A car insurance quote comparison tool sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Finding the best car insurance can be a tedious and time-consuming process, but it doesn’t have to be. Car insurance quote comparison tools have revolutionized the way consumers shop for insurance, empowering them to find the most affordable and comprehensive coverage options.

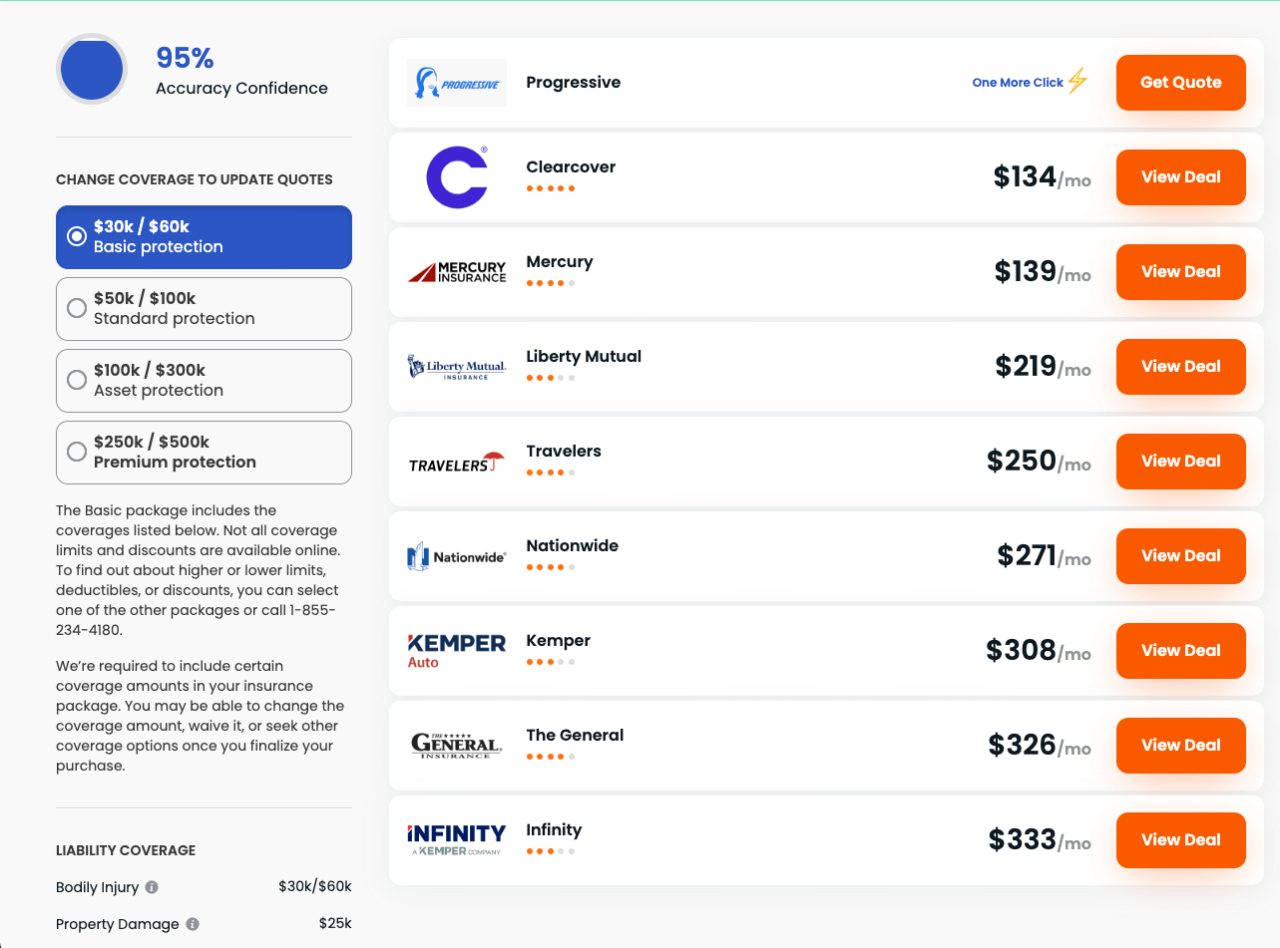

These tools streamline the process by allowing users to compare quotes from multiple insurance providers in one place. By simply entering basic information about their vehicle, driving history, and desired coverage, users can generate a personalized list of quotes, making it easy to compare prices, coverage options, and find the best deal.

Understanding Car Insurance Quote Comparison Tools

Car insurance quote comparison tools are valuable resources that empower consumers to find the best car insurance deals. These tools streamline the process of obtaining quotes from multiple insurers, saving you time and effort while potentially uncovering significant savings on your premiums.

How Car Insurance Quote Comparison Tools Work

Car insurance quote comparison tools work by gathering information about your driving history, vehicle, and coverage needs. This information is then sent to multiple insurance companies, who use it to generate personalized quotes. By comparing these quotes side-by-side, you can easily identify the most affordable and comprehensive coverage options.

Benefits of Using a Car Insurance Quote Comparison Tool

- Save Time and Effort: Instead of contacting each insurance company individually, you can use a comparison tool to gather quotes from multiple insurers simultaneously. This saves you valuable time and effort.

- Find the Best Deals: By comparing quotes from different insurers, you can identify the most competitive rates and potentially save hundreds or even thousands of dollars on your annual premiums.

- Get Personalized Quotes: Comparison tools gather your specific information to provide personalized quotes tailored to your individual needs.

- Compare Coverage Options: You can compare different coverage options, deductibles, and other features to find the plan that best fits your budget and requirements.

Real-World Examples of Savings

Numerous studies and consumer reports have highlighted the effectiveness of car insurance quote comparison tools in helping people save money. For instance, a study by the National Association of Insurance Commissioners (NAIC) found that consumers who used comparison websites saved an average of $487 on their car insurance premiums.

Types of Car Insurance Quote Comparison Tools

There are several types of car insurance quote comparison tools available:

- Online Websites: These websites allow you to enter your information and receive quotes from multiple insurers within minutes. Examples include Compare.com, Policygenius, and The Zebra.

- Mobile Apps: Mobile apps offer a convenient way to compare quotes on the go. Some popular apps include Insurance.com, Gabi, and Jerry.

- Insurance Brokers: Insurance brokers can help you compare quotes from various insurers and provide personalized advice. They typically work with a network of insurance companies and can offer competitive rates and customized coverage options.

Key Features of a Car Insurance Quote Comparison Tool

A car insurance quote comparison tool is a valuable resource for drivers seeking the best insurance coverage at the most affordable price. These tools streamline the process of comparing quotes from multiple insurance providers, saving time and effort. To be effective, a comparison tool should possess several key features that enhance its user-friendliness and provide accurate results.

Customizable Search Filters

Customizable search filters are essential for finding the most relevant insurance quotes. They allow users to refine their search based on specific criteria, ensuring that the quotes they receive are tailored to their individual needs. Some common search filters include:

- Vehicle Information: Year, make, model, vehicle identification number (VIN), mileage, and usage.

- Driver Information: Age, driving history, location, and any discounts.

- Coverage Preferences: Liability limits, collision and comprehensive coverage, and optional add-ons.

- Budget: Maximum premium amount the user is willing to pay.

By using these filters, users can narrow down their search to insurance providers offering the coverage they need at a price they can afford.

Clear and Concise Quote Presentations

A car insurance quote comparison tool should present quotes in a clear and concise manner, making it easy for users to understand the different options available. The tool should highlight key information, such as:

- Premium Amount: The total cost of the insurance policy.

- Coverage Details: A breakdown of the coverage included in the quote, such as liability limits, deductibles, and optional add-ons.

- Provider Information: Name of the insurance provider, contact information, and any relevant details about the provider, such as customer reviews or ratings.

The tool should also provide a clear comparison of different quotes, allowing users to quickly identify the best value for their needs.

Integration with Insurance Providers

Integrating with insurance providers is crucial for a car insurance quote comparison tool to provide accurate and up-to-date quotes. This integration allows the tool to access real-time information from insurance provider databases, ensuring that the quotes are based on the latest rates and policies. This also eliminates the need for users to manually enter their information on multiple insurance provider websites, saving time and effort.

Data Security and Privacy

Data security and privacy are paramount when using a car insurance quote comparison tool. Users should ensure that the tool they choose employs robust security measures to protect their personal and financial information. Some important data security and privacy considerations include:

- Encryption: The tool should use encryption to protect sensitive data during transmission. This ensures that the information is unreadable to unauthorized parties.

- Data Storage: The tool should store user data securely and only for legitimate purposes. The tool should also have clear policies regarding data retention and deletion.

- Privacy Policy: The tool should have a transparent privacy policy that Artikels how it collects, uses, and protects user data.

By prioritizing data security and privacy, users can trust that their information is protected when using a car insurance quote comparison tool.

How Car Insurance Quote Comparison Tools Work

Car insurance quote comparison tools streamline the process of finding the best coverage at the most competitive price. They work by connecting you with multiple insurance providers, allowing you to compare quotes side-by-side without having to contact each company individually. This saves you time and effort while helping you find the best deal.

The Process of Obtaining Quotes

Car insurance quote comparison tools gather information from you, such as your driving history, vehicle details, and desired coverage levels. This information is then sent to their network of insurance providers. Each provider uses its own algorithms to assess your risk and generate a personalized quote based on the information you provided. You can then review the quotes and choose the one that best meets your needs.

The Role of Algorithms and Data Analysis

Car insurance quote comparison tools utilize sophisticated algorithms and data analysis to generate personalized quotes. These algorithms consider a wide range of factors, including your driving history, vehicle type, location, age, and credit score. They analyze vast amounts of data to determine your risk profile and generate a quote that reflects your individual circumstances.

Factors Influencing Car Insurance Premiums

Several factors influence car insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums:

- Driving History: Your driving record, including accidents, traffic violations, and driving experience, significantly impacts your premium. A clean driving record generally leads to lower premiums.

- Vehicle Type: The make, model, year, and safety features of your vehicle affect your premium. Vehicles with higher safety ratings or lower theft rates often have lower premiums.

- Location: Where you live influences your premium due to factors like population density, crime rates, and weather conditions. Areas with higher accident rates or more severe weather tend to have higher premiums.

- Age and Gender: Younger drivers and males generally have higher premiums due to their higher risk of accidents. However, these factors vary based on individual driving history and other factors.

- Credit Score: In some states, your credit score can be used to determine your premium. A higher credit score typically leads to lower premiums.

- Coverage Levels: The type and amount of coverage you choose also influence your premium. Comprehensive and collision coverage, which protect against damage to your vehicle, are typically more expensive than liability coverage, which protects against financial losses to others.

Benefits of Using a Car Insurance Quote Comparison Tool

Car insurance quote comparison tools can be a valuable resource for anyone looking to save money on their car insurance. These tools allow you to compare quotes from multiple insurance companies in one place, making it easy to find the best deal.

Using a car insurance quote comparison tool can save you time and money, simplify the insurance shopping process, and help you find the best coverage options for your needs.

Saving Time and Money

- Convenience: Car insurance comparison tools eliminate the need to contact each insurance company individually. You can get quotes from multiple providers in minutes, saving you valuable time.

- Lower Premiums: By comparing quotes, you can identify insurers offering the most competitive rates, potentially saving hundreds or even thousands of dollars per year.

Simplifying the Insurance Shopping Process

- Streamlined Process: Instead of navigating multiple websites or calling different companies, comparison tools centralize the process, making it easier to manage.

- Personalized Recommendations: Some tools analyze your profile and preferences, suggesting insurers that might be a good fit for you.

Finding the Best Coverage Options

- Comprehensive Coverage: Comparison tools often display a wide range of coverage options, allowing you to compare different policies and find the best fit for your needs and budget.

- Customized Coverage: You can adjust coverage levels and add optional features to tailor your policy to your specific requirements.

Comparison with Direct Contacting

- Time-Saving: Using a comparison tool is significantly faster than contacting insurance companies individually, especially if you are considering multiple providers.

- Objectivity: Comparison tools provide a neutral platform, ensuring you see quotes from different insurers without any bias or influence.

Real-World Examples

“I used a car insurance comparison tool and saved over $500 a year on my premiums. It was so easy to use, and I was able to compare quotes from multiple insurers in just a few minutes.” – John, a satisfied customer.

“Before using a comparison tool, I had no idea how much my insurance premiums could vary. I was able to find a policy that offered better coverage at a lower price.” – Sarah, another satisfied customer.

Choosing the Right Car Insurance Quote Comparison Tool

Finding the best car insurance deal can feel like a daunting task, but using a comparison tool can significantly simplify the process. These tools allow you to compare quotes from multiple insurers simultaneously, saving you time and potentially money. However, not all comparison tools are created equal, so choosing the right one is crucial.

Factors to Consider When Choosing a Comparison Tool

It’s essential to consider several factors before settling on a specific comparison tool. These factors will help you find a tool that aligns with your needs and preferences.

- User Interface: A user-friendly interface is paramount. Look for a tool with a clear and intuitive design that allows you to easily input your information and compare quotes. Avoid tools with cluttered layouts or complex navigation.

- Coverage Options: The tool should offer a wide range of coverage options to suit your individual needs. Consider whether you require basic liability coverage or more comprehensive options like collision, comprehensive, or uninsured motorist coverage.

- Data Security: Protecting your personal information is crucial. Ensure the comparison tool you choose uses robust encryption and security measures to safeguard your data. Look for tools that comply with industry standards like GDPR or CCPA.

- Customer Support: Reliable customer support is essential, especially if you encounter any issues or have questions. Check if the tool offers multiple support channels like email, phone, or live chat, and ensure their response times are reasonable.

Comparing Different Car Insurance Quote Comparison Tools

Once you’ve considered the essential factors, you can start comparing different car insurance quote comparison tools. Here’s a breakdown of some key features to look for:

- Features: Some tools offer additional features beyond basic quote comparison, such as personalized recommendations, discounts, or the ability to manage your policy online.

- User Experience: The overall user experience is crucial. Consider how easy it is to navigate the website, enter your information, and compare quotes. Look for tools with clear instructions, helpful tooltips, and responsive design.

- Reputation: Research the tool’s reputation by reading online reviews, checking industry ratings, or looking for any complaints filed with regulatory bodies.

Avoiding Scams and Ensuring Legitimacy

It’s essential to be cautious and protect yourself from potential scams when using car insurance quote comparison tools. Here are some tips:

- Verify the Tool’s Authenticity: Before entering any personal information, verify the tool’s legitimacy by checking for a secure connection (HTTPS) and reading user reviews.

- Be Wary of Unrealistic Offers: Be cautious of unusually low quotes or offers that seem too good to be true. Legitimate insurers won’t offer unrealistically low rates.

- Check for Third-Party Verification: Look for tools that have been independently verified or endorsed by reputable organizations, such as consumer protection agencies or insurance industry associations.

Tips for Using Car Insurance Quote Comparison Tools Effectively

Car insurance quote comparison tools can be powerful resources for finding the best rates, but maximizing their effectiveness requires a strategic approach. By understanding the key features and leveraging the right techniques, you can significantly improve your chances of securing the most competitive insurance coverage.

Providing Accurate Information

Providing accurate and complete information to car insurance quote comparison tools is crucial for receiving accurate quotes. When you input your details, the tool uses this information to calculate your potential premiums. If you provide inaccurate or incomplete information, the quotes you receive may not reflect your actual risk profile, leading to unexpected surprises later on.

- Double-check your personal information: Ensure that your name, address, date of birth, and other personal details are correct. Any errors can lead to inaccuracies in the quotes.

- Be truthful about your driving history: Include all driving violations, accidents, and any other relevant information. Failing to disclose this information could result in your policy being canceled or your claim being denied.

- Specify your vehicle details accurately: Provide the make, model, year, and any modifications to your vehicle. This helps the tool accurately assess your risk and generate precise quotes.

- Be transparent about your driving habits: State your annual mileage, the purpose of your vehicle (e.g., commuting, personal use), and whether you frequently drive in high-risk areas. Accurate details ensure you receive quotes that align with your actual driving patterns.

Comparing Quotes from Different Providers

Once you have received quotes from various insurance providers, comparing them side-by-side is essential for identifying the most competitive options. Each insurer uses different algorithms and factors to calculate premiums, so comparing their quotes can reveal significant price differences.

- Pay attention to coverage details: Don’t solely focus on the price. Compare the coverage limits, deductibles, and other features of each policy to ensure you are getting adequate protection for your needs.

- Look for discounts and incentives: Many insurers offer discounts for good driving records, safety features, and bundling multiple policies. Check if these discounts are included in the quotes you receive.

- Read reviews and ratings: Before making a decision, research the reputation of the insurers offering the most attractive quotes. Read reviews from other customers and check their ratings to gauge their financial stability and customer service quality.

- Consider long-term factors: While price is important, also consider factors like the insurer’s financial stability, customer service reputation, and claims handling process. These aspects can significantly impact your experience in the long run.

Negotiating the Best Rates

After comparing quotes, you may have found an insurer offering a competitive rate, but there’s often room for negotiation. Armed with information from multiple quotes, you can leverage this leverage to secure an even better deal.

- Highlight your positive attributes: Emphasize your clean driving record, safety features, and any other factors that could make you a low-risk driver. This can influence the insurer’s willingness to offer a lower rate.

- Be prepared to switch insurers: If the insurer is unwilling to negotiate, be prepared to switch to a different provider. This can often motivate them to reconsider their offer.

- Consider bundling policies: Bundling your car insurance with other policies, such as home or renters insurance, can often lead to significant discounts. Inquire about these options during negotiations.

- Be polite but firm: Maintain a professional and respectful tone throughout the negotiation process. Clearly state your expectations and be prepared to walk away if the insurer is unwilling to meet them.

The Future of Car Insurance Quote Comparison Tools

The car insurance quote comparison tool landscape is constantly evolving, driven by technological advancements and changing consumer expectations. These tools are becoming increasingly sophisticated, offering a wider range of features and personalized experiences. The future of car insurance quote comparison tools holds exciting possibilities, with innovations that promise to revolutionize the way we shop for and manage our insurance.

The Impact of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to transform the insurance industry, and car insurance quote comparison tools are at the forefront of this revolution. AI and ML algorithms can analyze vast amounts of data to identify patterns and insights that would be impossible for humans to detect. This data can be used to:

- Personalize quotes: AI-powered tools can analyze individual driving habits, demographics, and other factors to provide more accurate and personalized quotes.

- Optimize pricing: AI can help insurers develop more dynamic pricing models that reflect real-time risk factors, leading to more competitive and fair premiums.

- Improve customer service: Chatbots and virtual assistants powered by AI can provide 24/7 customer support, answer common questions, and help policyholders manage their accounts.

“By 2025, AI is expected to drive $3.5 trillion in value creation in the insurance industry.” – McKinsey & Company

The Future Role of Car Insurance Quote Comparison Tools

As AI and ML technologies become more advanced, car insurance quote comparison tools will play an increasingly central role in the insurance market. Here are some potential future developments:

- Proactive insurance recommendations: AI-powered tools could analyze driver data and market trends to proactively suggest policy adjustments, discounts, or coverage options that better meet individual needs.

- Personalized risk assessments: Tools could use AI to analyze driving behavior, telematics data, and other factors to provide more accurate and personalized risk assessments, potentially leading to lower premiums for safe drivers.

- Integrated insurance solutions: Car insurance quote comparison tools could become platforms for managing all aspects of insurance, including home, health, and life insurance, offering a single point of contact for all insurance needs.

Case Studies

Car insurance quote comparison tools have proven their worth in helping individuals and families find better deals and coverage. These tools empower consumers to take control of their insurance needs, making informed decisions and potentially saving significant amounts of money. Let’s explore some real-world examples that illustrate the effectiveness of these tools.

Illustrative Examples of Car Insurance Quote Comparison Tool Success

Here are some examples of how individuals have successfully used car insurance quote comparison tools:

- Sarah, a young professional, was paying a hefty premium for her car insurance. She felt she was paying more than she should, given her clean driving record and safe driving habits. Using a comparison tool, Sarah discovered that she could get the same coverage for significantly less from another insurer. She switched providers and saved over $300 per year.

- John, a family man with a busy schedule, was overwhelmed by the prospect of shopping for car insurance. He didn’t have time to contact multiple insurers and compare quotes manually. Using a comparison tool, John was able to quickly gather quotes from various insurers, all in one place. He saved time and found a policy that met his family’s needs at a competitive price.

- Emily, a new driver, was unsure about the different types of car insurance coverage and their importance. A comparison tool allowed her to explore various coverage options and understand their benefits and costs. She was able to choose a policy that provided the right level of protection at a reasonable price.

Comparison Table: Key Car Insurance Quote Comparison Tools

Car insurance quote comparison tools are a valuable resource for finding the best rates and coverage options. They allow you to compare quotes from multiple insurers in one place, saving you time and effort. This table provides a comprehensive comparison of some of the most popular car insurance quote comparison tools, highlighting their key features, pros, and cons.

Comparison Table

| Feature | Compare.com | Insurify | Policygenius | The Zebra |

|---|---|---|---|---|

| Pricing | Free | Free | Free | Free |

| Coverage Options | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments |

| User Interface | Easy to use and navigate | User-friendly and visually appealing | Intuitive and streamlined | Simple and straightforward |

| Customer Support | Available by phone, email, and live chat | Provides 24/7 customer support | Offers various support channels, including phone, email, and live chat | Responsive and helpful customer service |

| Pros |

|

|

|

|

| Cons |

|

|

|

|

FAQs

Car insurance quote comparison tools are a valuable resource for drivers looking to find the best coverage at the most affordable price. However, there are many questions that arise about these tools, and it’s important to have clear answers to ensure you’re making informed decisions about your car insurance.

Understanding the Use and Function of Car Insurance Quote Comparison Tools

- What are car insurance quote comparison tools? Car insurance quote comparison tools are online platforms that allow you to compare quotes from multiple insurance companies in one place. These tools can save you time and money by simplifying the process of finding the best coverage for your needs.

- Do these tools provide accurate quotes? Car insurance quote comparison tools use algorithms to gather information from insurance companies and generate quotes based on your specific details. These quotes are generally accurate, but it’s important to verify the information with the insurance company directly before making a final decision.

- Are car insurance quote comparison tools free to use? Most car insurance quote comparison tools are free to use. They make money by receiving commissions from insurance companies when you choose a policy through their platform.

- What information do I need to provide when using a car insurance quote comparison tool? To generate accurate quotes, you’ll typically need to provide information such as your name, address, driving history, vehicle details, and desired coverage levels.

Exploring the Benefits of Using Car Insurance Quote Comparison Tools

- How can car insurance quote comparison tools save me money? By comparing quotes from multiple insurance companies, you can identify potential savings on your car insurance premiums. You might discover that different companies offer significantly different rates for the same coverage, even for similar drivers.

- Can I trust car insurance quote comparison tools to find the best coverage? Car insurance quote comparison tools can help you find the best coverage for your needs by presenting you with a range of options. However, it’s important to read the policy details carefully and consider your specific requirements before making a decision.

- Are there any downsides to using car insurance quote comparison tools? While car insurance quote comparison tools offer numerous benefits, it’s essential to be aware of potential downsides. Some tools may not include all insurance companies in their network, and some might not provide detailed information about the coverage options available.

Choosing the Right Car Insurance Quote Comparison Tool

- How do I choose the right car insurance quote comparison tool for me? When selecting a car insurance quote comparison tool, consider factors such as the number of insurance companies included in their network, the ease of use of the platform, and the level of detail provided in the quotes. It’s also important to check for reviews and testimonials from other users.

- Are there any specific features I should look for in a car insurance quote comparison tool? Some desirable features include the ability to filter quotes by coverage level, the option to adjust your deductible, and the provision of clear and concise policy summaries.

- What are some popular car insurance quote comparison tools? There are several popular car insurance quote comparison tools available, including:

- [Tool Name 1]

- [Tool Name 2]

- [Tool Name 3]

It’s important to research and compare different tools to find the one that best meets your individual needs.

Using Car Insurance Quote Comparison Tools Effectively

- What are some tips for using car insurance quote comparison tools effectively? To maximize the benefits of car insurance quote comparison tools, provide accurate information, compare quotes from multiple companies, and carefully review the policy details before making a decision. It’s also advisable to contact the insurance company directly to clarify any questions or concerns.

- Should I use multiple car insurance quote comparison tools? Using multiple car insurance quote comparison tools can help you broaden your search and potentially find even better rates. However, remember that the quotes generated may vary slightly depending on the algorithms used by each tool.

- Can I use car insurance quote comparison tools to switch insurance companies? Yes, car insurance quote comparison tools can be used to compare quotes from different insurance companies and potentially switch to a new provider if you find a better deal. It’s important to understand the cancellation terms of your current policy before switching.

In conclusion, car insurance quote comparison tools have become indispensable for savvy consumers seeking the best possible insurance rates. These tools empower individuals to make informed decisions by providing a comprehensive and transparent view of the insurance market. With their user-friendly interfaces, advanced features, and commitment to data security, these tools have revolutionized the way people shop for car insurance. By utilizing a reliable comparison tool, consumers can save time, money, and gain peace of mind knowing they have secured the most suitable and affordable coverage for their needs.

Finding the right car insurance policy can be a bit of a headache, but luckily, there are comparison tools available to help you sift through the options. While you’re thinking about securing your financial future, you might also want to consider Prudential Life Insurance: Secure Your Future , which offers a range of plans to protect your loved ones.

Once you’ve got your insurance needs sorted, you can get back to focusing on the joy of driving!

Just like comparing car insurance quotes online can save you money, Ethos Life Insurance: A Modern Approach to Coverage offers a streamlined way to secure your future. With a user-friendly online platform, Ethos simplifies the process of getting life insurance, allowing you to compare plans and find the best fit for your needs. Similar to how a car insurance comparison tool helps you find the best deal, Ethos empowers you to make informed decisions about your life insurance coverage.