

- Safe Driver Discount: Similar to the good driver discount, this reward is given to drivers who maintain a safe driving record, demonstrated by their driving history.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you might be eligible for a discount on your premiums.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in a substantial discount.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS trackers, can make your car less appealing to thieves and may result in a lower premium.

- Good Student Discount: This discount is often offered to students who maintain a good academic record, reflecting their responsible nature.

- Low Mileage Discount: If you drive less than a certain number of miles annually, you may qualify for a discount as your risk of accidents is lower.

- Loyalty Discount: Some insurers reward long-term customers with loyalty discounts for their continued business.

Eligibility Criteria for Car Insurance Discounts in Ohio

The eligibility criteria for car insurance discounts in Ohio vary by insurer and can include factors like:

- Driving Record: This includes the number of accidents, violations, or claims you’ve had.

- Age: Drivers under 25 are typically considered higher risk and may have limited access to discounts.

- Vehicle Type: Certain vehicle models may be considered safer and therefore qualify for discounts.

- Credit Score: Some insurers use credit score as a factor in determining insurance rates and discounts.

- Location: Your location can affect your insurance rates due to factors like traffic density and crime rates.

Tips for Maximizing Car Insurance Discounts in Ohio

Here are some tips to maximize your car insurance discounts:

- Maintain a Clean Driving Record: Avoid accidents, violations, and claims to qualify for good driver discounts.

- Shop Around: Compare quotes from multiple insurers to find the best discounts.

- Bundle Your Policies: Combining your car insurance with other insurance policies can result in significant savings.

- Consider Defensive Driving Courses: Taking a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

- Install Anti-theft Devices: Adding anti-theft devices to your car can make it less appealing to thieves and reduce your premium.

- Ask About Available Discounts: When you contact an insurer, inquire about all available discounts you might be eligible for.

Choosing the Right Car Insurance Provider in Ohio

Finding the best car insurance provider in Ohio can feel overwhelming, with so many options available. But don’t worry! We’ll guide you through the process, helping you choose the provider that best suits your needs and budget.

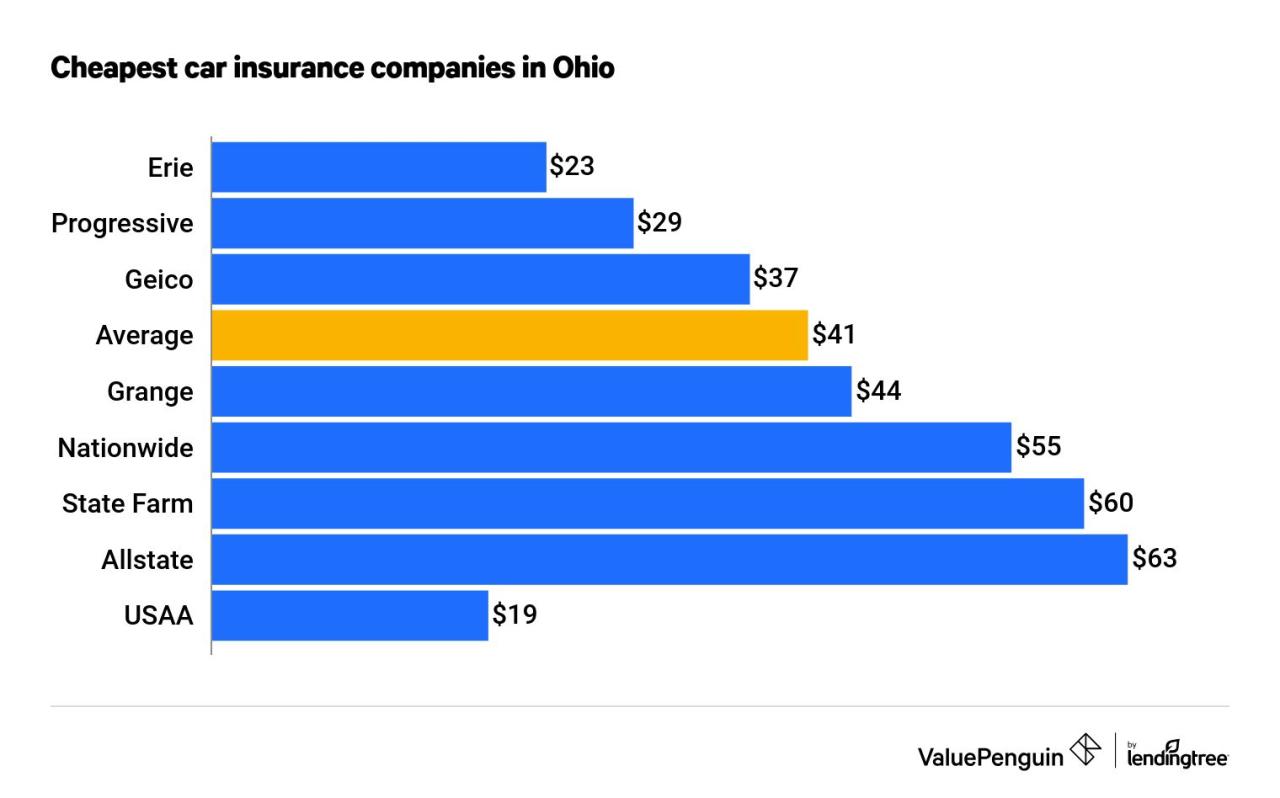

Comparing Car Insurance Providers in Ohio

To make an informed decision, it’s essential to compare different providers based on their features, benefits, and pricing. Here’s a table outlining key aspects of some prominent car insurance providers in Ohio:

| Provider | Coverage Options | Pricing | Customer Service | Claims Handling |

|—|—|—|—|—|

| Progressive | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Competitive | Excellent online tools and 24/7 phone support | Fast and efficient claims processing |

| State Farm | Similar to Progressive | Competitive | Strong network of local agents | Generally positive customer reviews |

| GEICO | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Often competitive | User-friendly website and mobile app | Streamlined claims process |

| Nationwide | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Varies based on factors | Extensive agent network and online resources | Positive customer reviews for claims handling |

| Erie Insurance | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Competitive, especially for good drivers | Strong regional presence and personalized service | Generally efficient claims processing |

Choosing the Best Car Insurance Provider

The ideal car insurance provider depends on your individual needs and preferences. Here’s a guide to help you make the right choice:

* Consider your coverage needs: Determine the level of coverage you require based on your driving habits, vehicle value, and financial situation.

* Compare prices: Get quotes from multiple providers to compare rates and identify the most affordable option.

* Evaluate customer service: Research customer reviews and ratings to gauge the provider’s responsiveness and efficiency in handling inquiries and claims.

* Check claims handling: Explore the provider’s claims process and customer satisfaction with their claims handling procedures.

* Look for discounts: Inquire about available discounts to potentially lower your premiums.

Remember, choosing the right car insurance provider is a crucial decision that can impact your financial well-being in case of an accident.

Car Insurance for High-Risk Drivers in Ohio

Being labeled a high-risk driver in Ohio can make finding affordable car insurance a challenge. Insurance companies assess risk based on various factors, and those deemed high-risk often face higher premiums.

Factors Contributing to High-Risk Driver Classification

Insurance companies consider several factors when determining a driver’s risk level. Here are some common factors that can lead to a high-risk classification:

- Poor Driving Record: A history of traffic violations, accidents, or DUI convictions can significantly increase your risk rating.

- Age and Experience: Younger drivers and those with limited driving experience are often considered higher risk due to their lack of experience.

- Type of Vehicle: Certain vehicles, like high-performance cars or those with a history of theft, are associated with higher risk and can result in higher premiums.

- Driving History: The number of miles you drive annually and your driving habits (e.g., commuting in high-traffic areas) can influence your risk assessment.

- Credit History: In Ohio, insurance companies can use your credit history as a factor in determining your rates. A poor credit history can indicate a higher risk of financial instability, which may be reflected in your insurance premiums.

Strategies for Finding Affordable Car Insurance Options

Even if you’re considered a high-risk driver, there are strategies you can employ to find affordable car insurance options in Ohio:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Online comparison websites can streamline this process.

- Consider a High-Risk Insurance Provider: Some insurance companies specialize in insuring high-risk drivers. These companies may have more lenient underwriting guidelines and offer more competitive rates for those with a less-than-perfect driving record.

- Improve Your Driving Record: Taking a defensive driving course or maintaining a clean driving record can help improve your risk rating over time.

- Increase Your Deductible: Choosing a higher deductible can lower your premium. However, ensure you can afford to pay the deductible in case of an accident.

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Ask About Discounts: Many insurance companies offer discounts for good students, safe drivers, and other factors. Inquire about available discounts to see if you qualify.

Car Insurance for Young Drivers in Ohio: Car Insurance Quotes Oh

Young drivers in Ohio face a unique set of challenges when it comes to car insurance. Insurance companies perceive them as higher risk due to their lack of experience and statistical likelihood of accidents. This results in significantly higher premiums compared to older drivers.

Factors Affecting Car Insurance Rates for Young Drivers in Ohio

Several factors influence car insurance rates for young drivers in Ohio. These factors are used by insurance companies to assess the risk associated with insuring a young driver.

- Age and Driving Experience: The most significant factor is age and driving experience. Younger drivers, especially those with less than a year of experience, are considered higher risk due to their lack of experience. The longer a driver has been on the road without accidents, the lower their rates tend to be.

- Driving Record: Any accidents, traffic violations, or DUI convictions will significantly increase insurance rates. Even a minor violation can lead to a considerable jump in premiums. A clean driving record is crucial for young drivers to keep their rates manageable.

- Vehicle Type: The type of vehicle a young driver owns can also affect insurance rates. High-performance or expensive vehicles are often considered riskier to insure, leading to higher premiums.

- Location: The location where a young driver lives can also influence their insurance rates. Areas with higher rates of accidents or crime tend to have higher insurance premiums.

- Credit History: In some states, including Ohio, insurance companies may consider your credit history when determining your rates. This is because a poor credit history can be an indicator of risk-taking behavior.

- Good Student Discount: Maintaining good grades can qualify a young driver for a discount. This is because good students tend to be more responsible and have a lower risk of accidents.

Tips for Young Drivers to Obtain Affordable Car Insurance in Ohio

Here are some practical tips for young drivers to secure affordable car insurance in Ohio:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Online comparison websites can help simplify this process.

- Maintain a Clean Driving Record: This is crucial for young drivers. Avoid traffic violations and accidents, as these can significantly increase your premiums.

- Consider a Used Car: Purchasing a less expensive, older car can lead to lower insurance premiums.

- Increase Your Deductible: A higher deductible can lower your monthly premiums. However, be sure you can afford to pay the deductible in case of an accident.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

- Bundle Your Policies: If you have other insurance needs, like renters or homeowners insurance, consider bundling them with your car insurance. This can often lead to significant savings.

- Ask About Discounts: Many insurance companies offer discounts for good students, safe drivers, and other factors. Be sure to ask about any discounts you may qualify for.

Car Insurance for Seniors in Ohio

Seniors in Ohio have unique car insurance needs, and understanding these needs can help them find affordable and appropriate coverage. While some insurance companies may offer discounts for seniors, others may charge higher rates due to factors like driving habits and health conditions.

Car Insurance Rates for Seniors in Ohio

Car insurance rates for seniors in Ohio can vary significantly compared to other age groups. Several factors influence these rates, including driving history, the type of vehicle driven, and the level of coverage desired. While seniors may have more experience on the road, they are also more likely to be involved in accidents due to factors such as slower reaction times and reduced vision. Additionally, seniors may drive less frequently, which could result in lower rates for some insurers.

Finding Affordable Car Insurance for Seniors in Ohio

Finding affordable car insurance for seniors in Ohio requires research and comparison. Here are some tips to help:

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. Online comparison tools can make this process easier.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Explore Discounts: Seniors may be eligible for various discounts, such as good driver discounts, safe driver discounts, or discounts for taking defensive driving courses. Ask about these discounts when you get quotes.

- Review Coverage Needs: Determine the level of coverage you truly need. Consider factors like your driving habits, the value of your vehicle, and your financial situation.

- Consider Senior-Specific Programs: Some insurance companies offer programs tailored to seniors, providing additional benefits or discounts.

Resources for Seniors in Ohio

Several resources can assist seniors in Ohio with finding affordable car insurance.

- Ohio Department of Insurance: The Ohio Department of Insurance website provides information on car insurance laws, consumer rights, and resources for finding affordable insurance.

- AARP: The AARP offers resources and information on car insurance for seniors, including discounts and tips for finding affordable coverage.

- Local Senior Centers: Senior centers in your community may offer workshops or seminars on car insurance for seniors.

Navigating the world of car insurance in Ohio can seem daunting, but with the right information and a strategic approach, you can find the perfect policy. Remember to compare quotes, understand your coverage options, and take advantage of available discounts. By taking these steps, you can ensure that you’re protected on the road and that you’re not paying more than you need to for your car insurance.

Finding the right car insurance quote in Ohio can be a bit of a chore, but it’s essential to protect your investment. While you’re comparing rates, consider also securing your future with Prudential Life Insurance: Secure Your Future , providing peace of mind for your loved ones. Once you’ve got your car insurance sorted, you can focus on building a secure financial future.

When looking for car insurance quotes in Ohio, it’s essential to consider the various factors that affect your premium. But just like your car, you also need to protect your loved ones. That’s where Ethos Life Insurance: A Modern Approach to Coverage can provide peace of mind. With its digital-first approach, Ethos simplifies the process of securing life insurance, making it a valuable addition to your overall financial planning, just like comparing car insurance quotes in Ohio.